Cover Letter Relocation Examples With Answers

Description

How to fill out Sample Letter For Relocation Of Company - Memo Style?

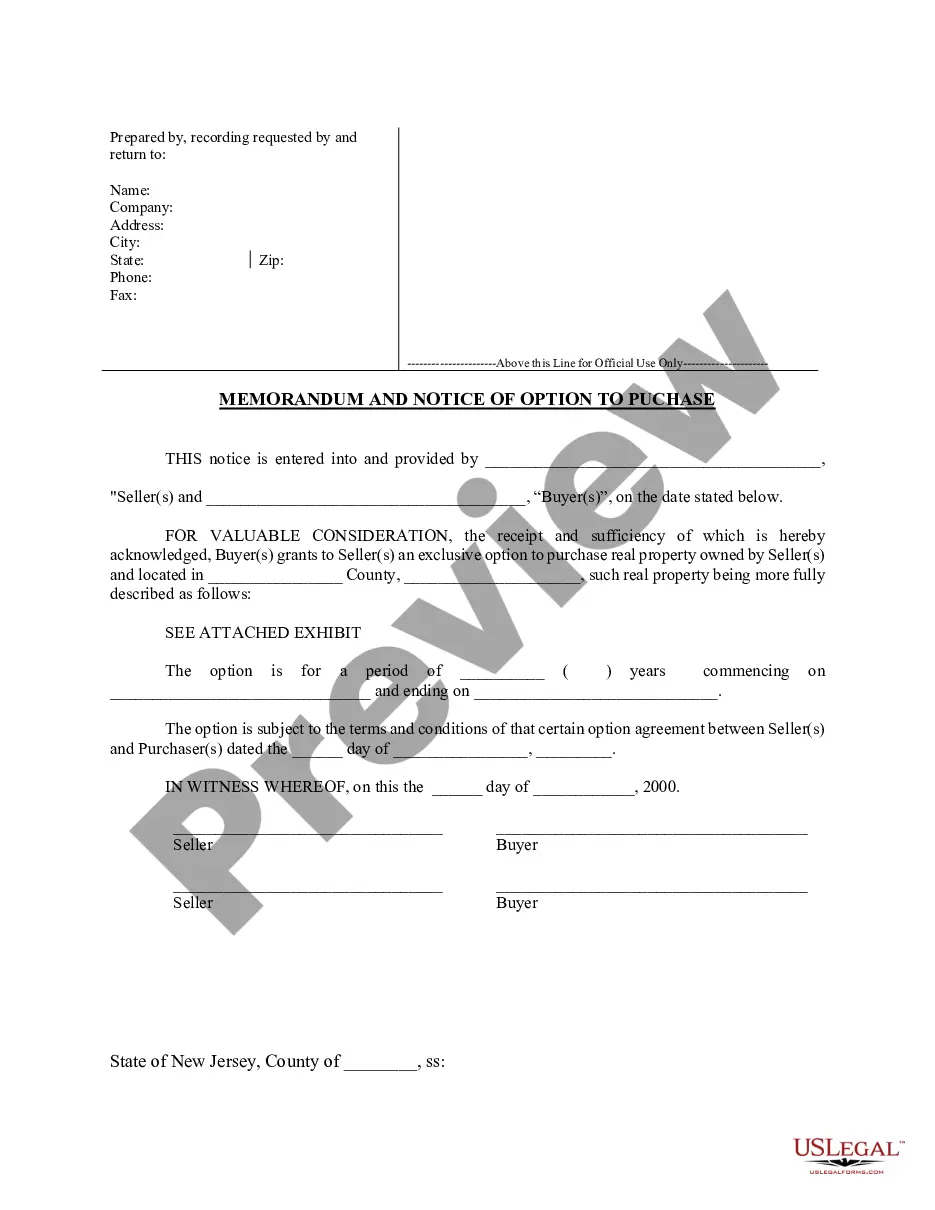

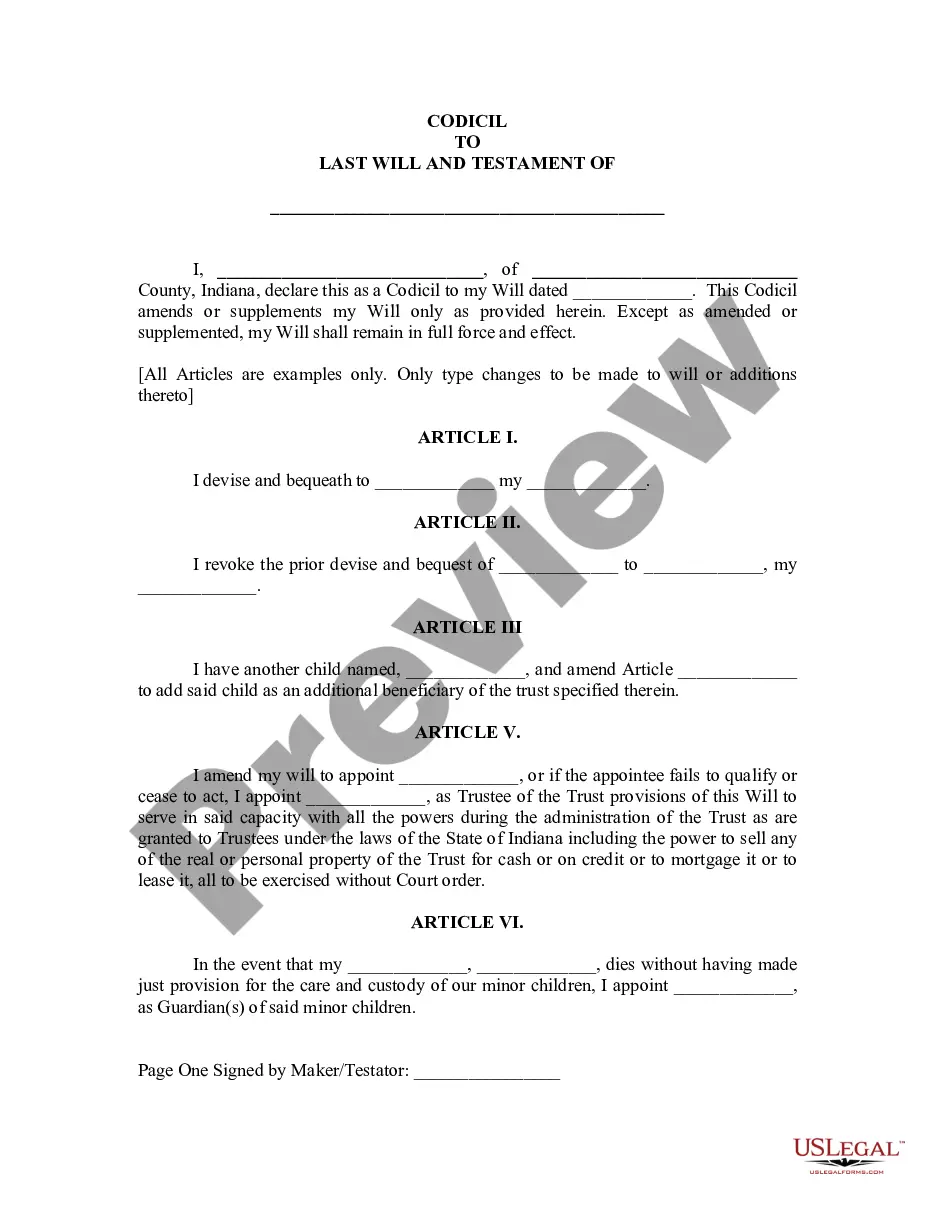

The Cover Letter Relocation Samples With Responses you encounter on this page is a reusable legal template crafted by experienced attorneys in accordance with federal and local laws and regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal experts with over 85,000 validated, state-specific forms for any professional and personal situation. It’s the fastest, simplest, and most reliable way to acquire the documents you need, as the service ensures the highest level of data protection and anti-malware security.

Select the format you prefer for your Cover Letter Relocation Samples With Responses (PDF, DOCX, RTF) and download the example to your device.

- Search for the document you require and examine it.

- Browse through the file you searched and preview it or review the form description to confirm it meets your needs. If it doesn’t, use the search bar to find the correct one. Click Buy Now once you have identified the template you want.

- Register and Log In.

- Choose the pricing option that fits you and create an account. Use PayPal or a credit card to make a swift payment. If you already have an account, Log In and verify your subscription to continue.

- Obtain the editable template.

Form popularity

FAQ

Starting a partnership is easy. You just need a partnership agreement. You might include all details in the partnership agreement, or you might draw up other documents, too. For example, you might want to create an exit plan in case a partner wants to leave and you need to dissolve the partnership.

You don't have to file paperwork to form a partnership?you create a partnership when you agree to go into business with another person. While you can form a partnership without formally filing or registering the entity, partnerships must comply with licensing and tax requirements that apply to all businesses.

How to start a Connecticut Sole Proprietorship Step 1 ? Business Planning Stage. ... Step 2 ? Name your Sole Proprietorship and Obtain a DBA. ... Step 3: Get an EIN from the IRS. ... Step 4 ? Research business license requirements. ... Step 5 ? Maintain your business.

The name of a limited partnership must contain, without abbreviation, the words ?limited partnership.? iv. LIMITED LIABILITY PARTNERSHIP DESIGNATIONS. The name of a limited liability partnership must end with one of the following designations: Limited Liability Partnership, L.L.P., or LLP.

Create a General Partnership in Connecticut Determine if you should start a general partnership. Choose a business name. File a DBA name (if needed) Draft and sign partnership agreement. Obtain licenses, permits, and clearances. Get an Employer Identification Number (EIN) Get Connecticut state tax identification numbers.