Agreement Borrowers Form With Answer

Description

How to fill out Line Of Credit Or Loan Agreement Between Corporate Or Business Borrower And Bank?

Regardless of whether it is for corporate reasons or personal affairs, everyone will confront legal matters at some point in their lives.

Completing legal paperwork requires meticulous care, starting with selecting the correct form template.

Once downloaded, you can either complete the form using editing software or print it out and fill it in manually.

With a vast catalog from US Legal Forms available, there's no need to waste time searching for the right sample across the internet.

Utilize the library's user-friendly navigation to locate the appropriate template for any situation.

- For instance, if you choose an incorrect version of the Borrower's Agreement Form With Response, it will be rejected upon submission.

- Thus, it's essential to have a trustworthy source for legal documents like US Legal Forms.

- Should you need to acquire a Borrower's Agreement Form With Response template, follow these straightforward instructions.

- Utilize the search bar or browse the catalog to find the necessary sample.

- Examine the form's description to confirm it corresponds to your circumstances, state, and locale.

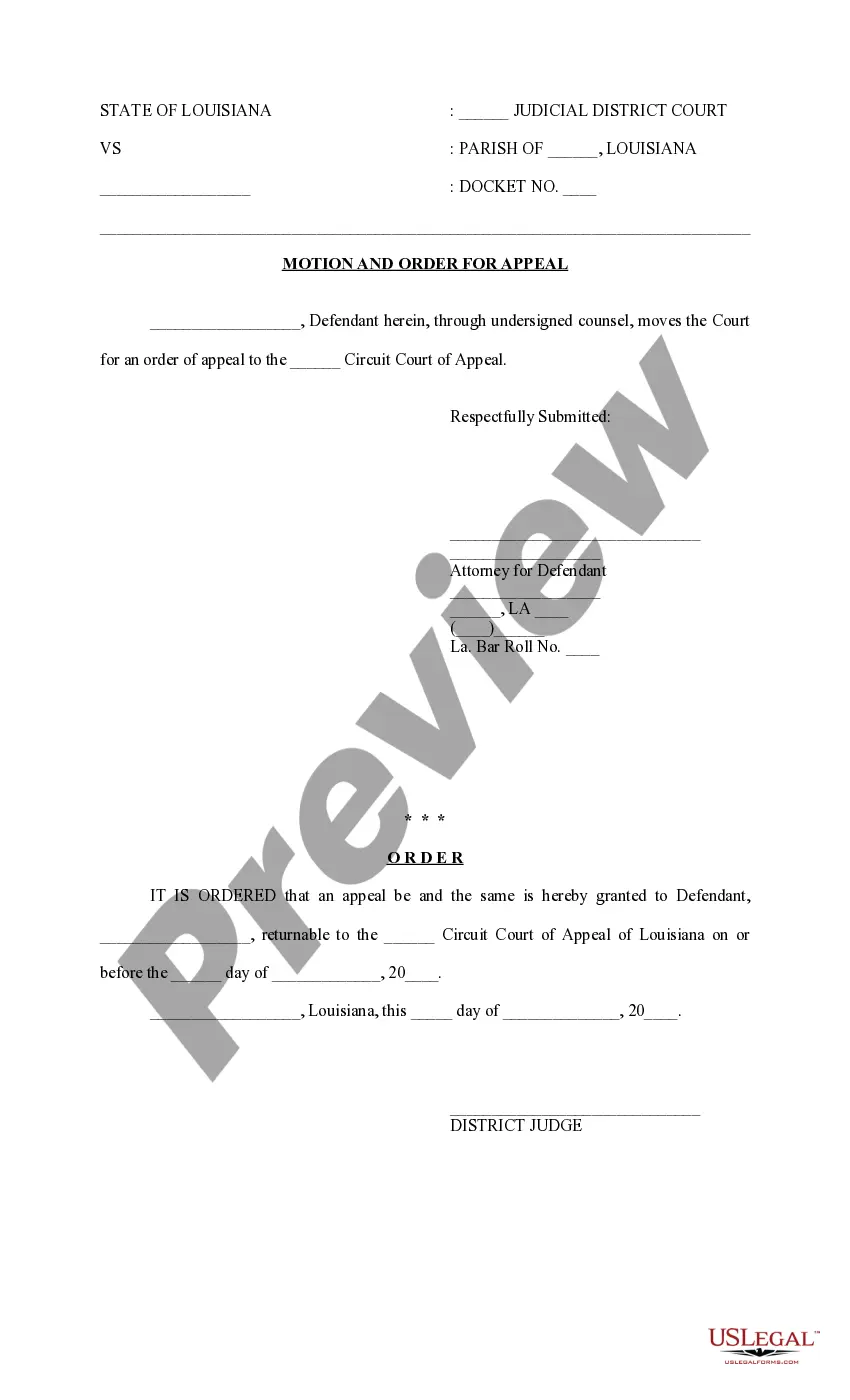

- Select the form's preview to review it.

- If it is the wrong document, return to the search tool to find the Borrower's Agreement Form With Response template you require.

- Obtain the file once it satisfies your requirements.

- If you already have a US Legal Forms account, click Log in to access documents you saved in My documents.

- If you do not yet have an account, you can acquire the form by clicking Buy now.

- Select the suitable pricing option.

- Complete the profile registration form.

- Choose your payment method: either a credit card or a PayPal account.

- Select the document format you prefer and download the Borrower's Agreement Form With Response.

Form popularity

FAQ

Filling an agreement form requires attention to detail and accuracy. Start by entering the personal or business information correctly, ensuring that all names, addresses, and contact details are clear. Next, outline the terms of the agreement, such as the amount, repayment terms, and any conditions. You can use the US Legal platform to access an Agreement borrowers form with answer, guiding you step-by-step through this process.

The purpose of this form is to collect identifying information about the applicant, loan request, indebtedness, principals of the business, and information on current or previous government financing.

SBA Form 1919, Borrower Information Form The form is completed by the Small Business Applicant(s) and its Associates(s)/Principal(s)/Key Personnel for submission to an SBA Lender. The form is primarily comprised of questions that help determine whether the request meets basic eligibility requirements.

How to Fill out an SBA 1919 (7a Borrower Information Form) YouTube Start of suggested clip End of suggested clip Now again what we're looking for is do you have any criminal. Issues if you do sometimes that's okayMoreNow again what we're looking for is do you have any criminal. Issues if you do sometimes that's okay we just need to do a little bit. More a little bit more information.

When applying for an SBA 7(a) loan, you must complete SBA Form 1919. The form is required for each owner, partner, officer and director with a 20% stake or more in the business and/or managing member who handles day-to-day operations.