Deed Time Share Foreclosure

Description

How to fill out Deed To Time Share Condominium With Covenants Of Title?

It’s clear that becoming a legal specialist is not something you can accomplish in a day, nor can you swiftly master how to prepare Deed Time Share Foreclosure without possessing a distinct skill set. Assembling legal documents is an extensive undertaking that necessitates specific training and expertise.

So why not entrust the preparation of the Deed Time Share Foreclosure to the experts.

With US Legal Forms, which boasts one of the most extensive libraries of legal documents, you can discover anything from court filings to templates for internal corporate messages. We recognize the importance of compliance with federal and local laws and regulations. This is why every form on our platform is tailored to specific locations and fully updated.

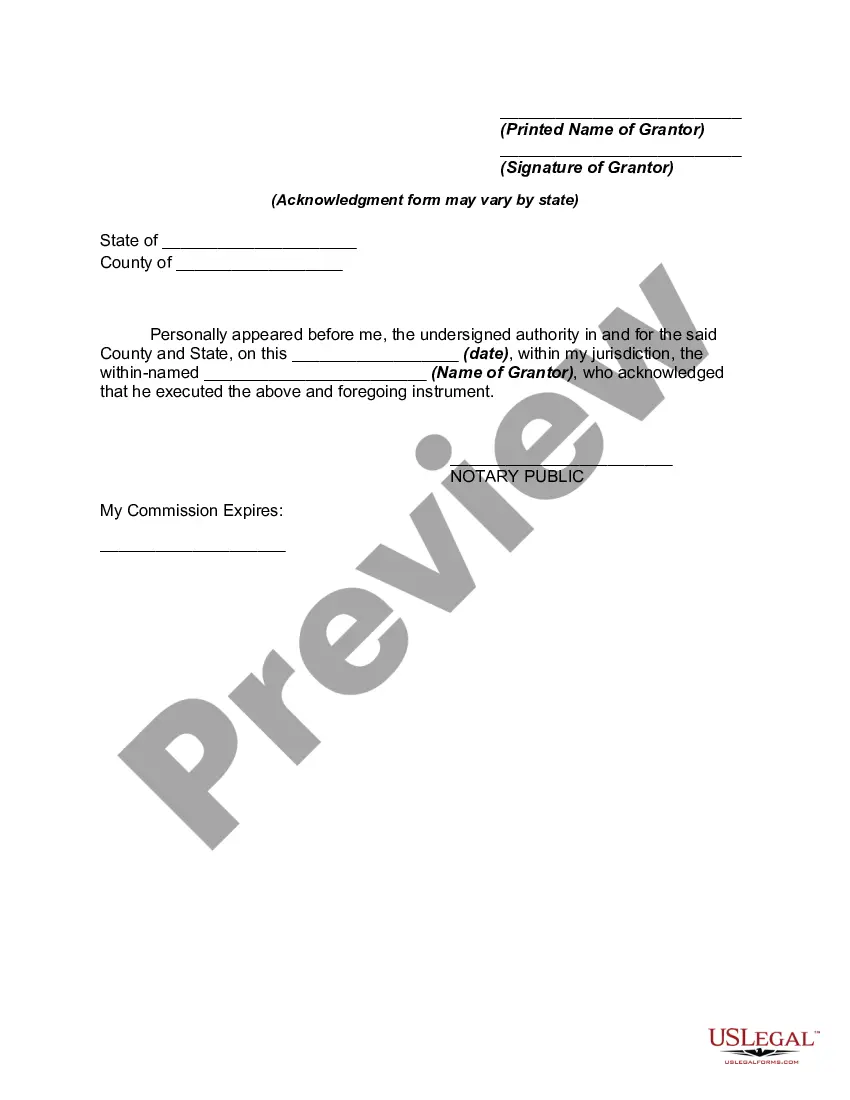

Select Buy now. After completing the payment, you can download the Deed Time Share Foreclosure, complete it, print it, and submit it by mail to the necessary parties or organizations.

You can access your documents again from the My documents tab at any time. If you are already a client, simply Log In to find and download the template from the same section. Regardless of the reason for your paperwork—whether legal and financial or personal—our platform has it covered. Give US Legal Forms a try now!

- Initiate your experience with our platform and acquire the document you need in just a few minutes.

- Utilize the search bar located at the top of the page to find the document you seek.

- If available, preview it and examine the accompanying description to ascertain if the Deed Time Share Foreclosure aligns with your needs.

- If you require another template, restart your search.

- Create a free account and choose a subscription plan to purchase the form.

Form popularity

FAQ

If they foreclose on your timeshare, you will lose your ownership rights and any potential equity in the property. Additionally, this action can severely impact your credit rating for several years. Understanding the consequences of deed time share foreclosure is crucial for making informed decisions. Consulting with professionals through USLegalForms can provide you with the necessary resources to manage this situation effectively.

To file a deed in lieu of foreclosure, you must first contact your lender to discuss your situation. You will need to provide documentation of your financial hardship and complete the necessary forms. This option allows you to transfer the property's title to the lender voluntarily, thus avoiding the lengthy foreclosure process associated with deed time share foreclosure. Utilizing platforms like USLegalForms can simplify this process with the right forms and guidance.

When a timeshare goes into foreclosure, the ownership of the property reverts back to the lender or developer. This process may negatively impact your credit score and can lead to legal actions. It's important to understand the terms of your agreement and the implications of deed time share foreclosure. Seeking guidance can help you navigate this challenging situation.

Yes, with a deeded timeshare, you receive a deed that grants you ownership of a specific time period at a property. This type of ownership means you have a legal claim to use the property during your allotted time. However, it’s important to be aware of the obligations that come with this ownership, especially if you face financial difficulties that could lead to a deed time share foreclosure. For clarity on your rights, USLegalForms can provide helpful resources.

A timeshare can lead to a foreclosure situation if the owner fails to make the required payments. In this case, the lender may initiate a deed time share foreclosure to reclaim the property. It’s crucial for timeshare owners to understand their rights and obligations to avoid this scenario. If you find yourself in such a situation, consider consulting with a legal expert through platforms like USLegalForms for guidance.

Yes, a timeshare can potentially place a lien on your home if you default on payments. This occurs when the timeshare company takes legal action to secure the debt owed, which can affect your home’s equity. It's important to stay informed about your financial obligations related to your timeshare. If you need guidance on managing these situations, platforms like US Legal Forms can help you navigate the complexities of deed timeshare foreclosure.

To obtain a copy of your timeshare deed, you should contact the resort or management company that oversees your timeshare. They often maintain records of ownership and can provide you with the necessary documentation. If you encounter difficulties, you can also check with your local county recorder's office, where such deeds are typically filed. Having a copy of your deed is crucial, especially when dealing with deed timeshare foreclosure.

Yes, a timeshare can indeed be foreclosed on if the owner fails to meet the payment obligations. Similar to traditional property, lenders can initiate foreclosure proceedings to reclaim the timeshare. This process can lead to significant financial repercussions, including a damaged credit history. If you find yourself in this situation, consider seeking assistance from platforms like US Legal Forms to understand your rights and options.

Yes, a timeshare can go into foreclosure if the owner stops making payments or fails to meet contractual obligations. The process for a deed time share foreclosure generally involves the timeshare company initiating legal action to reclaim the property. If you find yourself in this situation, it's vital to explore all available options before foreclosure occurs. Platforms like USLegalForms can assist you in navigating this challenging process and understanding your rights.

A deed time share foreclosure can have a serious impact on your credit score, potentially lowering it by 100 points or more. This negative mark can remain on your credit report for up to seven years, affecting your ability to secure loans or favorable interest rates in the future. It's important to fully understand the repercussions before proceeding with a foreclosure. Consulting resources from USLegalForms can provide you with information to make informed decisions regarding your credit and financial health.