Answer Complaint File With Fcc

Description

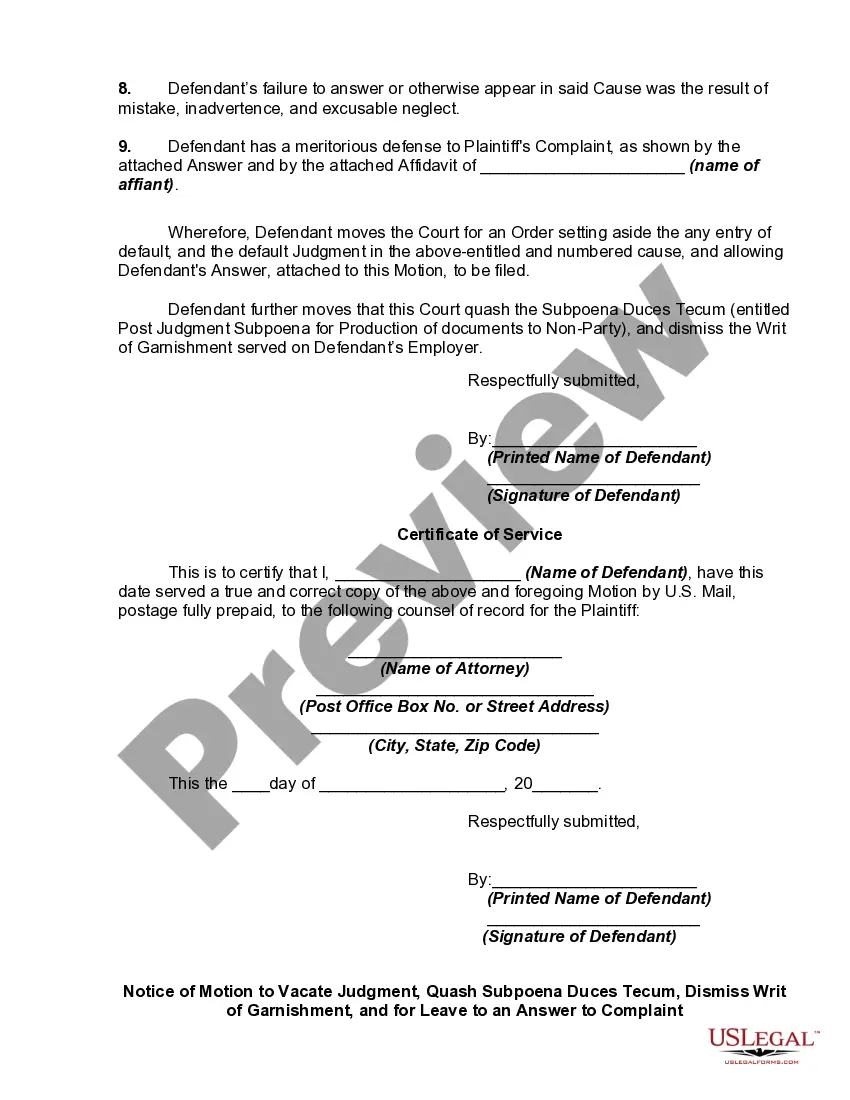

How to fill out Motion To Vacate Judgment, Quash Subpoena Duces Tecum, Dismiss Writ Of Garnishment, And For Leave To File An Answer To Complaint?

Managing legal documentation can be daunting, even for seasoned professionals.

When you seek to Answer Complaint File With Fcc and lack the time to dedicate to locating the right and current version, the procedures can be stressful.

With US Legal Forms, you can.

Access state- or county-specific legal and business documents. US Legal Forms addresses any requirements you might have, from personal to business paperwork, all in one location.

If this is your first experience with US Legal Forms, create an account and gain unlimited access to all the benefits of the library. Here are the steps to follow after accessing the necessary form.

- Utilize advanced tools to fill out and manage your Answer Complaint File With Fcc.

- Tap into a valuable resource center of articles, guides, handbooks, and materials relevant to your circumstances and requirements.

- Conserve time and effort searching for the documents you need, and use the advanced search and Preview feature to locate Answer Complaint File With Fcc and obtain it.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Visit the My documents section to view the documents you’ve saved and manage your folders as preferred.

- A powerful online form directory could be transformative for anyone looking to handle these matters effectively.

- US Legal Forms stands as a leader in the online legal forms industry, offering more than 85,000 state-specific legal forms available to you at any time.

Form popularity

FAQ

This myth is incorrect, debt does not disappear after 7 years in Canada. This common misconception is likely derived from the fact that most debts drop off your credit report after 7 years. However, this doesn't mean your debt disappears. It just disappears from your credit report.

Don't provide personal or sensitive financial information Never give out or confirm personal or sensitive financial information ? such as your bank account, credit card, or full Social Security number ? unless you know the company or person you are talking with is a real debt collector.

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

If you doubt that you owe a debt, or that the amount owed is not accurate, your best recourse is to send a debt dispute letter to the collection agency asking that the debt be validated. ?An effective debt-dispute letter must be clear and concise,? says Daniel Chan, Chief Technology Officer for Marketplace Fairness.

In this letter, you should include: Your name and address. Collection agency's name and address. Acknowledgment of contact from a collection agency, including the date they contacted you. A statement saying you dispute the debt. Request for proof that the debt is valid and belongs to you.

The 7-in-7 rule explained Collectors are permitted to place a call to the consumer about a particular debt seven (7) times within a period of seven (7) consecutive days, so long as no contact is made with the consumer in any of the attempts.

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

Debt collectors are legally obligated to send you a debt validation letter. If you don't receive a debt validation letter, or it lacks detail, you can make a debt verification request. You can file a complaint with the Consumer Federal Protection Bureau or the Federal Trade Commission.