Distribution Probate With A Service

Description

How to fill out Petition For Partial And Early Distribution Of Estate?

- Access your account by clicking the login link if you're a returning user. Ensure your subscription is active; if not, renew it as per your payment plan.

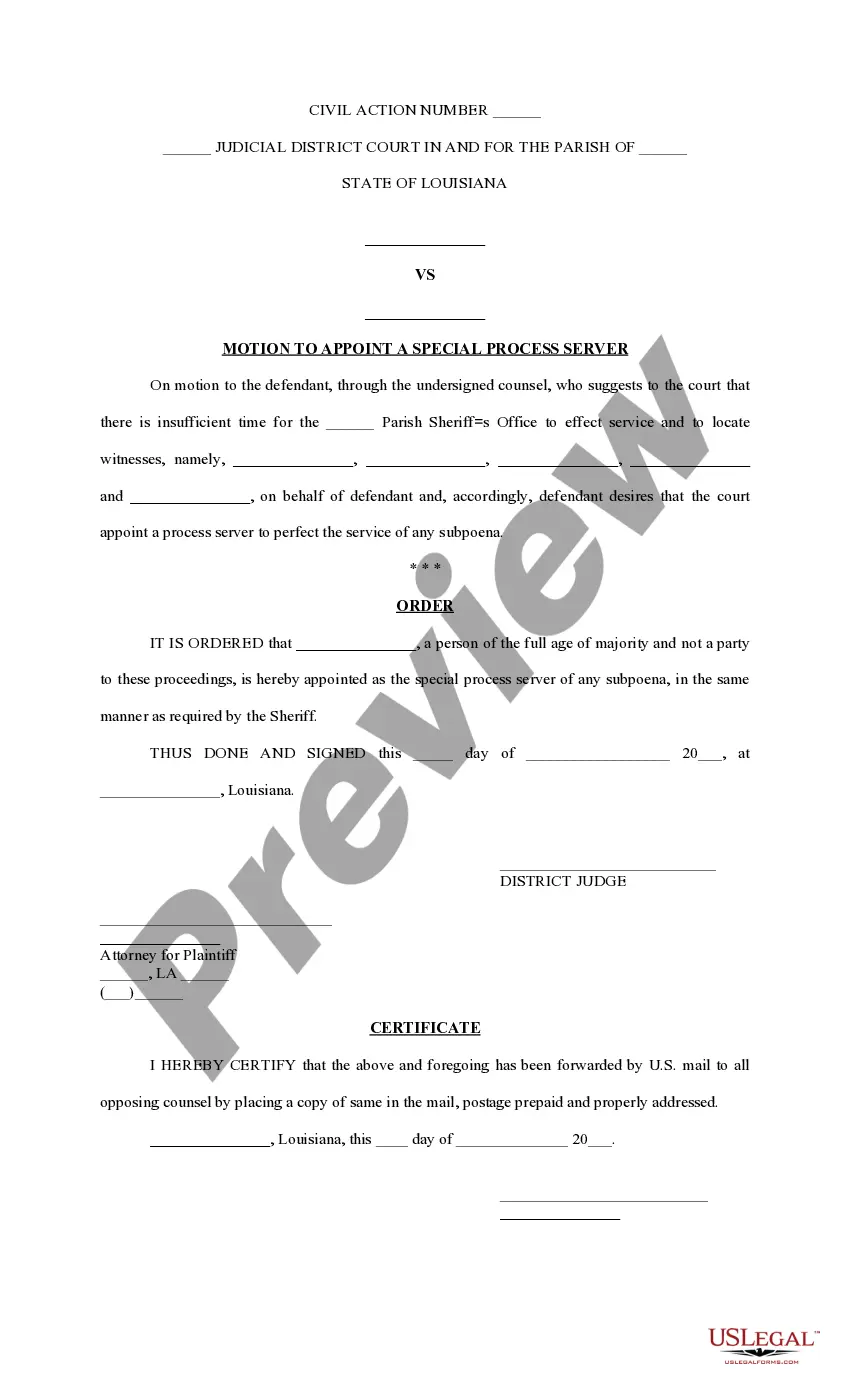

- For first-time users, browse through the preview mode and form descriptions. Verify that you have selected the form that fits your needs and meets your local legal standards.

- If the current form doesn't meet your criteria, use the search function to find a more suitable template.

- Proceed to purchase by clicking the Buy Now button. Choose the subscription plan that best suits your needs and create an account to access the library.

- Complete your purchase by entering your credit card details or utilizing your PayPal account.

- Download your form and save it on your device. You can also access it anytime from the My Forms section of your profile.

By utilizing US Legal Forms, you benefit from an extensive collection of over 85,000 legal templates, which are easily fillable and editable for your convenience.

Take the next step towards managing your legal documents more efficiently. Start using US Legal Forms today to ensure you have the right tools at your disposal!

Form popularity

FAQ

In Minnesota, several types of assets can bypass the probate process, including jointly owned properties, life insurance policies with named beneficiaries, and retirement accounts. These exemptions can simplify the estate management process significantly. For clear guidance on how to handle both exempt and non-exempt assets efficiently, consider implementing distribution probate with a service.

An executor in Minnesota generally should distribute assets within a year of the probate filing. However, if complications arise, this timeframe may need adjustment. To ensure proper compliance and a smooth distribution process, utilizing a distribution probate with a service can be a wise choice for both executors and beneficiaries.

Yes, Minnesota law allows a timeframe of up to one year for the settlement of an estate. However, unique situations may require more time, depending on the estate's complexity. To stay within legal requirements and effectively manage the estate, you may benefit from a distribution probate with a service, which can provide expert guidance.

In Minnesota, executors typically have up to a year to settle the estate after the probate court appoints them. While some executors may complete their duties sooner, it's vital to ensure all necessary steps are taken to avoid potential issues. Engaging a distribution probate with a service can streamline this process and help uphold your responsibilities.

Yes, there is a general time frame for executors to complete their duties, which varies by state. In many cases, executors should aim to finalize the estate within a year after the probate process begins. However, complications can arise, which may extend this timeline. If you require assistance, consider distribution probate with a service to help navigate the process efficiently.

Filling out probate paperwork may seem daunting, but you can manage it more easily with the right approach. Utilizing distribution probate with a service can guide you through the required forms, ensuring that you provide all necessary information. These services often offer templates and support, helping you avoid common mistakes. Completing this paperwork accurately is crucial, as it sets the stage for the entire probate process.

Distributing items from an estate can be simplified by using distribution probate with a service. Start by cataloging all items and identifying their value. Engage a service that specializes in probate distribution to help you navigate the complexities of asset distribution fairly and legally. They can assist with locating beneficiaries, addressing any potential conflicts, and ensuring compliance with state laws.

The best way to give inheritance is through a well-structured estate plan. Consider using distribution probate with a service to ensure your wishes are accurately conveyed and executed. A professional service can guide you in distributing assets fairly among beneficiaries, minimizing disputes. Additionally, proper documentation can help streamline the process and provide clarity for all parties involved.

Yes, an executor can distribute funds, but only after the probate process has been completed and all debts settled. They must follow the instructions laid out in the will while ensuring compliance with state laws. Engaging with services that support distribution probate can provide the necessary resources and expertise required to handle any complexities during the distribution of funds.

In Pennsylvania, you are not required to hire a lawyer to probate a will, but it is highly advisable. An attorney can navigate the complexities of probate law, ensuring that all documents are filed correctly and timely. Using a service for distribution probate can also streamline the process and ease your legal burdens, making the experience less daunting.