401k Beneficiary Form Without Social Security Number

Description

How to fill out Supplemental Needs Trust For Third Party - Disabled Beneficiary?

Legal oversight may be aggravating, even for seasoned experts.

When you are looking for a 401k Beneficiary Form Without Social Security Number and lack the time to search for the suitable and current version, the process can be challenging.

Gain access to a collection of articles, guides, and manuals pertinent to your circumstances and needs.

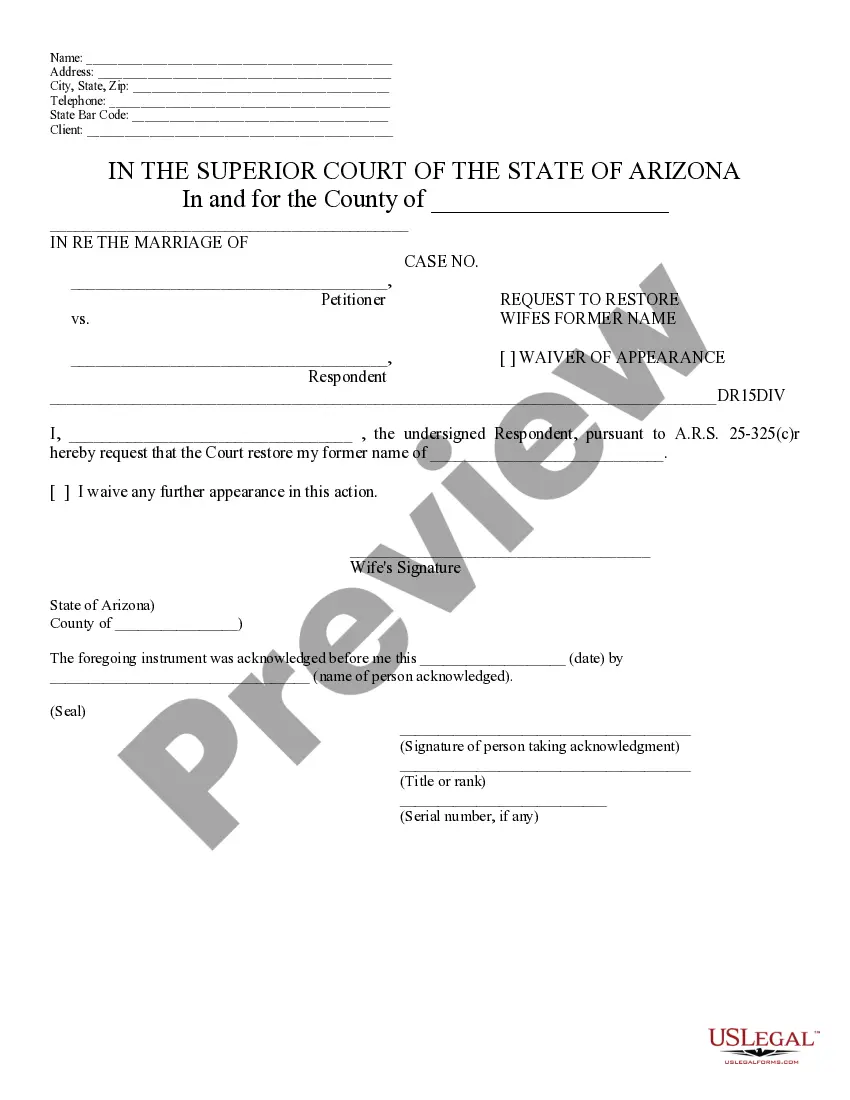

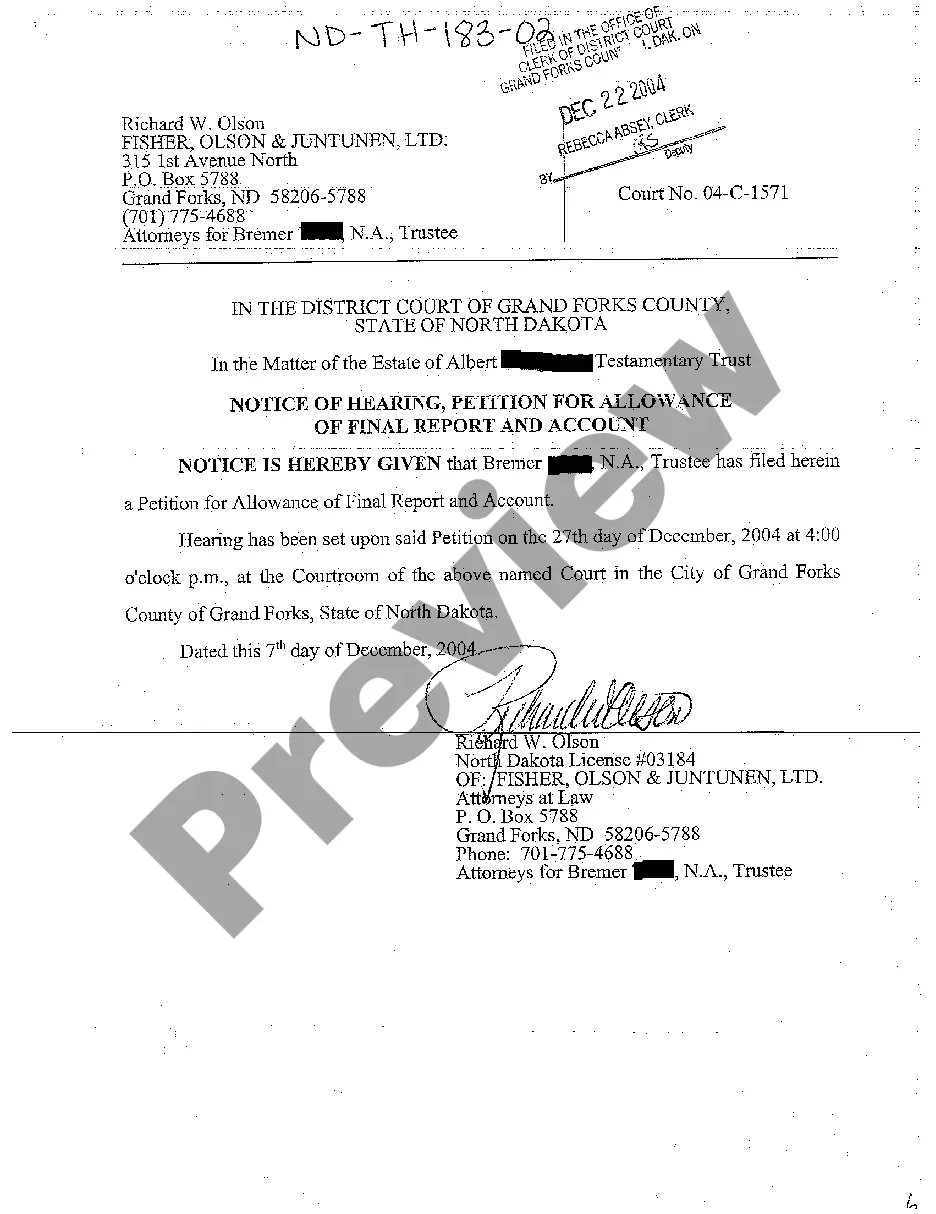

Conserve time and energy searching for the forms you require, and leverage US Legal Forms’ sophisticated search and Review tool to find the 401k Beneficiary Form Without Social Security Number and obtain it.

Make sure the template is accepted in your state or county.

- If you possess a membership, Log In to your US Legal Forms account, search for the form, and download it.

- Check the My documents tab to review the documents you previously saved and organize your folders as desired.

- If this is your inaugural experience with US Legal Forms, create an account and receive unlimited access to all the benefits of the library.

- Here are the steps to follow after obtaining the desired form.

- Confirm it is the correct form by previewing it and examining its description.

- Utilize an extensive online form catalog that could be transformative for anyone aiming to manage these situations effectively.

- Access state- or county-specific legal and organizational documents. US Legal Forms encompasses any demands you may have, from personal to corporate paperwork, all in a single location.

- Employ advanced tools to complete and manage your 401k Beneficiary Form Without Social Security Number.

Form popularity

FAQ

First, it is possible to name a non-U.S. citizen as a retirement account beneficiary. The retirement account could be an IRA, a 401(k), or a similar account.

You have four options as a surviving non-spouse beneficiary: Transferring to an inherited IRA. ... Take a lump-sum distribution. ... Withdraw funds over a 5 or 10 year period. ... Take the required minimum distributions based on your life expectancy.

A beneficiary is the person or entity that you designate to receive the proceeds from your Life insurance policy. You can designate anyone to be your beneficiary. The beneficiary does not have to be a U.S. citizen.

If the beneficiary refuses to give their social security number to collect on a life insurance claim, the insurance company will likely accept another form of identification such as a passport, ITIN, or valid driver's license.

Yes. Banks may require the beneficiary to provide a Social Security number (SSN) for monetary transactions. This requirement is intended to verify that funds are distributed to the correct designated individual(s) listed in a will, trust, insurance policy, retirement plan, annuity, or other contract.