Sample Motion To Vacate Default Foreclosure Sale

Description

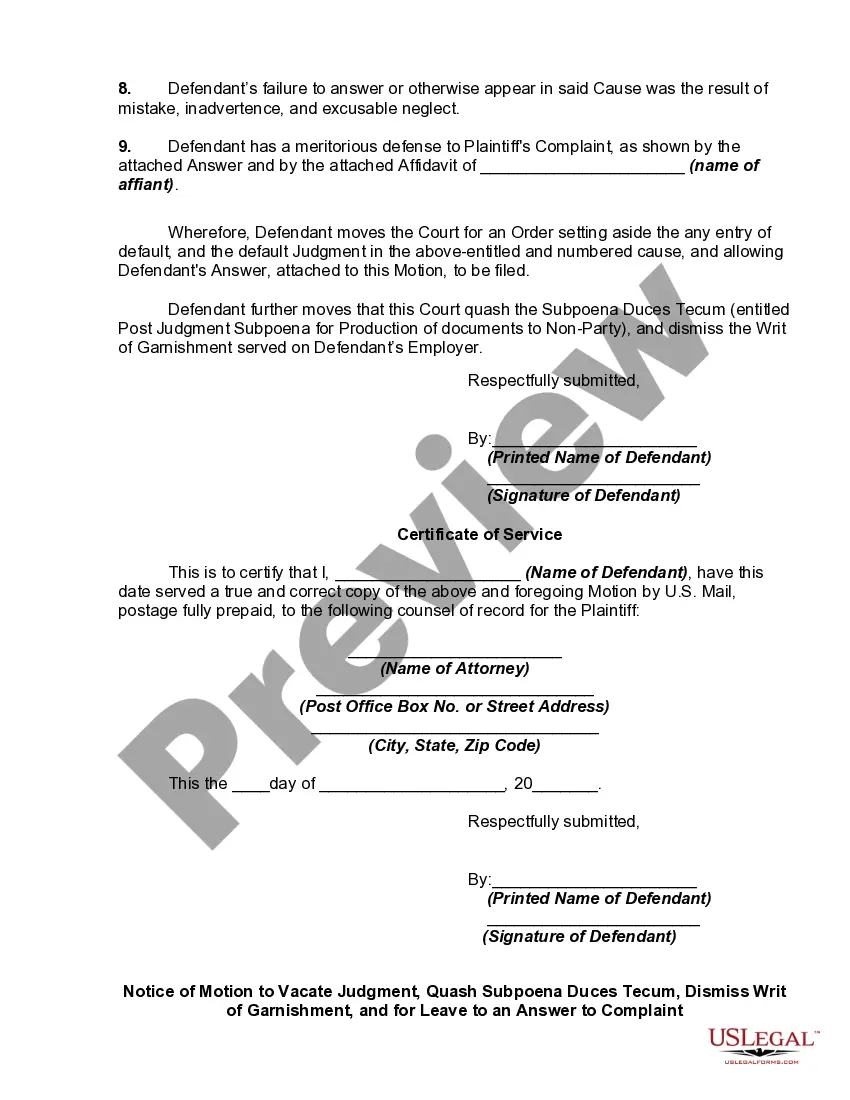

How to fill out Motion To Vacate Judgment, Quash Subpoena Duces Tecum, Dismiss Writ Of Garnishment, And For Leave To File An Answer To Complaint?

Creating legal documents from the ground up can often be overwhelming.

Certain situations may require extensive research and a significant financial commitment.

If you’re in search of a more straightforward and budget-friendly method of drafting Sample Motion To Vacate Default Foreclosure Sale or any other documents without unnecessary complications, US Legal Forms is readily accessible.

Our online repository of over 85,000 current legal forms encompasses nearly every element of your financial, legal, and personal matters. With just a few clicks, you can swiftly obtain state- and county-compliant templates carefully crafted for you by our legal professionals.

Examine the form preview and descriptions to ensure you are viewing the correct document. Confirm that the selected form meets the specifications of your state and county. Opt for the appropriate subscription plan to acquire the Sample Motion To Vacate Default Foreclosure Sale. Download the form. Subsequently, fill it out, validate, and print it. US Legal Forms has an excellent reputation and over 25 years of expertise. Join us today and transform form completion into a seamless and efficient process!

- Utilize our platform whenever you require a dependable and trustworthy service to easily find and download the Sample Motion To Vacate Default Foreclosure Sale.

- If you’re already familiar with our services and have set up an account with us previously, simply Log In to your account, find the template, and download it or retrieve it later in the My documents section.

- Not registered yet? No worries. It only takes a few minutes to create an account and explore the library.

- However, before directly downloading Sample Motion To Vacate Default Foreclosure Sale, be sure to follow these guidelines.

Form popularity

FAQ

If the satisfaction isn't recorded within a minimum of 60 days, they may incur penalties and be held liable for damages and attorney's fees.

Whether you get a deed of reconveyance, a full reconveyance or a satisfaction of mortgage document, it means the same thing: your loan has been repaid in full and the lender no longer has an interest in your property. In short, your home is finally all yours!

A mortgage commitment letter is a formal document from your lender stating that you're approved for the loan. Lenders issue a mortgage commitment letter after an applicant successfully completes the preapproval process.

Execution of Assignment or Satisfaction: Shall be executed by the mortgagee or authorized agent. Assignment: An assignment must be in writing and recorded. Demand to Satisfy: Following full pay-off, mortgagor is not required to notify mortgagee, who must, within 30 days, satisfy the mortgage of record.

Here are some of the things mortgage experts recommend you include: The date you're writing the letter. The lender's name, mailing address, and phone number. Your full legal name and loan application number. Your explanation, with references to any supporting documents you're including. Your mailing address and phone number.

A Certificate of Satisfaction You'll receive your deed and officially be the sole owner of your home. Note that some lenders may send the certificate of satisfaction directly to you. If this happens, you'll need to file it with your local government yourself.

A satisfaction of mortgage is a signed document confirming that the borrower has paid off the mortgage in full and that the mortgage is no longer a lien on the property.