Bankdrop

Description

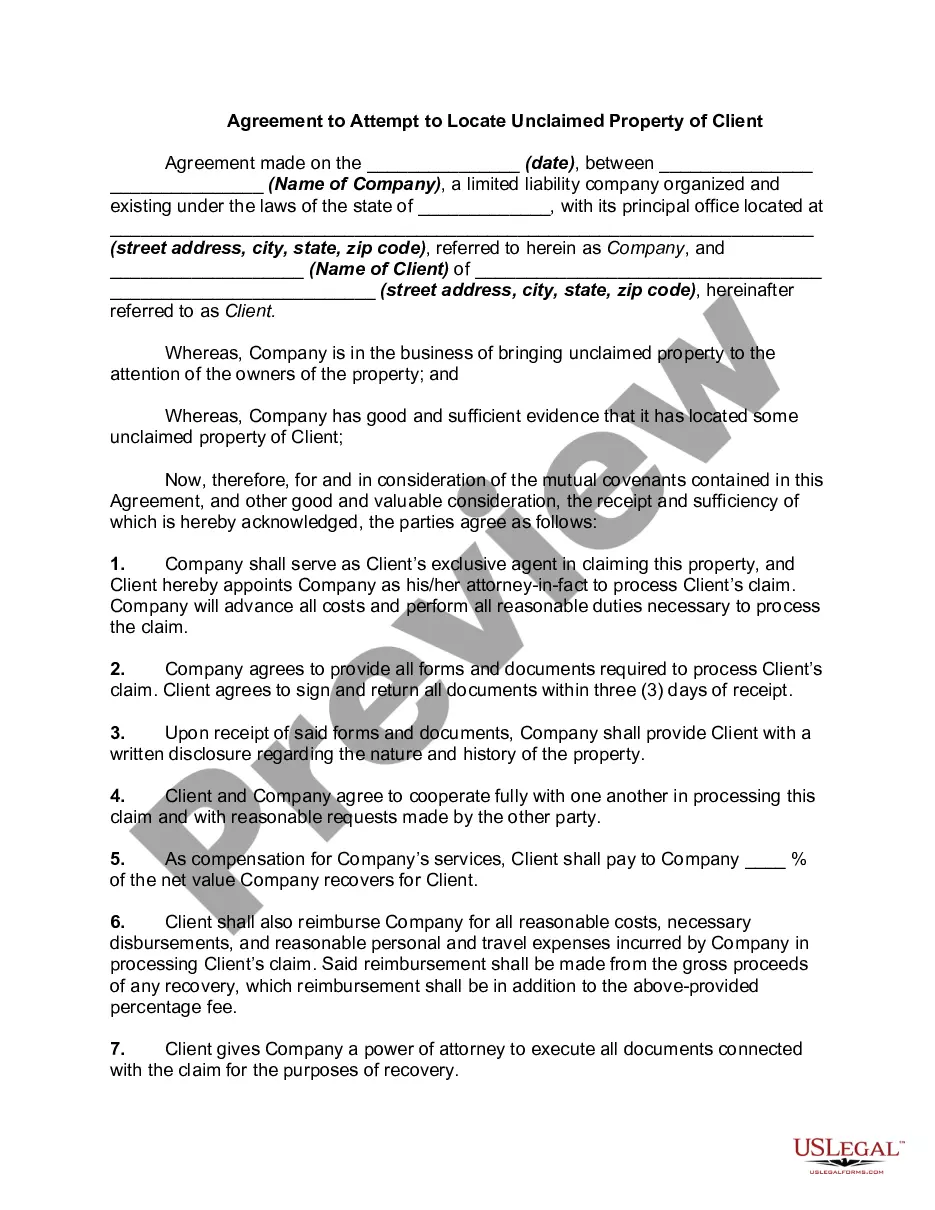

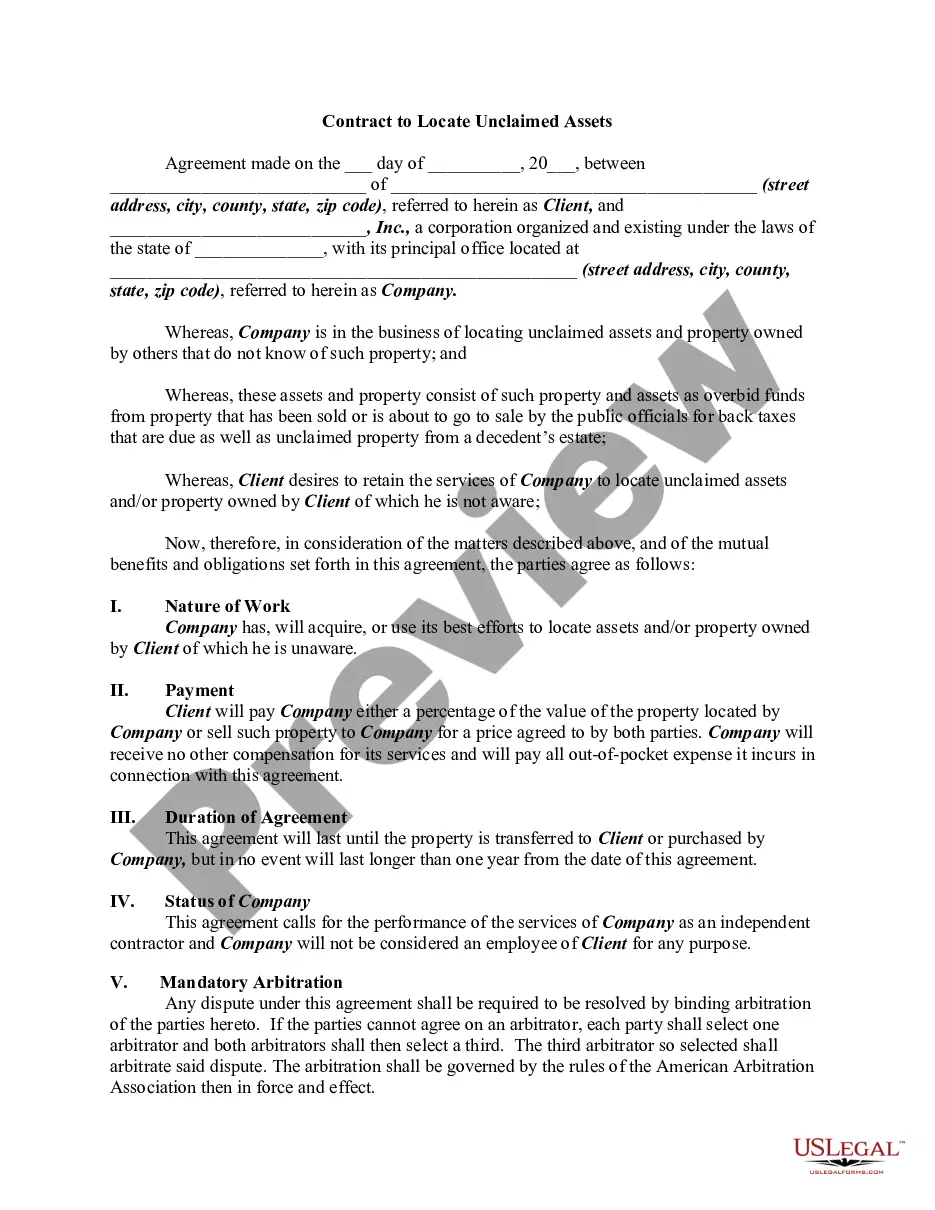

How to fill out Agreement To Attempt To Locate Unclaimed Property Of Client?

- If you're a returning user, log in to your account. Ensure your subscription is active to access the forms you need.

- For first-time users, check out the Preview mode and form descriptions to find a template that aligns with your legal requirements.

- If necessary, utilize the Search feature to locate the appropriate form for your situation.

- Once you select a suitable document, click on the Buy Now button to choose your preferred subscription plan.

- Complete the purchase process by entering your payment information via credit card or PayPal.

- Finally, download your form and save it on your device. You can also access it anytime through the My Forms section of your profile.

With US Legal Forms, users enjoy an extensive library consisting of over 85,000 editable legal forms. This service not only simplifies document execution but also provides access to premium experts for guidance.

Get started with Bankdrop today to make your legal form management seamless and efficient!

Form popularity

FAQ

To report a transaction over $10,000, the bank will handle the necessary paperwork through a Currency Transaction Report submitted to the IRS. However, as an individual, you also have to keep track of your transactions for accurate reporting on your tax returns. The Bankdrop solution simplifies monitoring your financial activities and ensuring compliance with IRS regulations.

Yes, a bank can drop you as a customer if they deem it necessary. They often have policies that allow them to close accounts based on your activity or failure to meet bank requirements. If you are facing potential issues, platforms like UsLegalForms can provide resources to navigate your banking situation effectively.

A bank might drop you for reasons like consistent late payments, fraudulent activity, or significant amounts of bounced checks. Each of these factors raises red flags for banks, potentially resulting in a bankdrop. To prevent this, monitor your financial habits and stay informed about your banking agreements.

Suspicious activity on a bank account includes frequent large deposits, transactions that don’t match your usual patterns, or sudden withdrawals without explanation. Such behaviors can prompt a bank to investigate, possibly leading to a bankdrop. Being aware of these patterns can help you maintain a healthy relationship with your bank.

A drop deposit is a method where funds are deposited into your account without a physical transaction at the bank. This can occur through various electronic channels. Understanding drop deposits helps you manage your finances effectively, ensuring safe and efficient transactions, which is essential in today's banking environment.

A bank may drop you as a customer for various reasons, including failure to maintain a minimum balance, repeated overdrafts, or suspicious account activity. Understanding these reasons can help you avoid a bankdrop. Additionally, banks must comply with regulations, and if they identify risks, they may end their relationship for their protection and yours.

Banks may exit customers to mitigate risks and comply with regulatory requirements. Factors like chronic late fees, insufficient funds, or suspicious transactions can prompt this decision. It’s important to understand your bank’s policies and work to avoid behaviors that lead to termination of the relationship.

A bank may cut ties with a customer for several reasons, such as frequent overdrafts, fraud concerns, or violating terms and conditions. Customer behavior plays a significant role in how banks establish trust. Always remain transparent and responsible in your banking activities to maintain a positive relationship.

Yes, a bank can drop you as a customer if you fail to meet their account requirements or engage in suspicious activity. Banks need to comply with regulations, and customer behavior can lead to a relationship ending. To stay in good standing, manage your account responsibly and communicate any issues proactively.

When filling a bank draft, ensure you write the correct date and amount in both numerical and written form. Include the recipient's name and your signature to authorize the draft. Always double-check your details to avoid any errors. For quick access to online drafts, consider the Bankdrop platform.