Avoidance Of Lien

Description

How to fill out Motion To Avoid Creditor's Lien?

Navigating legal management can be bewildering, even for the most proficient professionals.

When you're looking into an Avoidance Of Lien and lack the time to invest in finding the suitable and updated version, the procedures can become overwhelming.

Gain access to a valuable repository of articles, guidance, handbooks, and resources related to your situation and requirements.

Conserve energy and time searching for the documents you need, and utilize US Legal Forms’ advanced search and Review tool to locate Avoidance Of Lien and obtain it.

Enjoy the US Legal Forms online catalog, supported by 25 years of expertise and reliability. Transform your routine document management into a seamless and user-friendly process today.

- If you have a subscription, Log In to your US Legal Forms account, find the form, and download it.

- Check the My documents tab to see the documents you have saved previously and to manage your folders as you see fit.

- If this is your first experience with US Legal Forms, create an account and gain unlimited access to all the benefits of the library.

- Here are the steps to follow after accessing the required form.

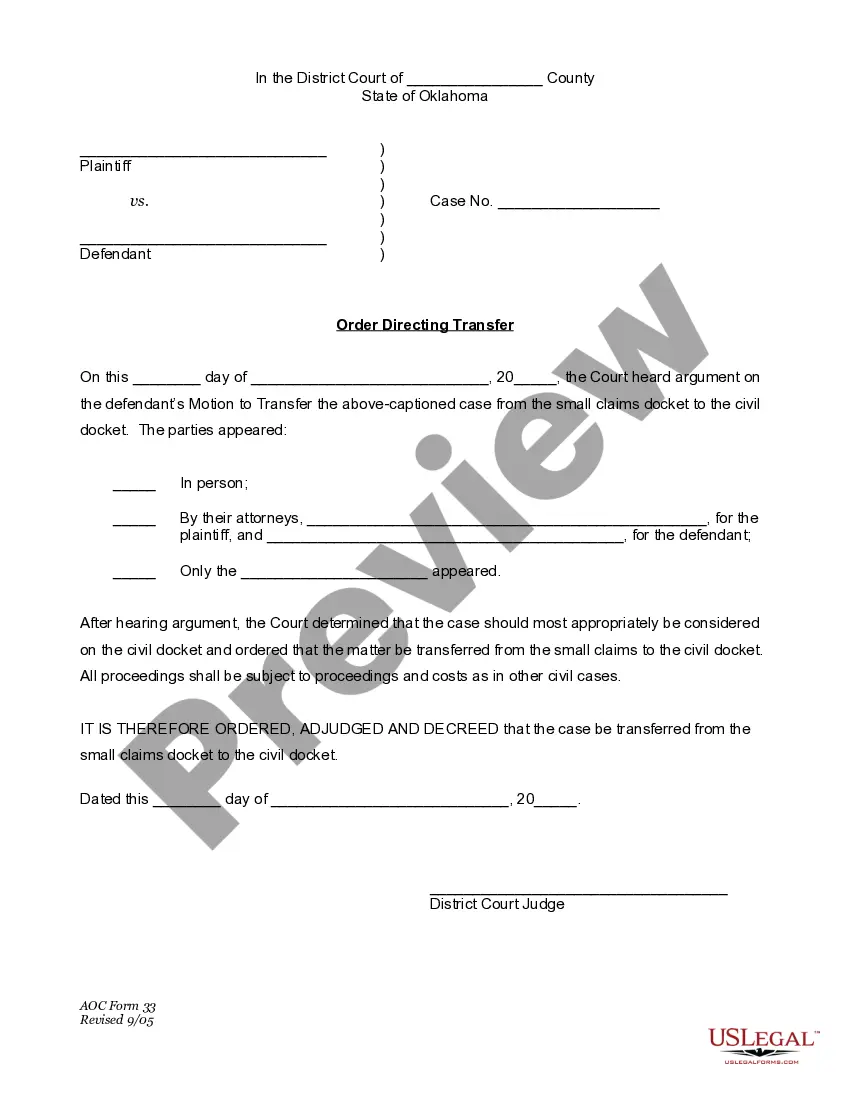

- Confirm this is the correct form by previewing it and reviewing its details.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses all the requests you might have, from personal to business files, all in one location.

- Employ sophisticated tools to complete and oversee your Avoidance Of Lien.

Form popularity

FAQ

There is also no version history which makes it very difficult to reset the questions that have been overwritten.

Google Forms does not have version history like Google Docs or Sheets. When you delete responses in Google Forms, it will be deleted permanently. The deleted form responses cannot be restored later.

Recover a deleted form Go to the Deleted forms tab. This tab serves as your recycle bin. ... On the form you want to delete, select More options in the lower right corner of the form tile, and then click Restore. ... To see your recovered form, go to your All forms tab.

Re: Forms Version History/Tracking Edits @CMSCMSCMS unfortunately not, there is no version history currently on Forms (nor on Power Automate) which is a major issue for many users.

Try it! Open the form for which you want to review the results, and then select the Responses tab. Scroll down to review a summary of the responses for each question asked. Select View results to see detailed responses from each respondent. Select Open in Excel to view an editable spreadsheet of responses to your form.

To copy a form within List view, hover to the right of the form, select More options > Copy. You'll see a duplicate form at the top of your list under All My Forms. It will have the same name as your original form.

Re: Restoring a prior version of your Form that has been edited and autosaved. @MarciAngela there's no way to restore a previous version of a form.

Please Note: Forms and Quizzes can only be recovered within 30 days of deletion. Anything after that will be permanently lost.