Garnishment Order In Law

Description

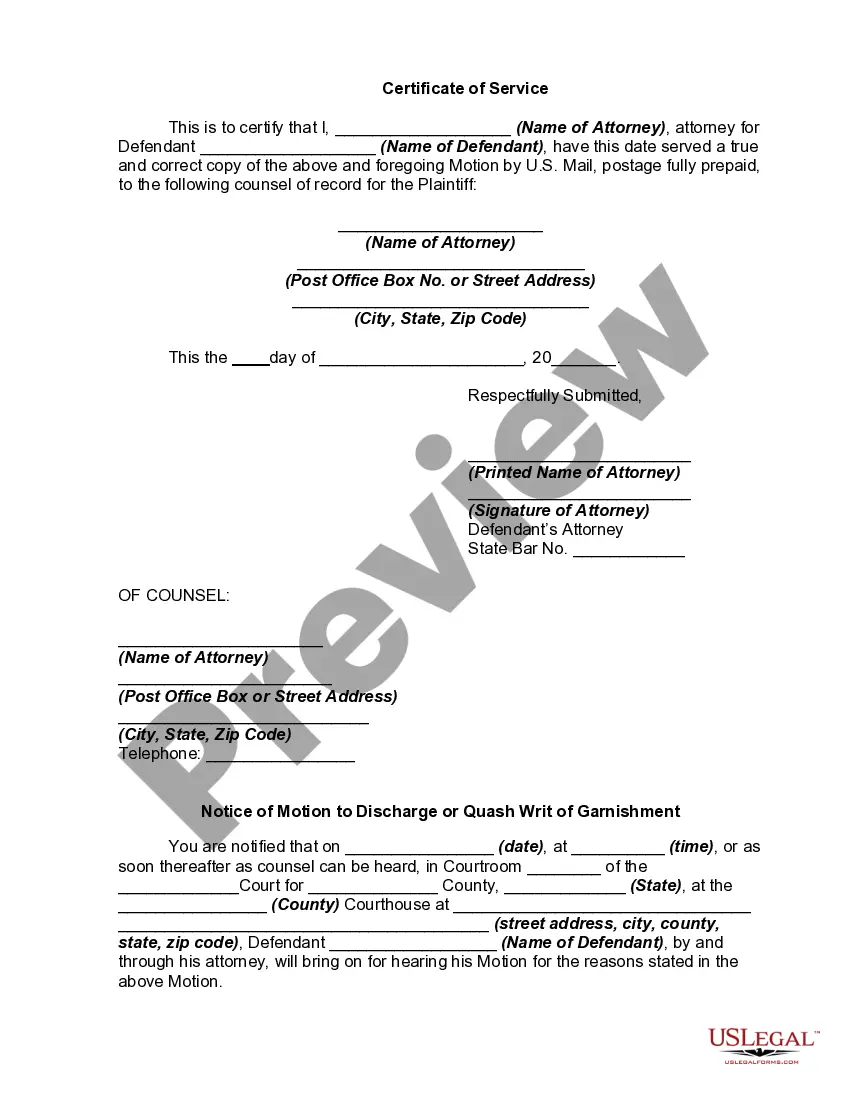

How to fill out Motion To Discharge Or Quash Writ Of Garnishment?

The Garnishment Order In Law displayed on this page is a versatile official template created by experienced attorneys in accordance with federal and state regulations.

For over 25 years, US Legal Forms has offered individuals, businesses, and legal practitioners more than 85,000 validated, state-specific documents for various business and personal needs.

Reuse the same document whenever necessary. Access the My documents tab in your profile to redownload any previously saved forms. Subscribe to US Legal Forms for verified legal templates for every life situation at your convenience.

- Explore the document you require and evaluate it.

- Search through the file you were looking for and preview it or review the form description to confirm it meets your requirements. If it does not, utilize the search bar to find the correct one. Click Buy Now once you have found the template you require.

- Choose a pricing plan that fits you and create an account. Use PayPal or a credit card for a swift payment. If you already have an account, Log In and check your subscription to proceed.

- Select the format you want for your Garnishment Order In Law (PDF, DOCX, RTF) and store the sample on your device.

- Print out the template to complete it by hand. Alternatively, employ an online multifunctional PDF editor to swiftly and accurately complete and sign your form with a legally-binding electronic signature.

Form popularity

FAQ

Wage Garnishment Isn't Included on Your Credit Report From a credit perspective, the damage has more or less been done. Since your wages are likely being garnished as a result of having missed payments on one or more debts, your credit may have been dinged, but it was the missed payments that hurt your score.

§ 2A:17-50). Also, under New Jersey law, a creditor may only garnish: up to 10% of your income if you earn no more than 250% of the federal poverty level for a household of your size, or. for a debt owing to the state, up to 25% if you earn more than 250% of the federal poverty level.

Ordinary garnishments Under Title III, the amount that an employer may garnish from an employee in any workweek or pay period is the lesser of: 25% of disposable earnings -or- The amount by which disposable earnings are 30 times greater than the federal minimum wage.

Complete the Garnishee order for debts form ???Your case number. Date of the judgment. Name and address of the other party. Name and address of the garnishee (the bank or third party who owes the other party money). Total amount of the judgment. Your contact details including address, telephone, fax and email.

The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less. (15 U.S.C. § 1673.)