Writ Of Garnishment Bank Account Without Ssn

Description

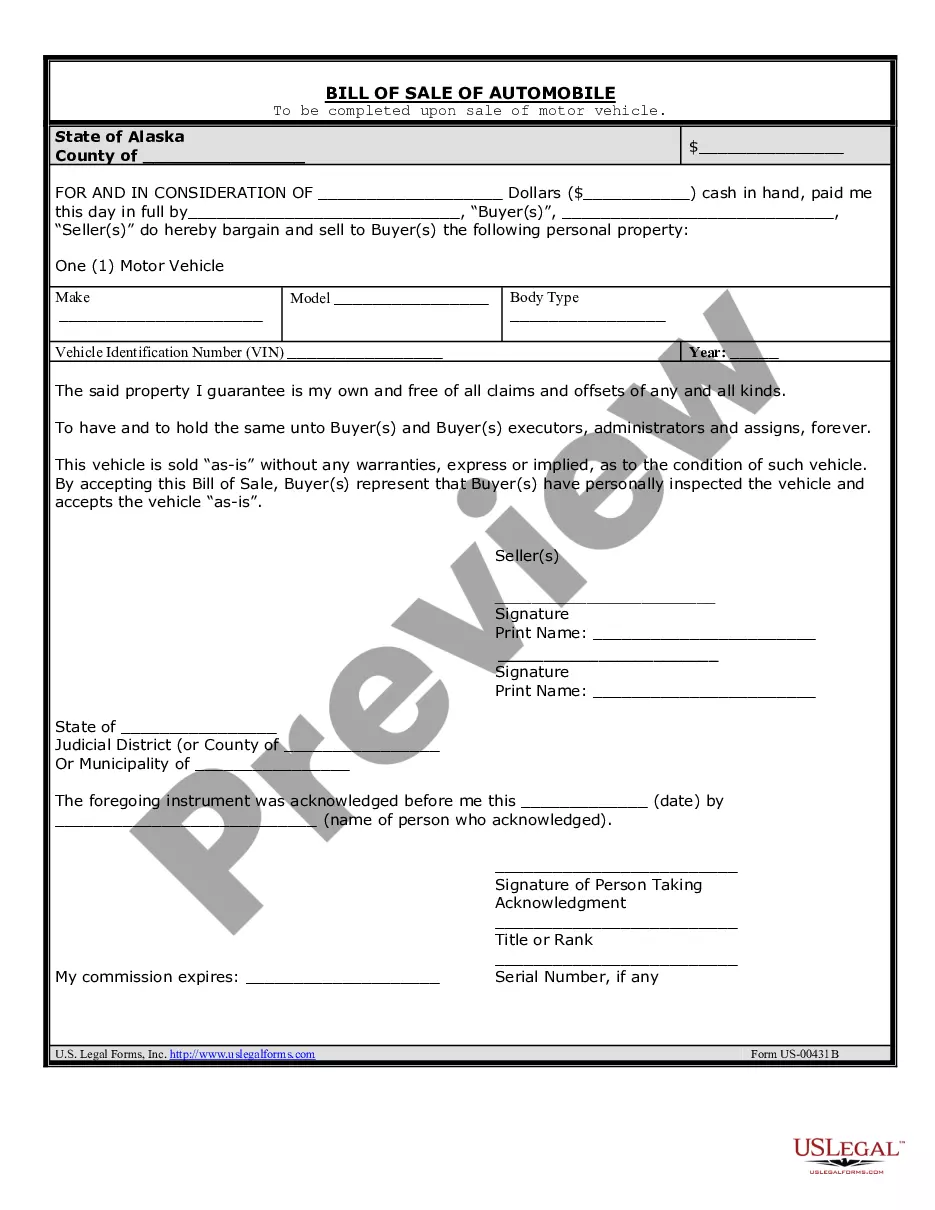

How to fill out Sample Letter For Writ Of Garnishment?

Utilizing legal document examples that comply with federal and state laws is vital, and the internet provides numerous options to select from.

However, what’s the use of squandering time looking for the properly written Writ Of Garnishment Bank Account Without Ssn example online when the US Legal Forms digital collection already contains such forms consolidated in one location.

US Legal Forms is the largest online legal database with over 85,000 editable templates created by lawyers for any business and personal situation.

Review the template using the Preview option or through the text outline to confirm it satisfies your needs. Search for another sample using the tool at the top of the page if required. Click Buy Now once you’ve located the correct form and select a subscription package. Create an account or Log In and process your payment using PayPal or a credit card. Choose the format for your Writ Of Garnishment Bank Account Without Ssn and download it. All templates available through US Legal Forms are reusable. To re-download and complete previously purchased documents, access the My documents section in your profile. Make the most of the largest and user-friendly legal document service!

- They are straightforward to navigate with all documents sorted by state and purpose.

- Our experts keep track of legal changes, so you can always rest assured your documents are current and compliant when acquiring a Writ Of Garnishment Bank Account Without Ssn from our site.

- Obtaining a Writ Of Garnishment Bank Account Without Ssn is quick and easy for both existing and new users.

- If you already hold an account with an active subscription, Log In and download the document template you need in the appropriate format.

- If you are a newcomer to our site, follow the instructions below.

Form popularity

FAQ

Some sources of income are considered protected in account garnishment, including: Social Security, and other government benefits or payments. Funds received for child support or alimony (spousal support) Workers' compensation payments.

Pay your debts if you can afford it. Make a plan to reduce your debt. If you cannot afford to pay your debt, see if you can set up a payment plan with your creditor. ... Challenge the garnishment. ... Do no put money into an account at a bank or credit union. See if you can settle your debt. ... Consider bankruptcy.

However, the general rule is that debt collectors, even with your details, cannot simply remove funds from your account without specific authorization. Typically, they require something known as a 'bank levy' to access your account.

There are four ways to open a bank account that no creditor can touch: (1) use an exempt bank account, (2) establish a bank account in a state that prohibits garnishments, (3) open an offshore bank account, or (4) maintain a wage or government benefits account.

Even if you owe the debt a creditor seeks to garnish, the money in your bank account may be exempt from a levy. Federal law prohibits bank levies on Social Security payments, Supplemental Security Income (SSI) payments, veteran's benefits, student assistance, and many other types of federal benefits.