Not Profit File With Irs

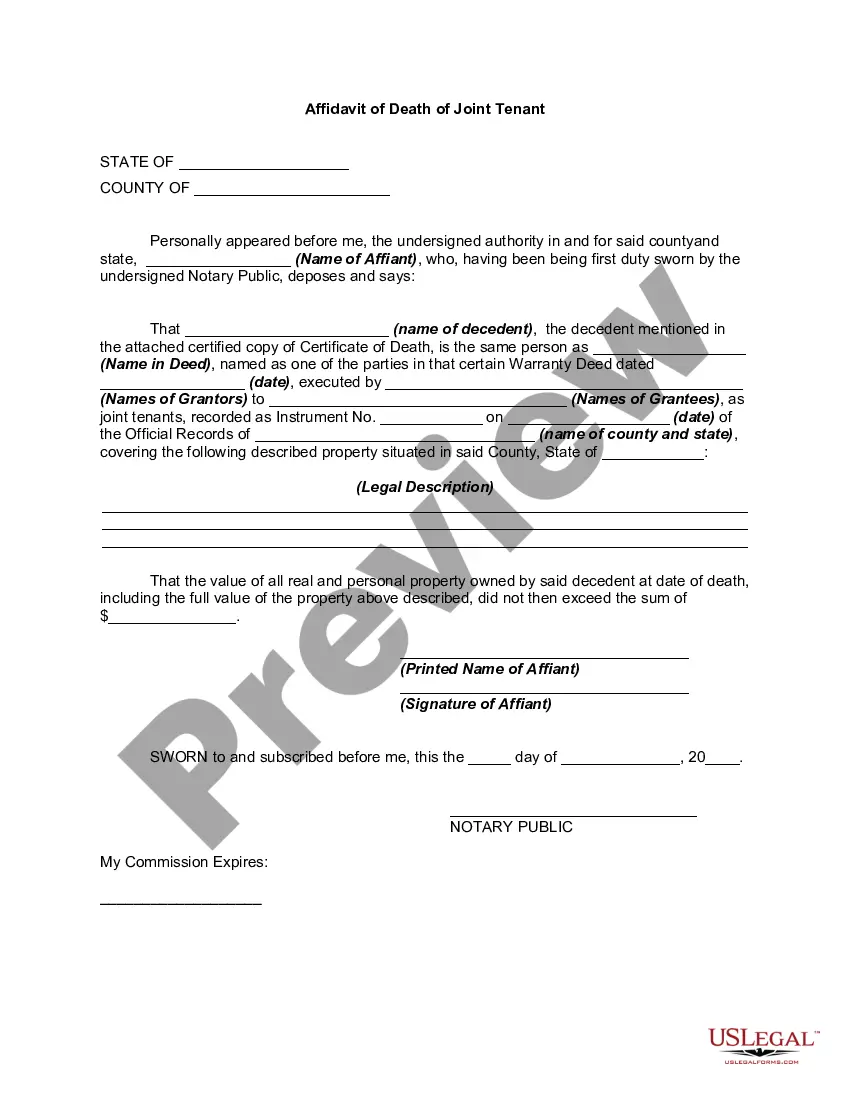

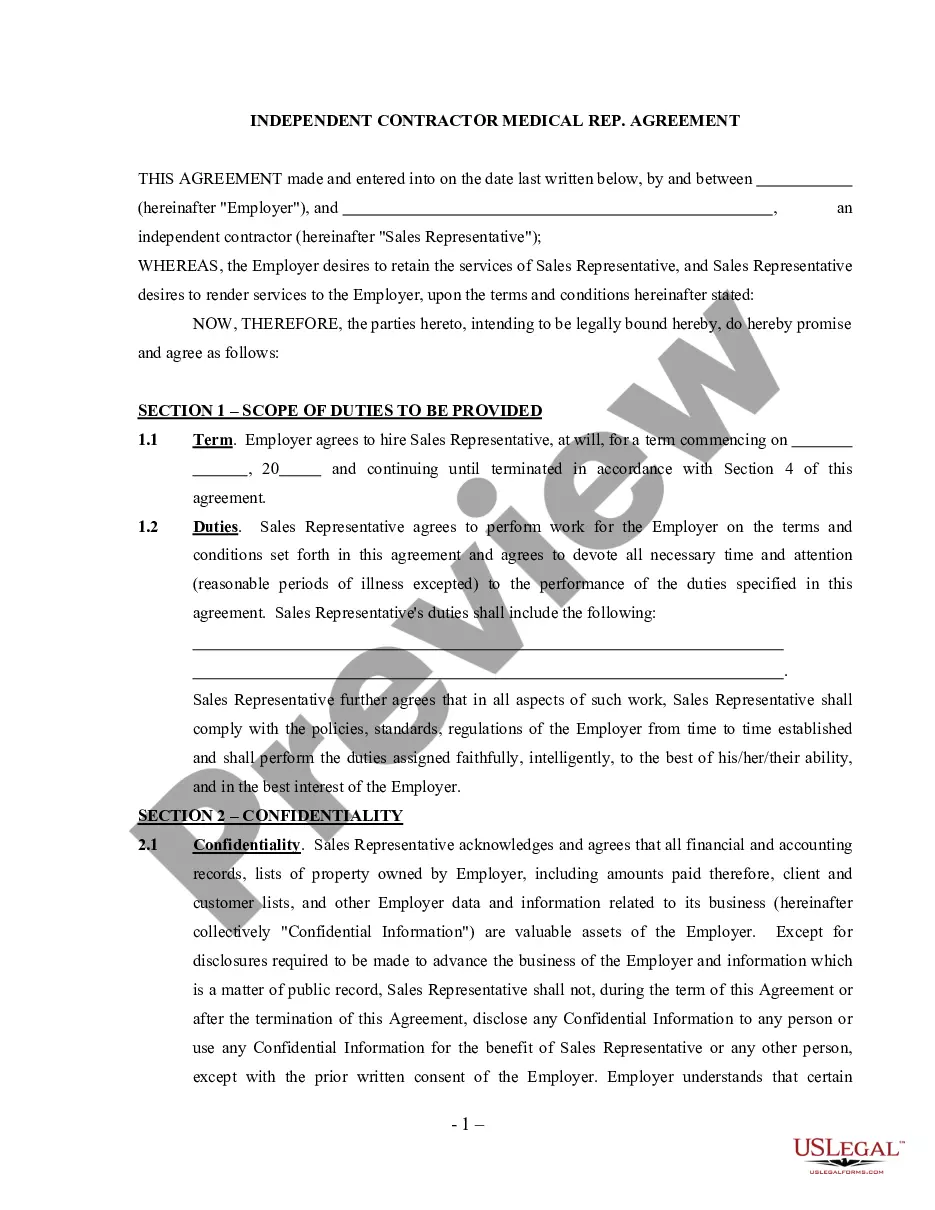

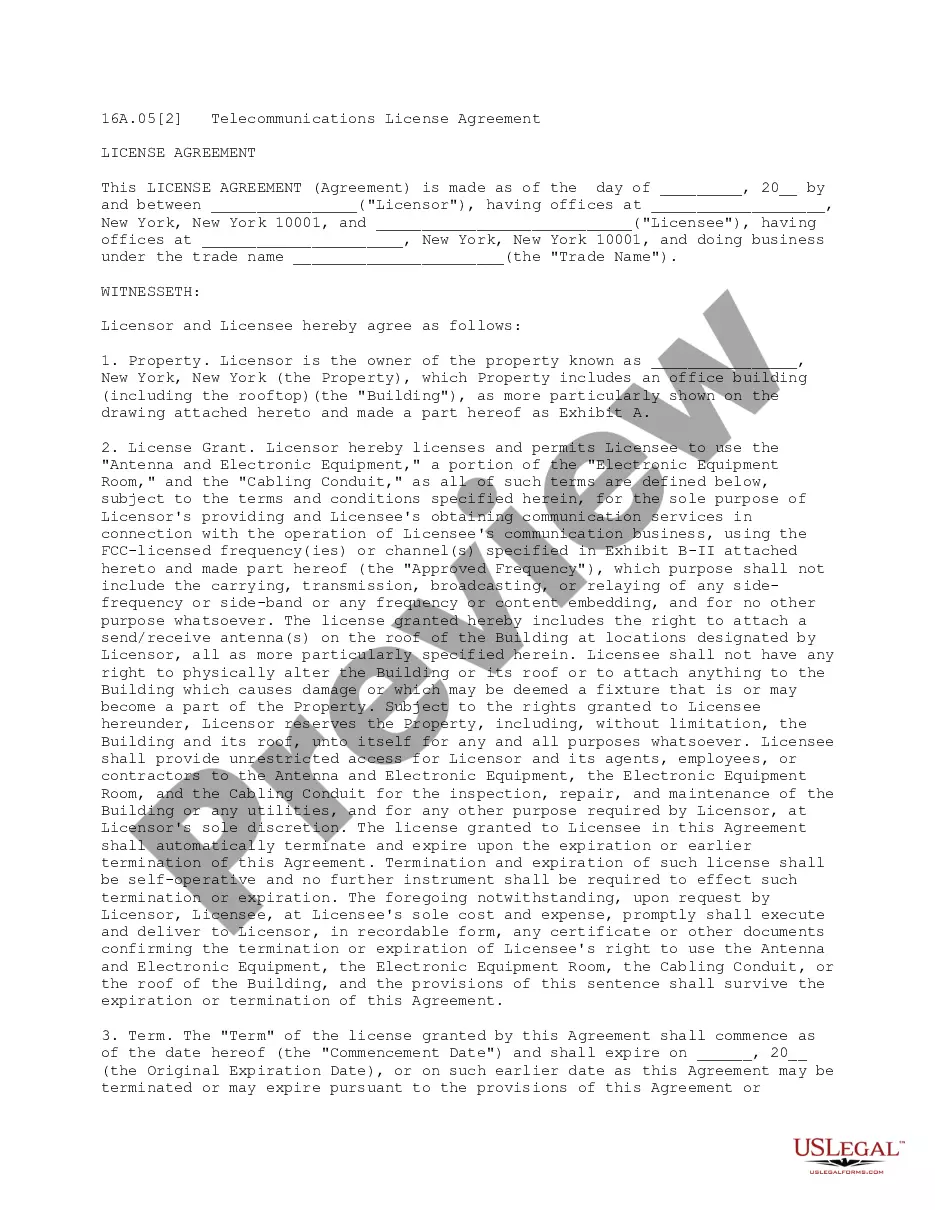

Description

How to fill out Articles Of Incorporation, Not For Profit Organization, With Tax Provisions?

Creating legal documents from the ground up can occasionally feel a bit daunting.

Certain cases may require extensive research and significant financial investment.

If you’re searching for an easier and more cost-effective method to generate Not Profit File With Irs or similar paperwork without unnecessary complications, US Legal Forms is here to help.

Our online collection of more than 85,000 current legal documents encompasses nearly every facet of your financial, legal, and personal needs. With just a few clicks, you can swiftly obtain state- and county-compliant forms meticulously organized for you by our legal experts.

Review the form previews and descriptions to ensure you find the document you need. Verify that the form you select complies with the rules and regulations of your state and county. Choose the correct subscription option to purchase the Not Profit File With Irs. Download the form, then complete, validate, and print it. US Legal Forms has a flawless reputation and over 25 years of experience. Join us today and make document preparation a breeze!

- Utilize our platform whenever you require dependable and trustworthy services to quickly find and download the Not Profit File With Irs.

- If you’re already familiar with our website and have set up an account, simply Log In, choose the form, and download it immediately or retrieve it any time from the My documents section.

- Not signed up yet? No problem. Registration takes just a few minutes and navigating the library is straightforward.

- But before you dive into downloading the Not Profit File With Irs, keep these tips in mind.

Form popularity

FAQ

Examples of waivers include the waiving of parental rights, waiving liability, tangible goods waivers, and waivers for grounds of inadmissibility. Waivers are common when finalizing lawsuits, as one party does not want the other pursuing them after a settlement is transferred.

Key Takeaways On How To Write A Waiver Choose a waiver template. Determine the type of activity or service. State the purpose of the waiver. Identify the risks. Include a title. Include customer information. Include waiver terms. Include a statement of understanding.

The liability release form, also known as the waiver form, contains a legally binding agreement between two parties, stating that one of them (the releasor) promises not to sue the other side (the releasee) for past, current, or future damages, losses, or injuries.

Use Form 4506, Request for Copy of Tax Return, to request copies of tax returns. Automated transcript request. You can quickly request transcripts by using our automated self-help service tools. Please visit us at IRS.gov and click on ?Get a Tax Transcript...? under ?Tools? or call 1-800-908-9946.

The IRS Form 4506 is used to retrieve photo copies of the tax returns that were filed by the taxpayer. 4506 can take the IRS up to 60 days to complete. The IRS Form 4506-T is used to request tax transcripts directly from the IRS.

T Instructions Fill out lines 14, if applicable. List your BYU ID number on line 5. Check box 7 (for Verification of Nonfiling). On line 9 enter 12/31/__ for the tax year you are requesting. ... Sign the document. Mail to the appropriate address on page 2 (Chart for all other transcripts).

Download IRS Form 4506-T at ? Complete lines 1 ? 4, following the instructions on page 2 of the form. Line 3: enter the non-filer's street address and zip or postal code.