Supplemental Needs Trust Allowable Expenses Withholding

Description

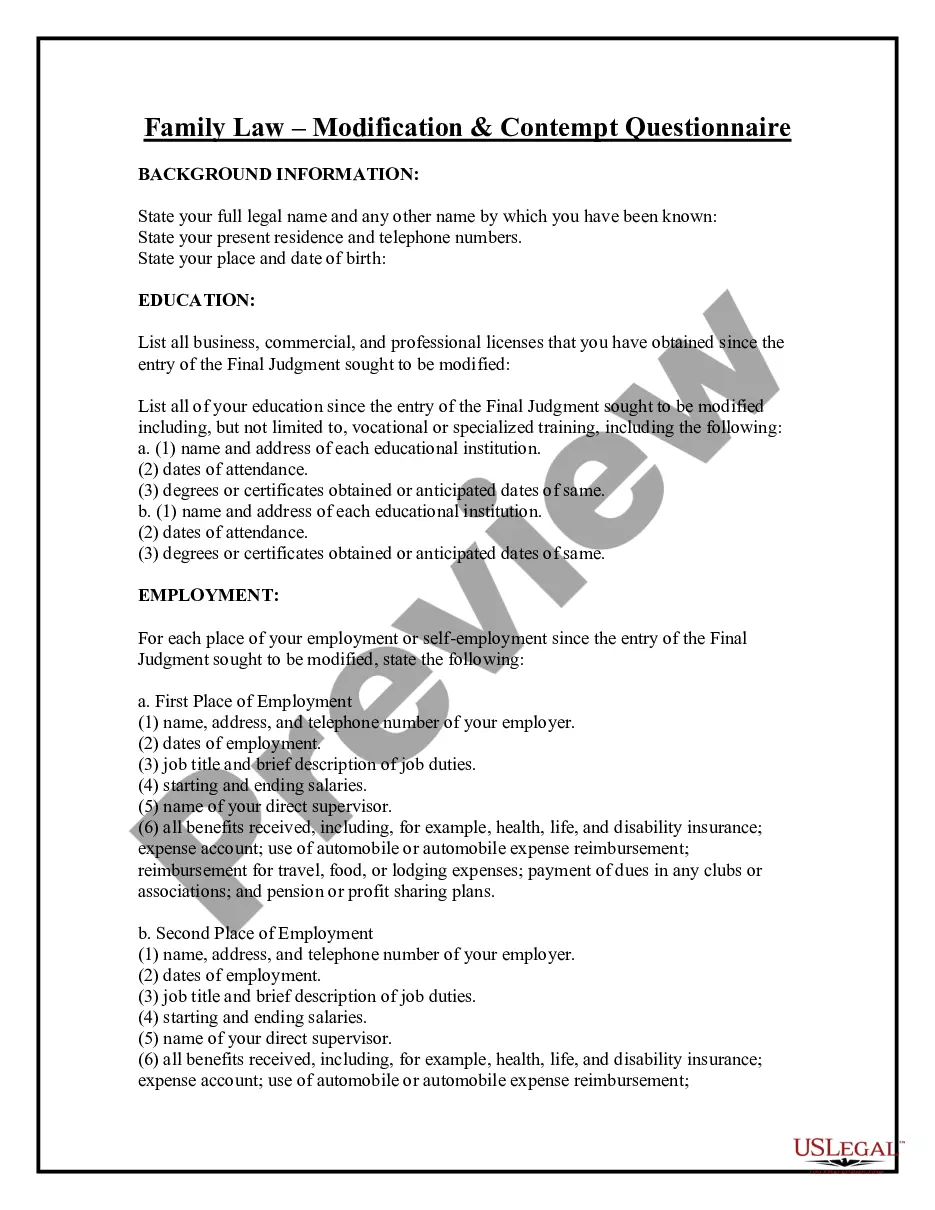

How to fill out Supplemental Needs Trust For Third Party - Disabled Beneficiary?

Obtaining legal templates that comply with federal and local regulations is crucial, and the internet offers a lot of options to pick from. But what’s the point in wasting time searching for the right Supplemental Needs Trust Allowable Expenses Withholding sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the largest online legal catalog with over 85,000 fillable templates drafted by lawyers for any business and life situation. They are simple to browse with all papers organized by state and purpose of use. Our experts keep up with legislative changes, so you can always be confident your form is up to date and compliant when getting a Supplemental Needs Trust Allowable Expenses Withholding from our website.

Getting a Supplemental Needs Trust Allowable Expenses Withholding is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the right format. If you are new to our website, adhere to the guidelines below:

- Take a look at the template using the Preview feature or via the text outline to ensure it meets your needs.

- Locate a different sample using the search function at the top of the page if needed.

- Click Buy Now when you’ve found the correct form and choose a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Select the best format for your Supplemental Needs Trust Allowable Expenses Withholding and download it.

All templates you locate through US Legal Forms are multi-usable. To re-download and fill out earlier obtained forms, open the My Forms tab in your profile. Enjoy the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

Supplemental Needs Trust (SNT) The SNT is a Medicaid planning tool used to shelter a disabled person's assets for: Maintaining eligibility for governmental benefits like Medicaid. Enhancing the disabled person's quality of life by paying for needs Medicaid does not cover.

A Supplemental Needs Trust (SNT) is a special kind of trust. The SNT allows a person who is certified as disabled to get government benefits, such as Medicaid. Under Medicaid law, a person with a disabil- ity is not eligible for Medicaid if they have too much money or savings (?excess resources?).

Using a first party SNT will not affect any benefits a person receives that are not based on an income limitation or resource level. The beneficiary can work with a special needs attorney to set up the trust and appoint someone, called the trustee, to hold the money on his or her half.

If the Trust generates a Capital Loss, it can not be passed through to the Trust's beneficiaries. It is retained within the trust itself and is designated as a Capital Loss Carryforward of the trust. This carryforward will be used to offset future year capital gains.

Cons of Special Needs Trusts The trust must be maintained, and yearly management costs can be high. Depending on who manages the fund, there may be a minimum amount required to set up the trust. It may be financially difficult for the settlor to actually establish the trust, depending upon their circumstances.