Pay For Wages

Description

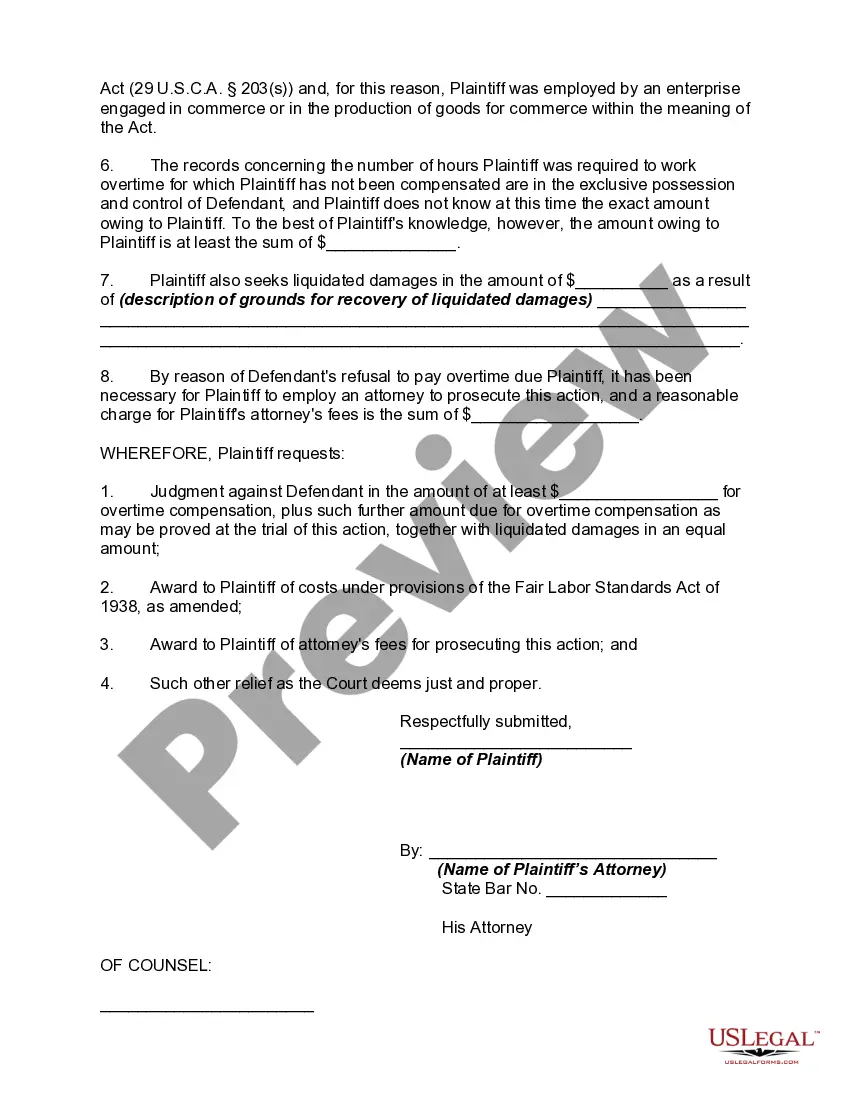

How to fill out Complaint To Recover Overtime Compensation Or Wages In State Court Under Section 16(b) Of Fair Labor Standards Act?

It’s well-known that you can’t transform into a legal expert in a day, nor can you swiftly learn to draft Pay For Wages without a specialized background.

Producing legal documents is a lengthy endeavor that necessitates specific education and expertise. So why not entrust the creation of the Pay For Wages to the specialists.

With US Legal Forms, one of the most extensive legal template collections, you can access everything from court documents to templates for in-office correspondence. We recognize how vital compliance and adherence to federal and local regulations are.

You can revisit your forms from the My documents section anytime. If you’re a current customer, you can simply Log In, and find and download the template from the same section.

Regardless of the intent of your documents—whether financial and legal, or personal—our platform has you covered. Give US Legal Forms a try now!

- Discover the document you require using the search bar at the top of the page.

- Preview it (if this option is available) and read the accompanying description to determine if Pay For Wages is what you need.

- Restart your search if you need a different document.

- Create a free account and choose a subscription plan to buy the form.

- Click Buy now. Once the payment is processed, you can obtain the Pay For Wages, complete it, print it, and send or deliver it to the necessary individuals or organizations.

Form popularity

FAQ

The $600 rule refers to the IRS requirement for businesses to issue a 1099-MISC form if they pay an independent contractor $600 or more in a calendar year. This rule ensures that the IRS is notified of significant payments made to individuals who are not employees. When you pay for wages to contractors, be diligent about tracking these payments. US Legal Forms can provide guidance on how to comply with this rule effectively.

Legally paying an employee involves adhering to federal and state labor laws, including minimum wage requirements and proper payroll processing. You must collect necessary information, such as the employee's Social Security number, and maintain accurate records of hours worked. It's vital to pay for wages accurately and on time to avoid penalties. US Legal Forms offers resources to help you navigate the legal requirements for employee payments.

If you need to report income without a 1099, you can still do so by accurately reporting the income on your tax return. You should gather all relevant records, such as bank statements or invoices, to substantiate your earnings. It's essential to pay for wages reported, even if you don't receive a 1099 form. Utilizing US Legal Forms can help you organize your finances and ensure proper reporting.

Definition of Wages Wages are usually associated with employee compensation that is based on the number of hours worked multiplied by an hourly rate of pay. Generally, the employees earning hourly wages will be paid in the week that follows the hours worked.

Income is reported in the tax year it is received. It flat out does not matter in what year you may have earned it.

At the end of the year, you must prepare and file Form W-2, Wage and Tax Statement to report wages, tips and other compensation (including noncash payments) paid to each employee in your trade or business. Use Form W-3, Transmittal of Wage and Tax Statements to transmit Forms W-2 to the Social Security Administration.

How to Know What to Pay Your Employees Assess the position. While a job title is a good place to start, it alone isn't enough to determine a starting salary. ... Consider experience and education. ... Research wages and industry rates. ... Factor in benefits and perks. ... Set a salary range. ... Negotiate with the employee.

A wage is payment made by an employer to an employee for work done in a specific period of time. Some examples of wage payments include compensatory payments such as minimum wage, prevailing wage, and yearly bonuses, and remunerative payments such as prizes and tip payouts.