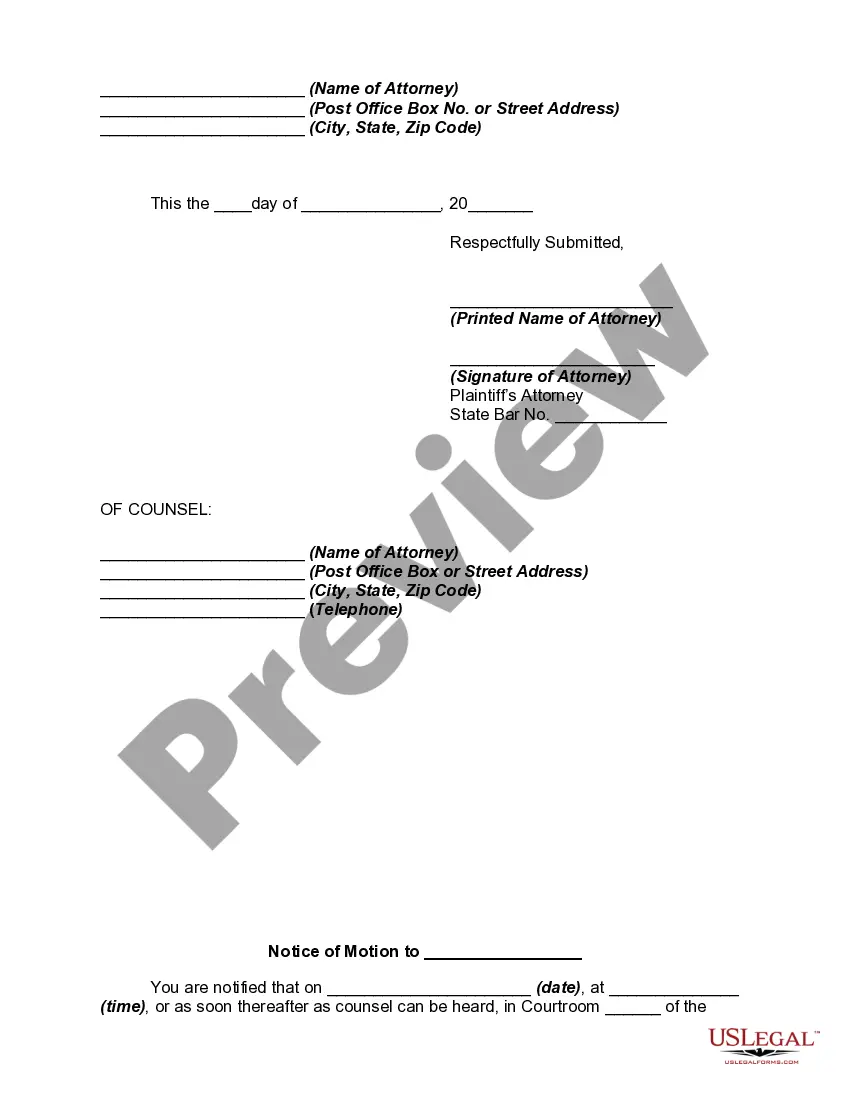

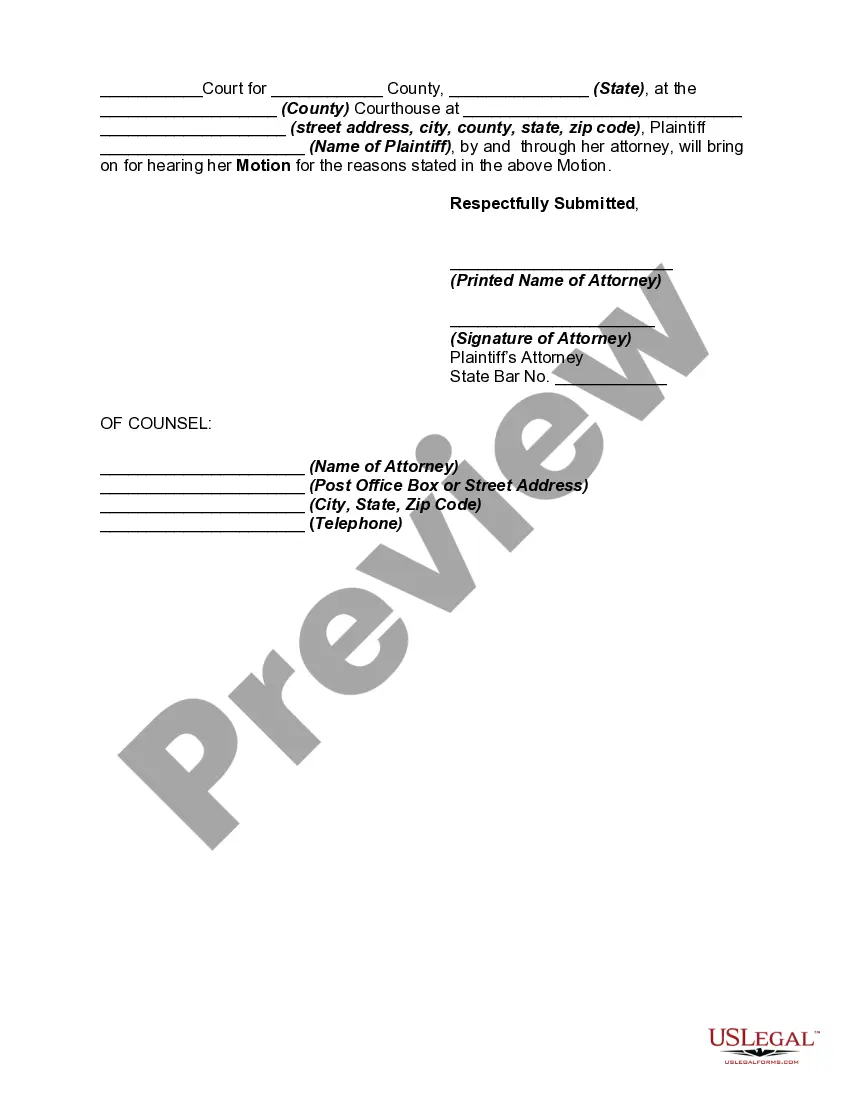

Motion For Protective Order Example

Description

How to fill out Motion For Temporary Restraining Order To Restrain And Enjoin Harassment Of Employee?

Whether for commercial reasons or for personal issues, everyone must deal with legal circumstances eventually in their life.

Completing legal paperwork necessitates meticulous attention, starting with selecting the correct form template.

With an extensive US Legal Forms catalog available, you never have to waste time searching for the suitable sample online. Utilize the library’s user-friendly navigation to find the correct form for any circumstance.

- Obtain the sample you require by utilizing the search bar or catalog navigation.

- Review the form's details to confirm it fits your situation, state, and county.

- Click on the form's preview to inspect it.

- If it is the wrong document, return to the search functionality to locate the Motion For Protective Order Example template you need.

- Acquire the template if it aligns with your requirements.

- If you already possess a US Legal Forms account, click Log in to access previously saved documents in My documents.

- If you do not yet have an account, you can download the form by selecting Buy now.

- Select the relevant pricing option.

- Complete the profile registration form.

- Choose your method of payment: you can utilize a credit card or PayPal account.

- Select the file format you desire and download the Motion For Protective Order Example.

- Once it is saved, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

There is no State requirement in Alabama to have an operating agreement, however, it is still highly recommended to have one in order to state the purpose of the business as well as the ownership interest of the members (if a multi-member LLC).

Benefits of starting an Alabama LLC: Quick and simple filing, management, compliance, regulation and administration. Protect your personal assets from your business liability and debts. Low cost to file ($200)

After you form an Alabama LLC, you will need to obtain a business license.

The cost to register a new LLC in Alabama is $200. You'll need to provide basic information about your LLC in the articles of organization, including: Owner's name(s) and contact information.

Steps on How to Start Your LLC in Alabama Reserve Your LLC Name With the Alabama Secretary of State. ... Designate a Registered Agent. ... File a Certificate of Formation. ... Create an Operating Agreement. ... Request an IRS Employer Identification Number (EIN) ... Fulfill Ongoing Obligations.

It costs $200 to form an LLC in Alabama. This is a fee paid for the Certificate of Formation. You'll file this form with the Alabama Secretary of State. And once approved, your LLC will go into existence.

How to start a business in Alabama in 8 steps 1) Think about the type of business you want to start. ... 2) Set up your legal structure. ... 3) Name and register your business. ... 4) Apply for licenses and permits. ... 5) Choose a location. ... 6) Open a bank account and prepare for future taxes. ... 7) Purchase business insurance.

How to Form an Alabama LLC in 2023 (Step-by-Step Guide) #1: Reserve Your LLC Name With the Alabama Secretary of State. #2: Designate a Registered Agent. #3: File a Certificate of Formation. #4: Create an Operating Agreement. #5: Request an IRS Employer Identification Number (EIN)

It costs $200 to form an LLC in Alabama. This is a fee paid for the Certificate of Formation. You'll file this form with the Alabama Secretary of State. And once approved, your LLC will go into existence.

It costs $200 to form an LLC in Alabama. This is a fee paid for the Certificate of Formation. You'll file this form with the Alabama Secretary of State. And once approved, your LLC will go into existence.