Agreement Associate Contract Without

Description

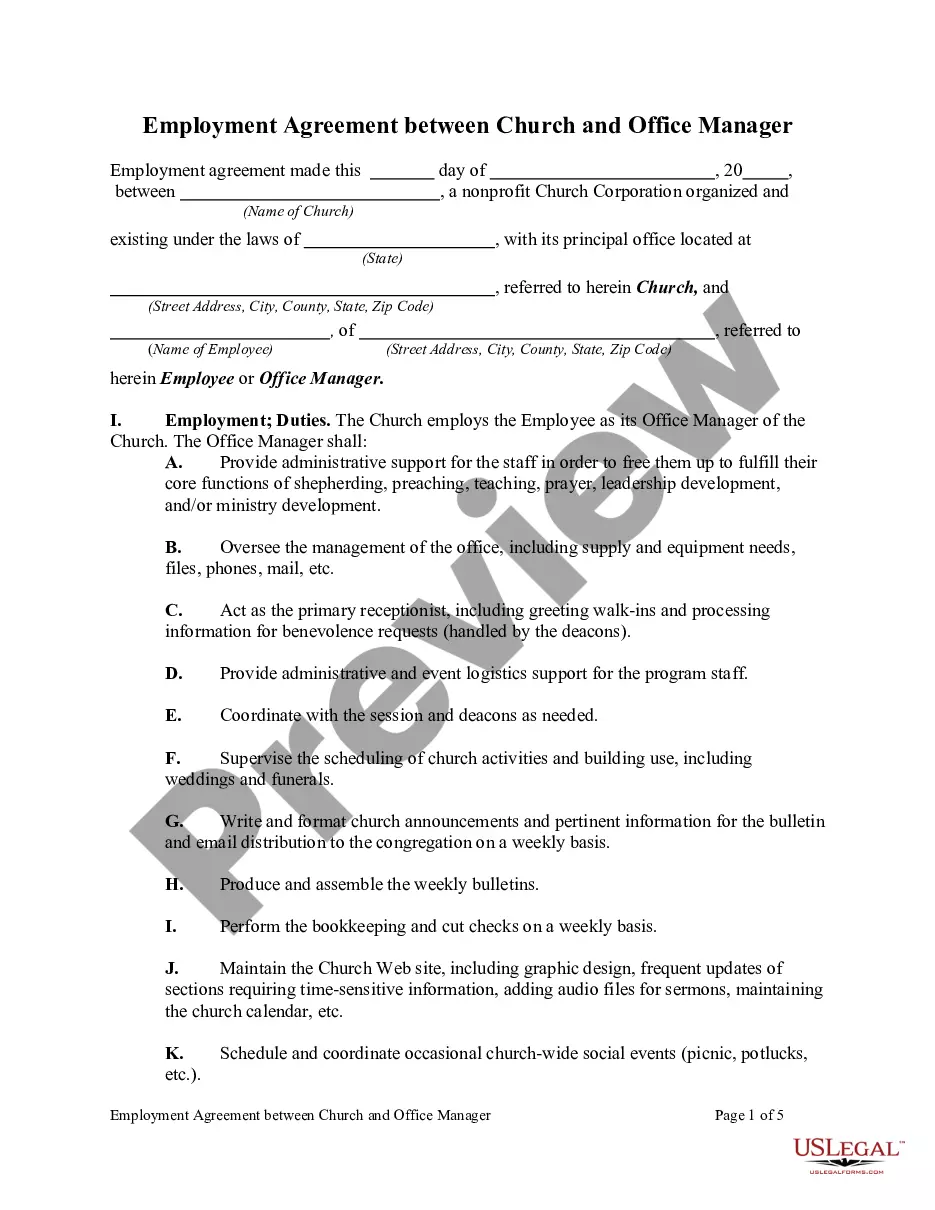

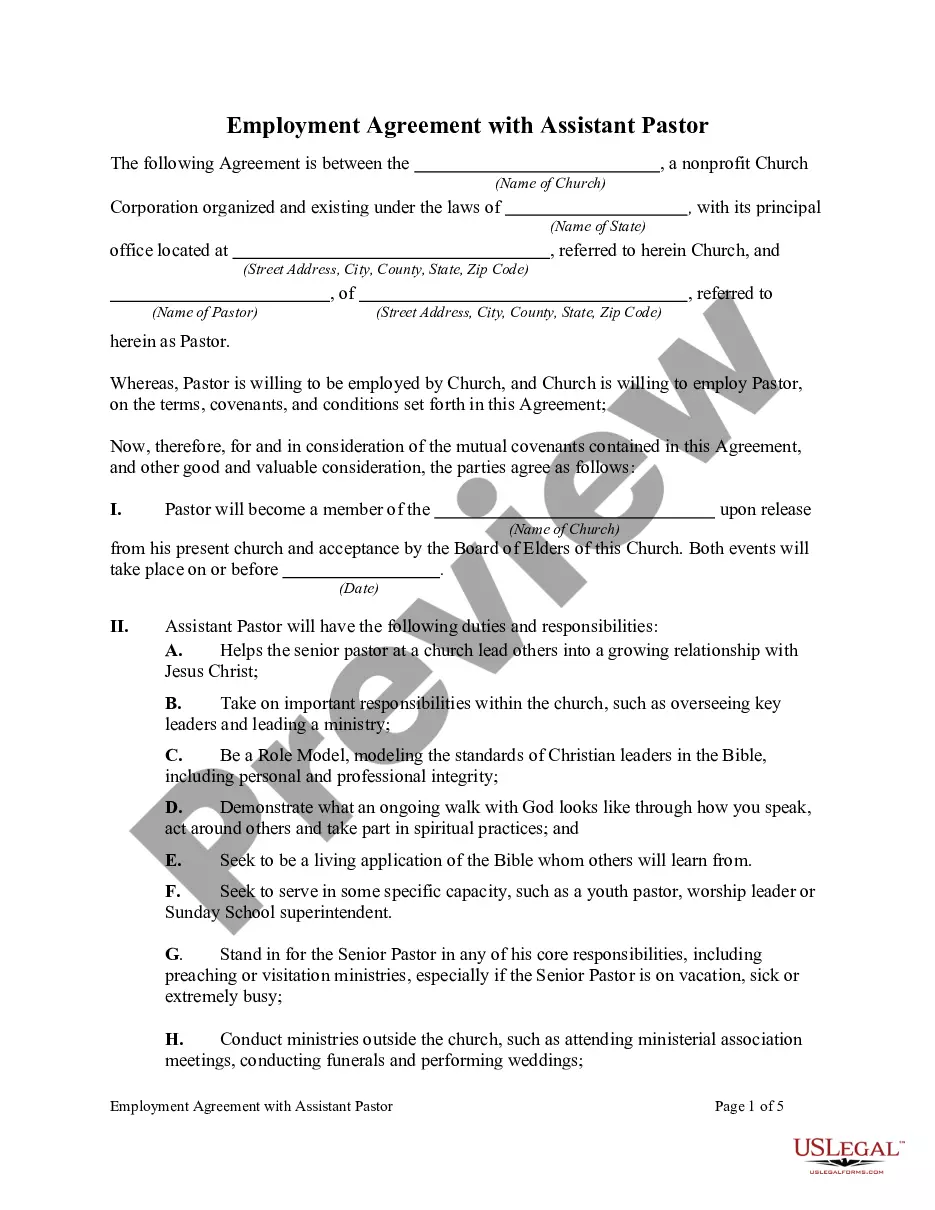

How to fill out Employment Agreement With Associate Pastor?

The Agreement Associate Contract Without you observe on this page is a reusable legal template composed by professional attorneys in accordance with federal and local statutes and regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and lawyers with more than 85,000 validated, state-specific documents for any corporate and personal circumstance. It’s the quickest, simplest and most dependable method to acquire the forms you require, as the service ensures the utmost level of data protection and anti-malware security.

Use the same document again whenever necessary. Access the My documents tab in your profile to redownload any forms you previously obtained.

- Search for the document you require and examine it.

- Browse the sample you looked for and preview it or review the form description to verify it meets your needs. If it doesn’t, utilize the search bar to obtain the correct one. Click Buy Now when you’ve found the template you need.

- Choose a pricing plan that fits you and create an account. Use PayPal or a credit card to make a swift payment. If you already have an account, Log In and check your subscription to proceed.

- Select the format you desire for your Agreement Associate Contract Without (PDF, Word, RTF) and download the sample onto your device.

- Print the template to fill it out by hand. Alternatively, utilize an online multi-functional PDF editor to rapidly and accurately complete and sign your form with a valid signature.

Form popularity

FAQ

Workman's comp in Nebraska gives your employees different benefits to help them recover from work-related injuries or illnesses. The amount of benefits depends on an employee's average weekly wage. As of January 2023, the maximum weekly income benefit is $1,029.

§ 48-137): two years from date of accident or of last benefits paid, unless the injury report is not timely filed by the employer. In that case, the statute tolls the two-year limitation until the injury report is filed.

The Nebraska Workers' Compensation Court is not bound by the usual common law or statutory rules of evidence; and ingly, with respect to medical evidence on hearings before a judge of said court, written reports by a physician or surgeon duly signed by him, her or them and itemized bills may, at the discretion of ...

The state of Nebraska provides a free online tool for verifying workers' compensation insurance coverage. Anyone can search by business name or FEIN. The results will only show the business name and policy number for employers who have coverage in the state being searched.

Fortunately for workers in Nebraska, wage replacement/disability benefits are also not taxable, as explained by a Nebraska Workers' Compensation Court Information Sheet published by the state_. _ There is a single exception to this at the federal level, called the workers' compensation offset.

Top 5 States with the Highest Workers' Compensation Costs New Jersey: $2.52 ? The Garden State comes in at #1, with a $2.52 index rate that's 175% higher than the median. ... New York: $2.23 ? New York comes in just below its neighboring state at #2, with an index rate of $2.23.

What report is filed? A detailed narrative progress/supplemental report to document any significant change in the worker's medical or disability status.

The workers' compensation system in Nebraska is a no-fault system that compensates injured workers for medical bills, lost wages, and permanent impairments resulting from their injuries.