11 U.s. Code § 523 - Exceptions To Discharge

Description

How to fill out Motion To Avoid Creditor's Lien?

Legal document managing may be overwhelming, even for the most knowledgeable specialists. When you are looking for a 11 U.s. Code § 523 - Exceptions To Discharge and do not get the time to devote looking for the appropriate and up-to-date version, the procedures could be stress filled. A strong online form library could be a gamechanger for everyone who wants to handle these situations efficiently. US Legal Forms is a market leader in web legal forms, with over 85,000 state-specific legal forms available to you at any moment.

With US Legal Forms, you may:

- Access state- or county-specific legal and business forms. US Legal Forms handles any requirements you might have, from personal to organization paperwork, in one place.

- Employ innovative tools to complete and manage your 11 U.s. Code § 523 - Exceptions To Discharge

- Access a useful resource base of articles, guides and handbooks and materials relevant to your situation and needs

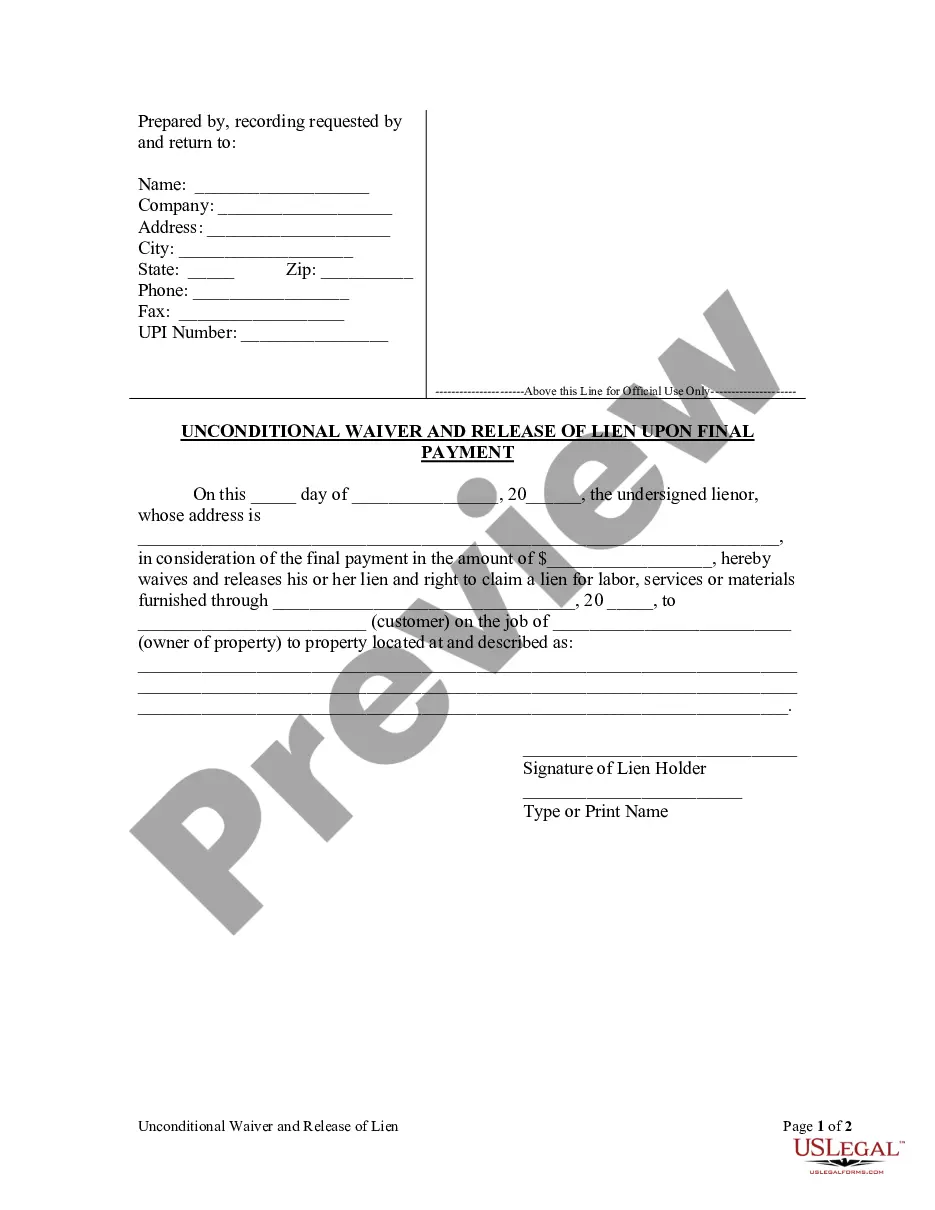

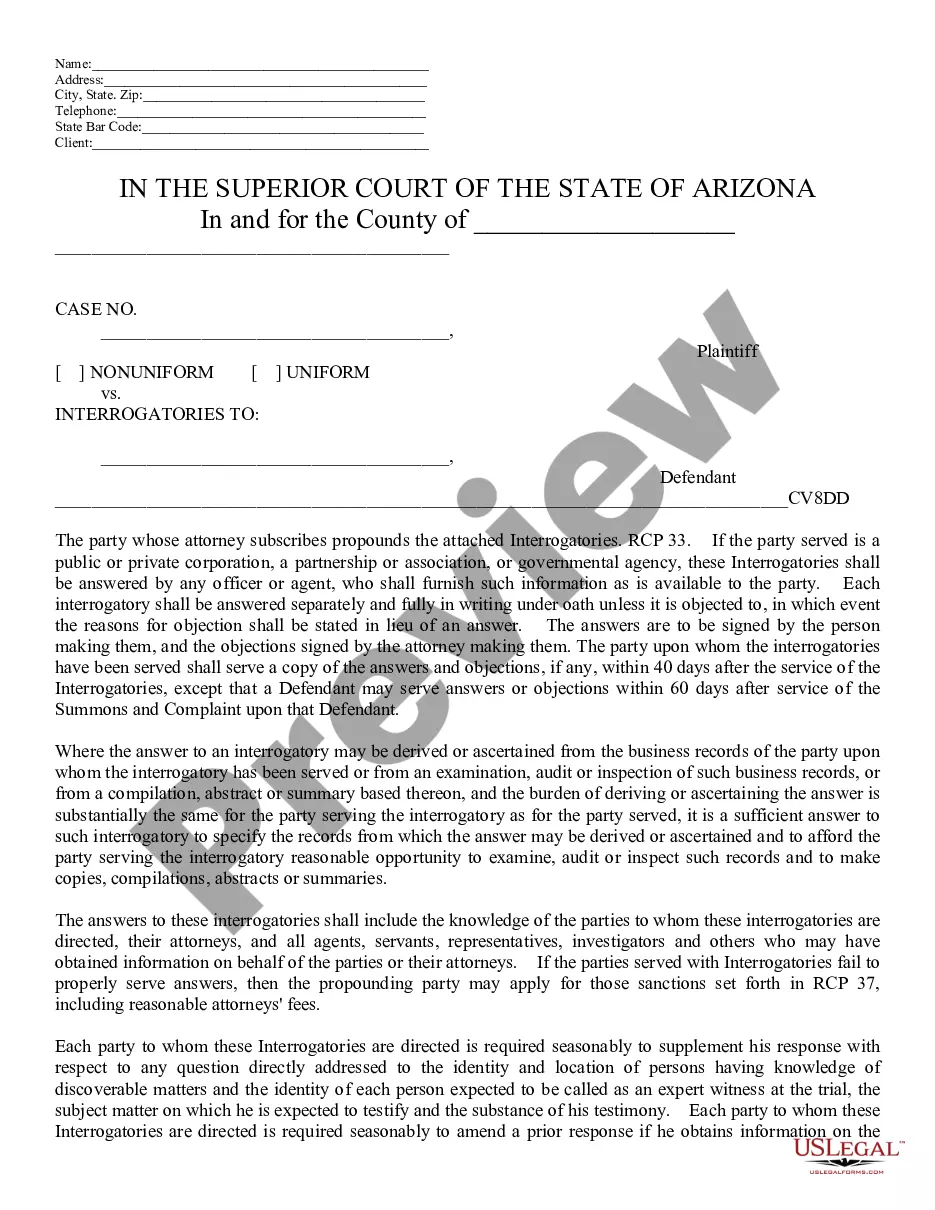

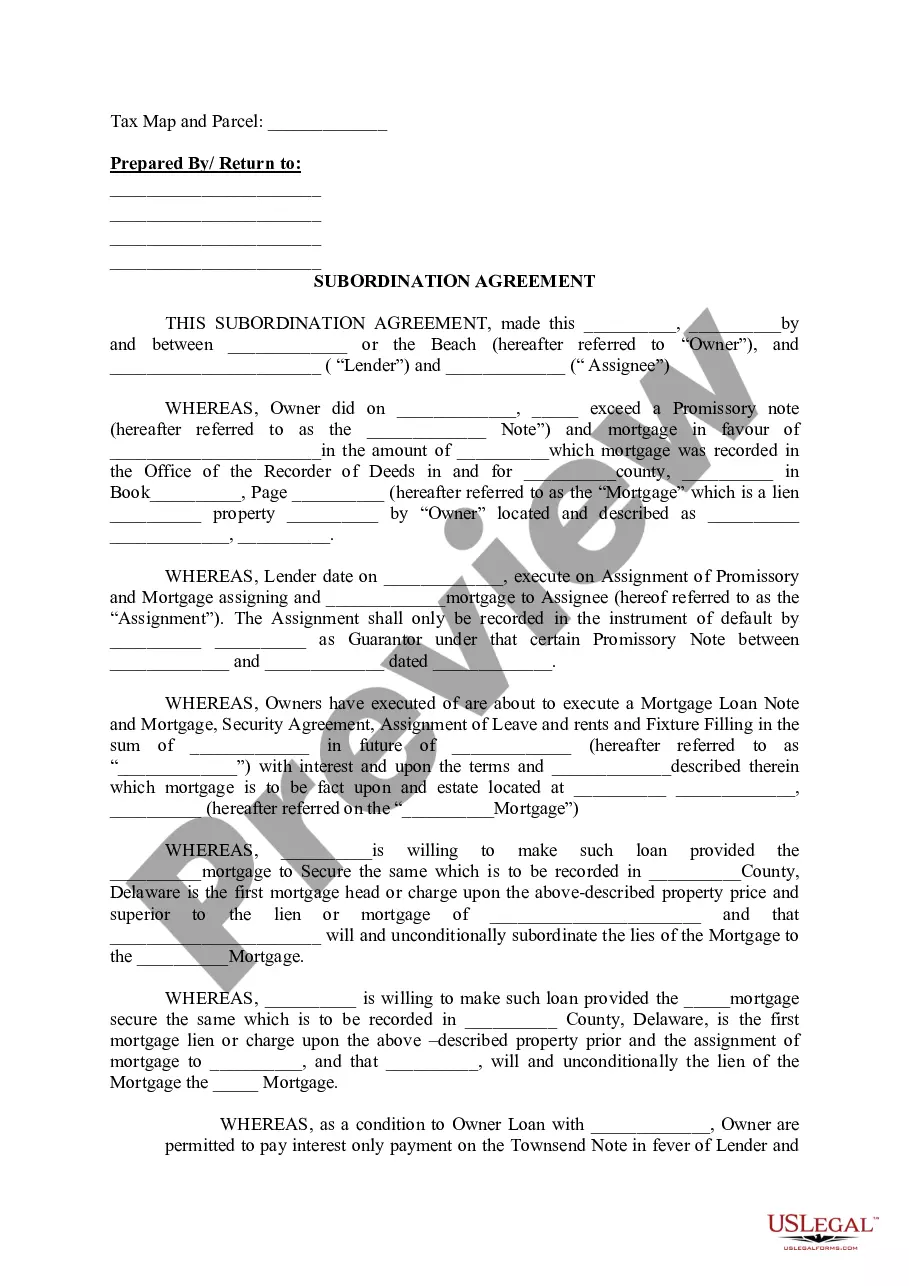

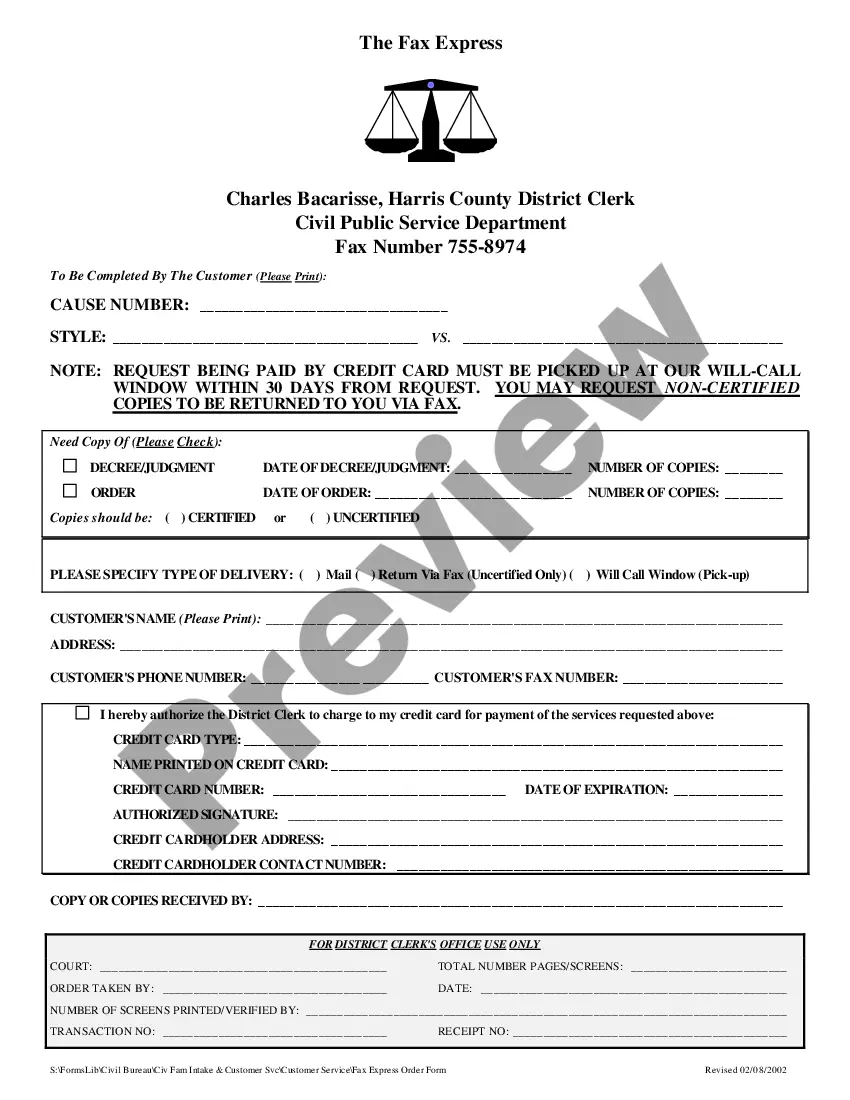

Help save effort and time looking for the paperwork you will need, and utilize US Legal Forms’ advanced search and Preview tool to discover 11 U.s. Code § 523 - Exceptions To Discharge and download it. If you have a membership, log in for your US Legal Forms account, search for the form, and download it. Take a look at My Forms tab to find out the paperwork you previously downloaded as well as manage your folders as you see fit.

If it is the first time with US Legal Forms, create a free account and obtain unrestricted access to all benefits of the library. Here are the steps to take after downloading the form you need:

- Verify this is the right form by previewing it and looking at its information.

- Ensure that the sample is accepted in your state or county.

- Pick Buy Now when you are all set.

- Choose a monthly subscription plan.

- Pick the file format you need, and Download, complete, eSign, print out and deliver your document.

Enjoy the US Legal Forms online library, backed with 25 years of expertise and reliability. Enhance your daily document managing into a smooth and easy-to-use process today.

Form popularity

FAQ

As under Bankruptcy Act § 17a(2) [section 35(a)(2) of former title 11], debt for obtaining money, property, services, or an extension or renewal of credit by false pretenses, a false representation, or actual fraud, or by use of a statement in writing respecting the debtor's financial condition that is materially false ...

523(a)(2)(A) bars an individual from discharging in bankruptcy a debt for money she obtained through the fraud of her business partner, in the absence of a finding that the debtor personally committed the fraud or intended or knew of its occurrence.

The exception of discharge is where one specific debt is denied but the rest are discharged. The denial of discharge is what is sounds like, all debts are not discharged. It gets a little confusing because most cases filed are Chapter 7.

A trustee's or creditor's objection to the debtor being released from personal liability for certain dischargeable debts. Common reasons include allegations that the debt to be discharged was incurred by false pretenses or that debt arose because of the debtor's fraud while acting as a fiduciary.