New Jersey Flooring Contract for Contractor

What is this form?

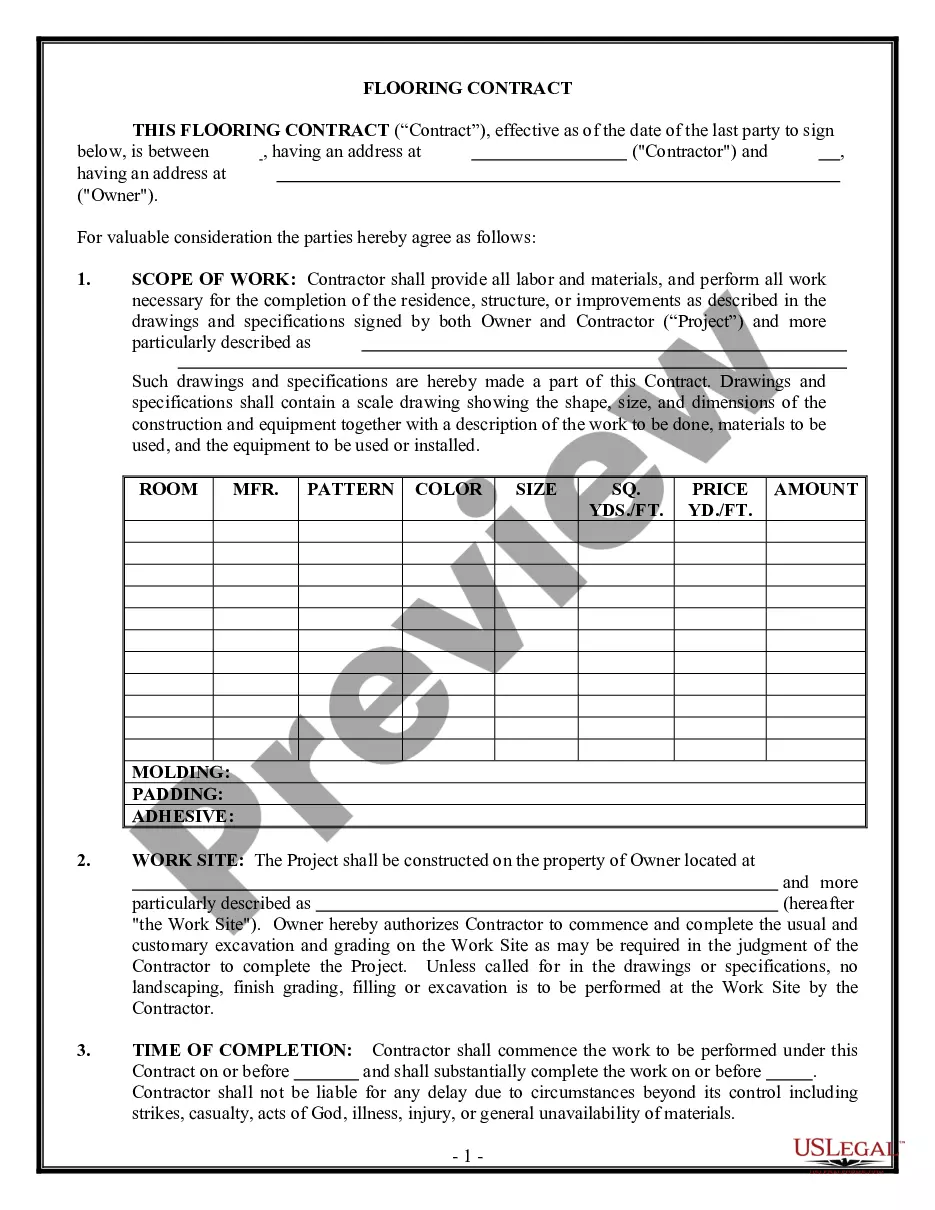

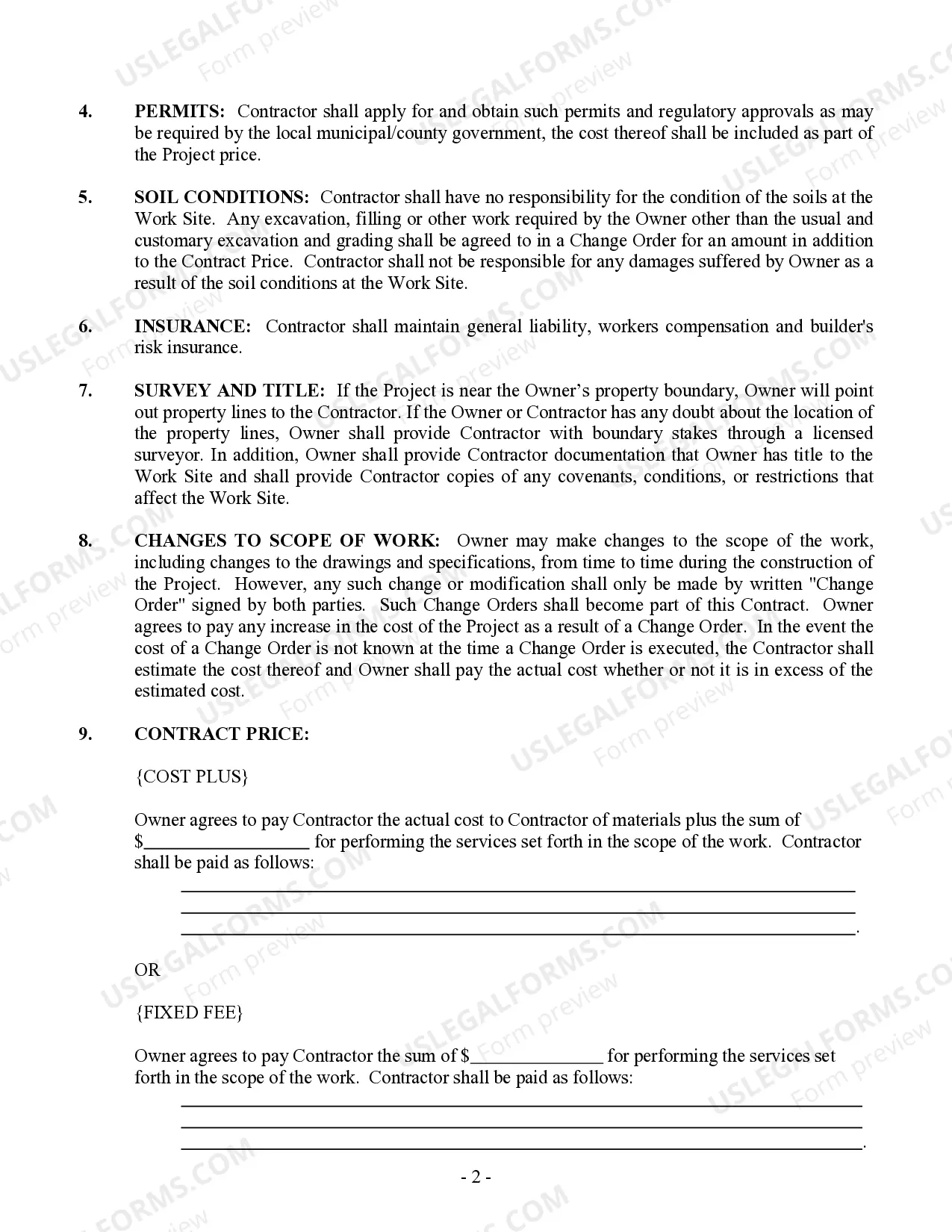

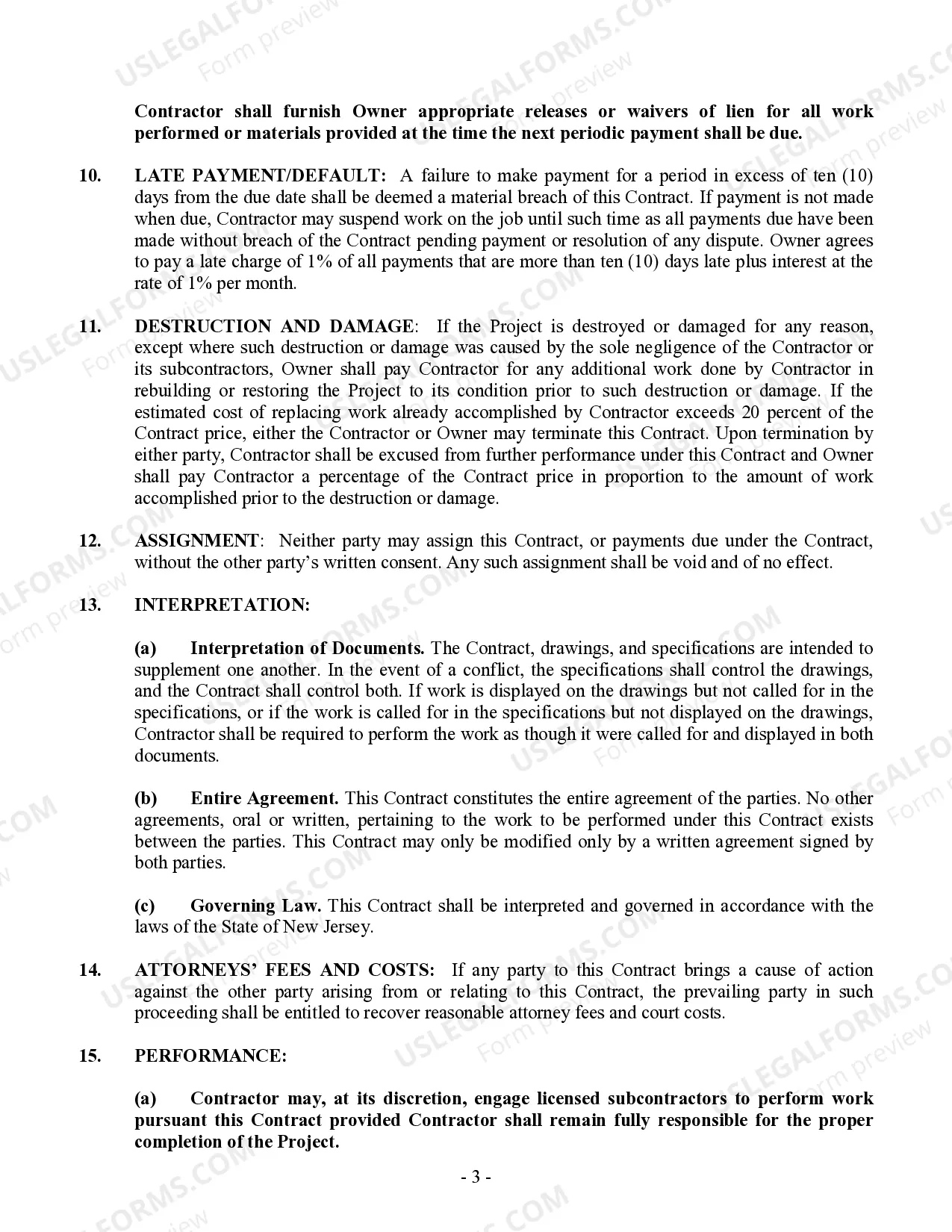

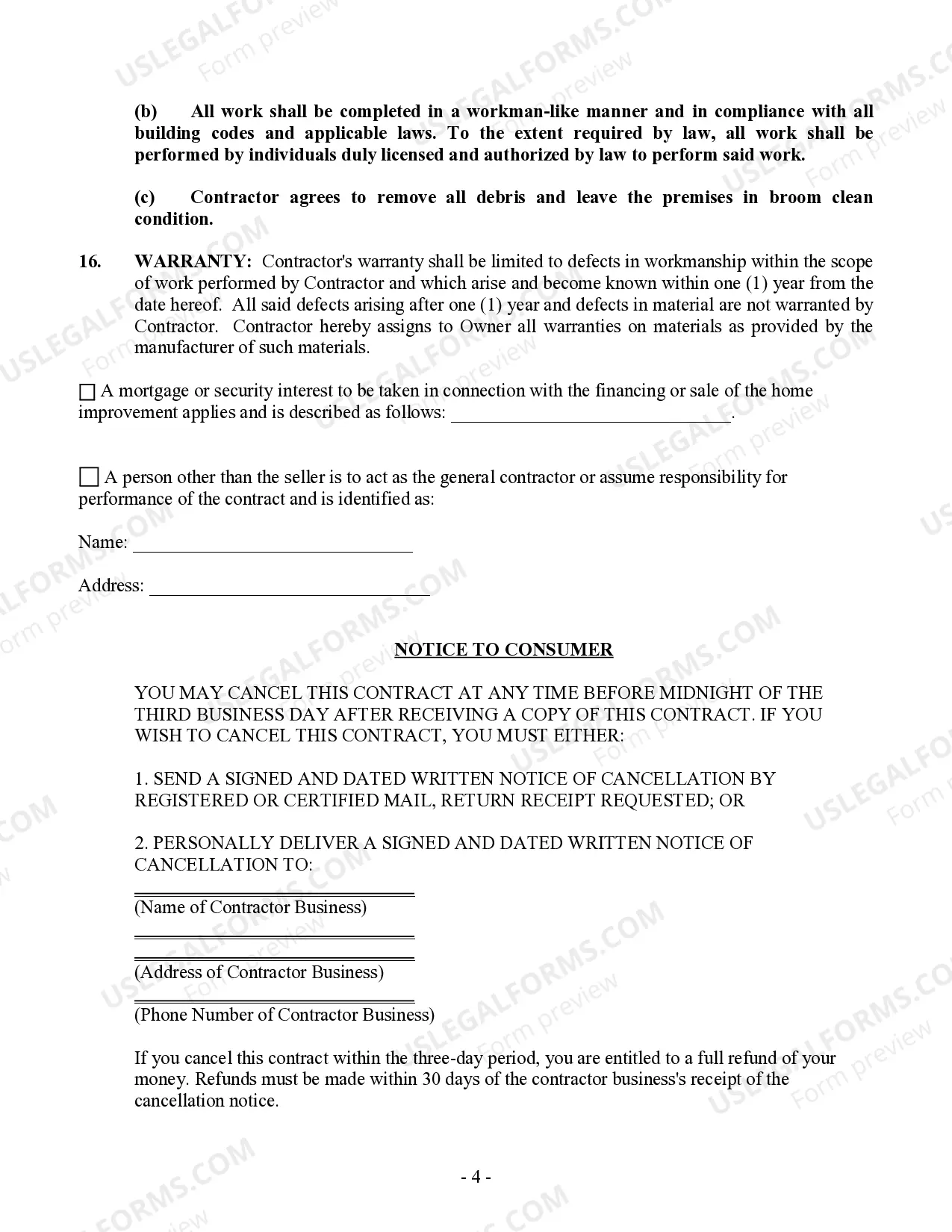

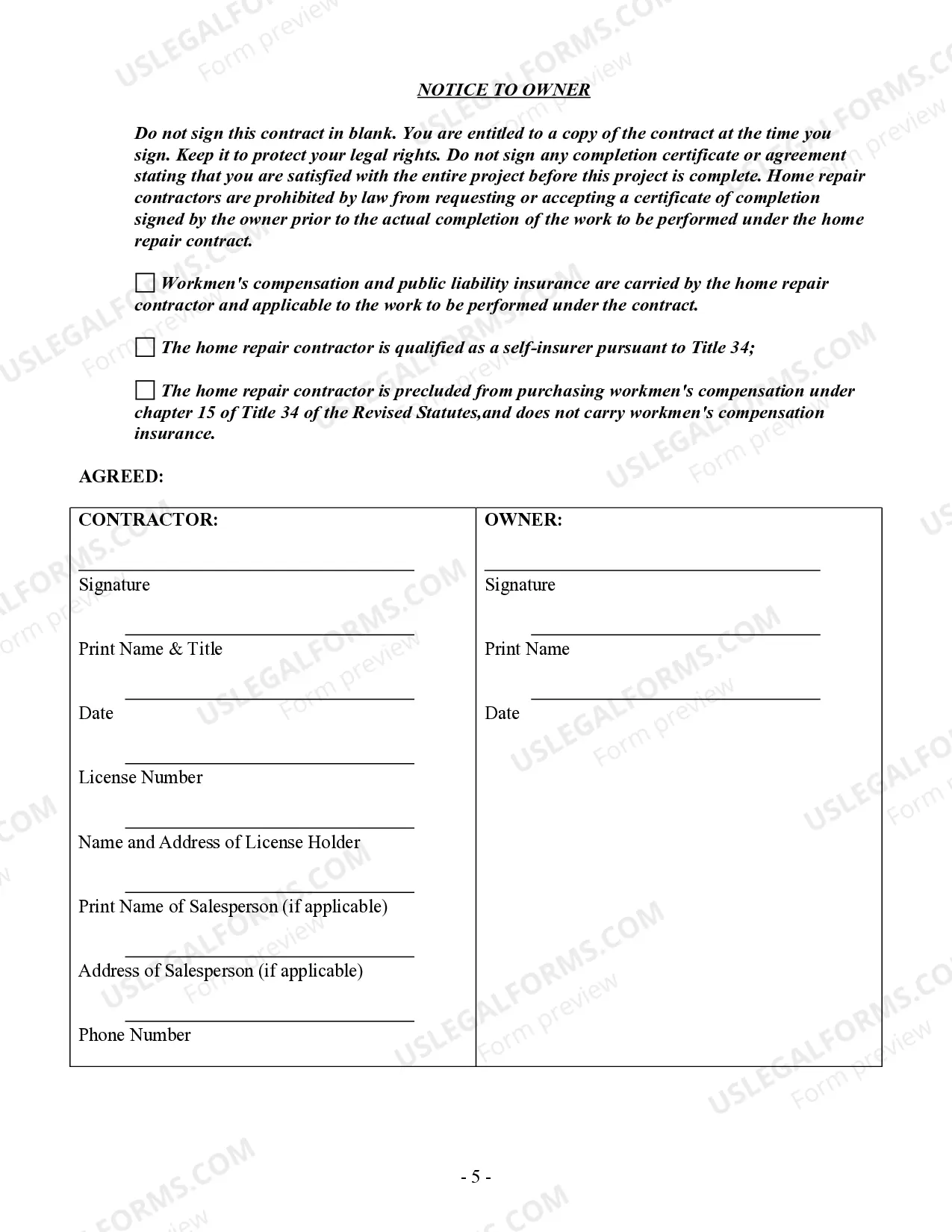

The Flooring Contract for Contractor is a legal document designed for use between flooring contractors and property owners. This contract outlines the terms of the flooring project, including payment arrangements such as cost-plus or fixed fee. It covers important aspects like change orders, warranty, and insurance, making it essential for establishing clear expectations and responsibilities for both parties. This form is customized to meet the legal requirements of the State of New Jersey, ensuring enforceability and clarity in contractual obligations.

Key parts of this document

- Payment terms: Cost plus or fixed fee arrangements.

- Change orders: Procedures for modifying the scope of work.

- Permits: Responsibilities for obtaining necessary legal approvals.

- Insurance: Requirements for general liability and workers compensation coverage.

- Warranty: Terms regarding defects in workmanship and materials.

- Default and late payment: Consequences of payment delays and breach.

When to use this form

This flooring contract should be used when a property owner hires a flooring contractor for a project. It is ideal when the project details include payment structures, scope of work changes, or when specific legal obligations must be documented. Using this form helps protect both the contractorâs and ownerâs interests, ensuring that all legal requirements are followed and that there is a mutual understanding of the projectâs terms.

Who needs this form

- Property owners looking to hire a flooring contractor.

- Flooring contractors seeking to formalize agreements with clients.

- Individuals or businesses involved in home improvement projects requiring flooring installation.

- Homeowners interested in understanding their rights and obligations under a flooring contract in New Jersey.

How to complete this form

- Identify the parties involved: Enter the names and addresses of both the contractor and the property owner.

- Specify the project details: Provide descriptions of the flooring work to be performed and any relevant specifications or drawings.

- Choose payment terms: Indicate whether the payment arrangement is cost plus or fixed fee.

- Detail permits and approvals: Note which party will be responsible for obtaining necessary permits.

- Sign and date the contract: Ensure both parties sign and date the document to make it legally binding.

Notarization guidance

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to specify the scope of work in detail, leading to misunderstandings.

- Not documenting changes through formal change orders.

- Omitting necessary permits, which can lead to legal issues.

- Neglecting to provide clear payment terms, causing disputes later.

- Signing without thoroughly reviewing the contract, risking unanticipated obligations.

Benefits of completing this form online

- Convenience: Easily download and fill out the form at your own pace.

- Editability: Customize the form to suit specific project needs.

- Reliable: Ensure your legal agreement meets the necessary requirements set forth by attorneys.

Legal use & context

- This contract provides a clear legal framework for the flooring project, protecting both parties from future disputes.

- Ensures compliance with state laws, which can vary significantly by jurisdiction.

- Functionally transparent in outlining roles, responsibilities, and expectations for the project.

Summary of main points

- The Flooring Contract for Contractor is essential for formalizing agreements between contractors and property owners.

- Key components include payment terms, change orders, and warranty conditions.

- Specific to New Jersey, ensuring compliance with local legal standards.

- Completing the form accurately prevents misunderstandings and protects legal rights.

Looking for another form?

Form popularity

FAQ

Because freelancers must budget for both income tax and FICA taxes, you should plan to set aside 25-30% of your taxable freelance income to pay both quarterly taxes and any additional tax that you owe when you file your taxes in April. You can use IRS Form 1040-ES to calculate your estimated tax payments.

The IRS taxes 1099 contractors as self-employed. If you made more than $400, you need to pay self-employment tax. Self-employment taxes total roughly 15.3%, which includes Medicare and Social Security taxes.

Acquire 4 years of experience in the trade for which you plan to get the license for. After this, you will have to take two exams: the California Law and Business Exam and the Flooring & Floor Covering C-15 exam.

Add up all the payments you have received each month from your contract and freelance work. Multiply that amount by the 10.4 percent you must pay in Social Security taxes. This 10.4 percent figure represents the 4.2 percent levy you pay as an employee, plus the extra 6.2 percent you pay as an employer.

Independent contractor tax rates at the federal and state level vary by income. The federal income tax rate starts at 10% and gradually increases to 37% based on a person's filing status and taxable income after deductions. The self-employment tax has two rates of 15.3% and 2.9%.

In most states, construction contractors must pay sales tax when they purchase materials used in construction. This means that any materials and supplies you purchase are taxable at the time of purchase. However, you won't have to pay sales or use tax upon the sale of the finished construction.

You'll also have to pay self-employment tax, which covers the amounts you owe for Social Security and Medicare taxes for the year. As of 2019, the self-employment tax rate is 15.3%. You can calculate your self-employment tax using Schedule SE on Form 1040.

Sales Tax LawExempt items include most food sold as grocery items, most clothing and footwear, disposable paper products for household use, prescription drugs, and over-the-counter drugs.

Contractors are required to pay Sales or Use Tax on the materials, supplies, equipment, and services they purchase, rent, or use when performing work on the real property of others, except as described below. It is the general rule that the sale to the actual consumer is a retail sale.