Spouse Elective Shares For Partnership

Description

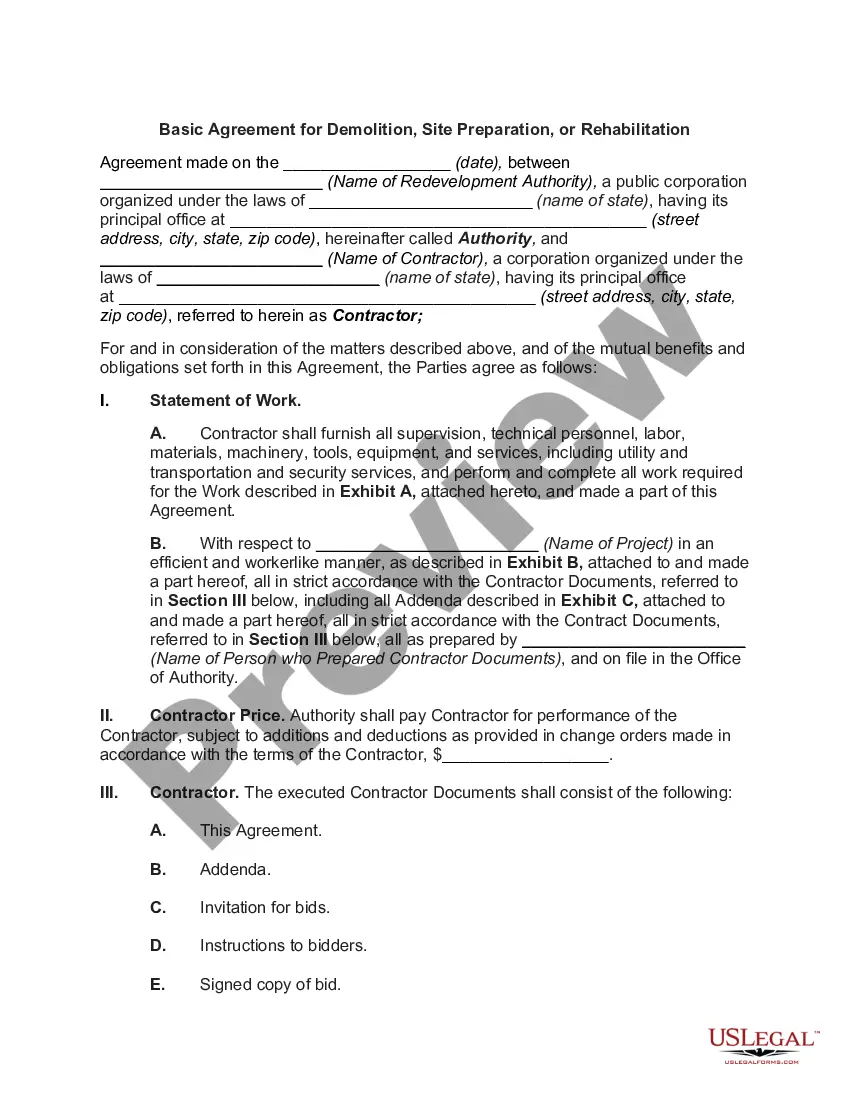

How to fill out Waiver Of Right To Election By Spouse?

Identifying a reliable source for obtaining the most up-to-date and suitable legal templates is a significant part of navigating bureaucracy.

Finding the appropriate legal forms requires precision and meticulousness, which is why it is crucial to acquire Spouse Elective Shares For Partnership samples solely from trustworthy entities, such as US Legal Forms. A faulty template can waste your time and delay your process.

Once the form is on your device, you can modify it using the editor or print it out to fill it out by hand. Eliminate the complications associated with your legal documents. Browse the extensive US Legal Forms catalog to discover legal templates, verify their applicability to your situation, and download them instantly.

- Utilize the catalog browsing or search bar to locate your template.

- Examine the form's details to verify if it complies with the regulations of your state and county.

- View the form preview, if provided, to confirm that the template is indeed what you need.

- Return to the search for the correct template if the Spouse Elective Shares For Partnership does not meet your requirements.

- Once you are certain about the form's applicability, download it.

- If you are a registered user, click Log in to verify and access your chosen forms in My documents.

- If you haven't created an account yet, click Buy now to acquire the form.

- Select the pricing option that suits your needs.

- Proceed to the registration to complete your purchase.

- Conclude your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Spouse Elective Shares For Partnership.

Form popularity

FAQ

Surviving spouses invoke their right to take an elective share most often when the decedent attempts to disinherit them or leaves them less than they would receive if they took an elective share. In Florida, the elective share a surviving spouse is entitled to is 30% of the decedent's elective estate.

Depending on the facts and circumstances, this would either be half or all of the probate estate. Unlike an elective share, the inheritance to a pretermitted spouse is made up exclusively of probate assets.

California, unlike other states, does not have a right to an elective share. Had the above scenario happened in New Jersey, the wife would have the right to an elective share of 33%, despite what the deceased said in his will. California is a community property state, meaning that each spouse owns half of the property.

In most states, the elective share is between one-third and one-half of all the property in the estate, although many states require the marriage to have lasted a certain number of years for the elective share to be claimed, or adjust the share based on the length of the marriage, and the presence of minor children.

By state law, a surviving spouse in Pennsylvania can elect to take one-third of a decedent spouse's property, which includes: Property passing by the will or intestacy: A surviving spouse can take one-third of any property that the decedent included in his or her will.