Release Of Executor Form Withdrawal

Description

How to fill out Release And Exoneration Of Executor On Distribution To Beneficiary Of Will And Waiver Of Citation Of Final Settlement?

Creating legal documents from the ground up can occasionally be daunting.

Some situations may necessitate extensive research and considerable expenses.

If you're seeking a simpler and more cost-effective method for preparing the Release Of Executor Form Withdrawal or any other forms without the hassle, US Legal Forms is always accessible.

Our online collection of over 85,000 current legal documents encompasses nearly every area of your financial, legal, and personal needs. With just a few clicks, you can promptly access state- and county-compliant forms meticulously crafted by our legal experts.

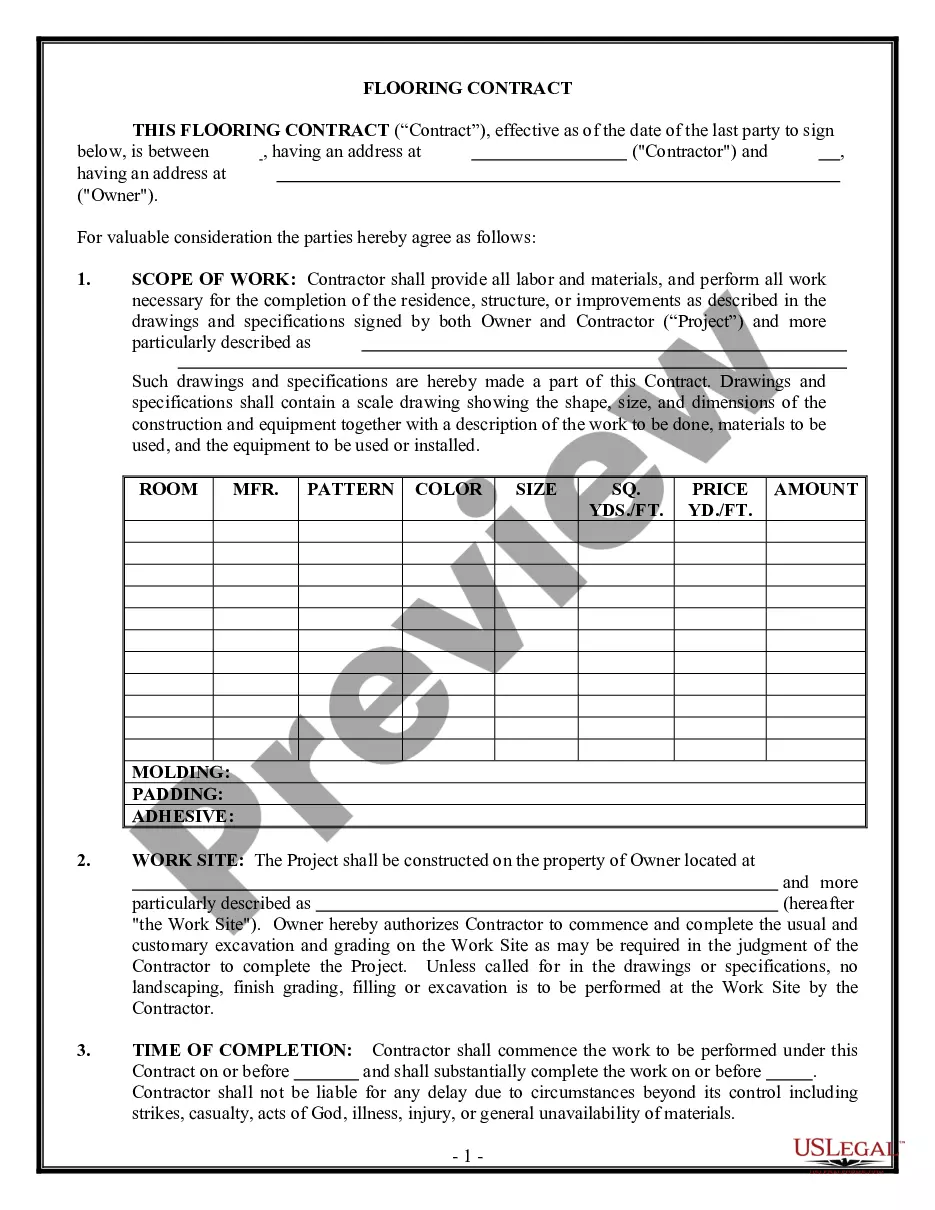

Examine the document preview and descriptions to ensure you have located the form you need. Confirm that the form you select aligns with the regulations and laws applicable in your state and county. Choose the most appropriate subscription option to purchase the Release Of Executor Form Withdrawal. Download the file, then complete, sign, and print it. US Legal Forms enjoys a solid reputation and possesses over 25 years of experience. Join us today and simplify the form completion process!

- Utilize our platform whenever you require trustworthy and dependable services that allow you to easily find and download the Release Of Executor Form Withdrawal.

- If you're already familiar with our website and have set up an account, simply Log In to your account, select the template, and download it or re-download it at any time in the My documents section.

- Not registered yet? No worries. It takes just a few minutes to sign up and browse the catalog.

- But before proceeding to download the Release Of Executor Form Withdrawal, please adhere to these suggestions.

Form popularity

FAQ

The length of time an executor has to settle an estate in Pennsylvania can vary considerably, typically spanning from several months to over a year, depending on factors like the size and complexity of the estate, the clarity of the will, and whether the probate process is contested.

The length of time an executor has to settle an estate in Pennsylvania can vary considerably, typically spanning from several months to over a year, depending on factors like the size and complexity of the estate, the clarity of the will, and whether the probate process is contested.

What Happens Next? If you renounce being executor and there are other executors named in the will, they will need to take on the jobs that would have been yours. If you are the only executor mentioned, then the beneficiaries must come together to choose an administrator for the estate.

Under Pennsylvania law, executors have a duty to provide an accounting to beneficiaries. An accounting is a detailed report that outlines the assets, liabilities, income, and expenses associated with the estate, as well as the executor's actions in managing and distributing the estate.

Executors are bound to the terms of the will, which means that they are not permitted to change beneficiaries. The beneficiaries who were named by the decedent will remain beneficiaries so long as the portions of the will in which they appear are not invalidated through a successful will contest.