Garnishment File With Irs

Description

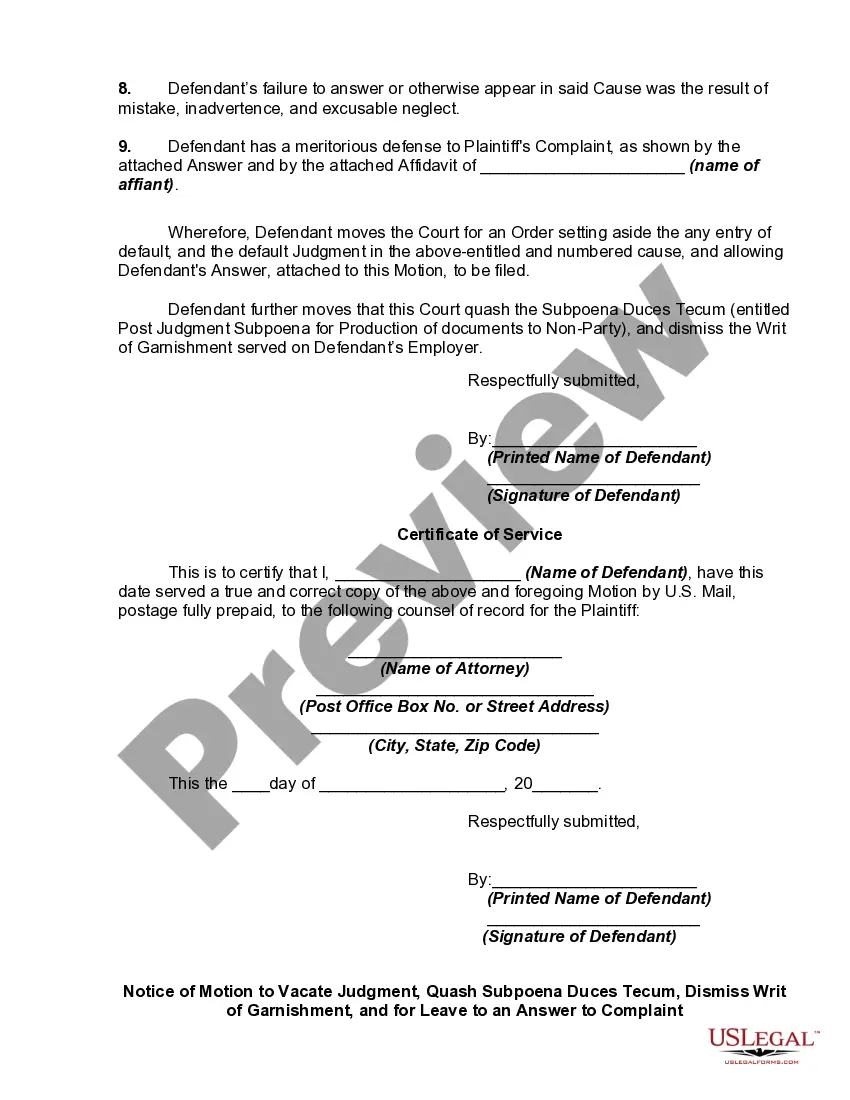

How to fill out Motion To Vacate Judgment, Quash Subpoena Duces Tecum, Dismiss Writ Of Garnishment, And For Leave To File An Answer To Complaint?

Identifying a reliable location to obtain the latest and suitable legal templates is a significant part of navigating bureaucracy.

Finding the appropriate legal documents requires precision and carefulness, which is why it's vital to obtain Garnishment File With Irs samples solely from trustworthy providers, such as US Legal Forms. An incorrect template can waste your time and delay your situation.

Once you have the form on your device, you can edit it using the editor or print it to complete it manually. Eliminate the frustration associated with your legal documentation. Explore the extensive US Legal Forms library where you can locate legal samples, assess their relevance to your situation, and download them promptly.

- Utilize the catalog browsing or search bar to find your template.

- Examine the form's details to verify if it complies with your state's requirements.

- Check the form preview, if accessible, to confirm that the template matches what you're looking for.

- Return to the search if the Garnishment File With Irs does not suit your needs to find the right document.

- If you are confident about the form's appropriateness, download it.

- For registered users, click Log in to verify and access your chosen templates in My documents.

- If you don’t have an account yet, click Buy now to acquire the template.

- Select the pricing option that aligns with your preferences.

- Proceed with the registration to complete your purchase.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Garnishment File With Irs.

Form popularity

FAQ

Public records requests may be submitted in person, by mail, by phone or through electronic means. The preferred method for receiving public records requests is through the department's online public request form, which allows NCDOA to better track requests and respond in a timely manner.

Basically, it is a court order from the judge allowing the sheriff to take possession of any assets you may have on hand. Why is this happening to you? A writ of execution is filed after a judgment has been issued against you in favor of the plaintiff, such as a credit card company or other creditor.

If there is no agreement, the winning party can begin the collections process. The clerk of superior court will record the judgment, and interest will begin to accrue if it is not paid.

Information about criminal cases in the North Carolina court system can be accessed by visiting a public, self-service terminal located at a clerk of court's office in any county. You can use the terminal to search for cases by defendant name, case number, or victim or witness name.

North Carolina considers "public records" a broad category that covers a lot of information. You can access vital records like birth, death, or marriage certificates, criminal histories, sex offender registrations, court filings, driving histories, car data, property records, and criminal histories.

Public Integrity North Carolina's Public Records and Open Meetings laws ensure that the public can know what government officials and entities do. North Carolinians are entitled to see any public record. Public bodies must conduct business in public.

Information about civil, special proceeding, or estates cases in the North Carolina court system can be accessed on the public, self-service terminals in the clerk of court's office in any county.

NCAOC offers online remote access to both criminal and civil information from all 100 North Carolina counties. The North Carolina Administrative Office of the Courts (NCAOC) offers online remote access to both criminal and civil information from all 100 North Carolina counties.