Final Estate Sample Withholding Tax

Description

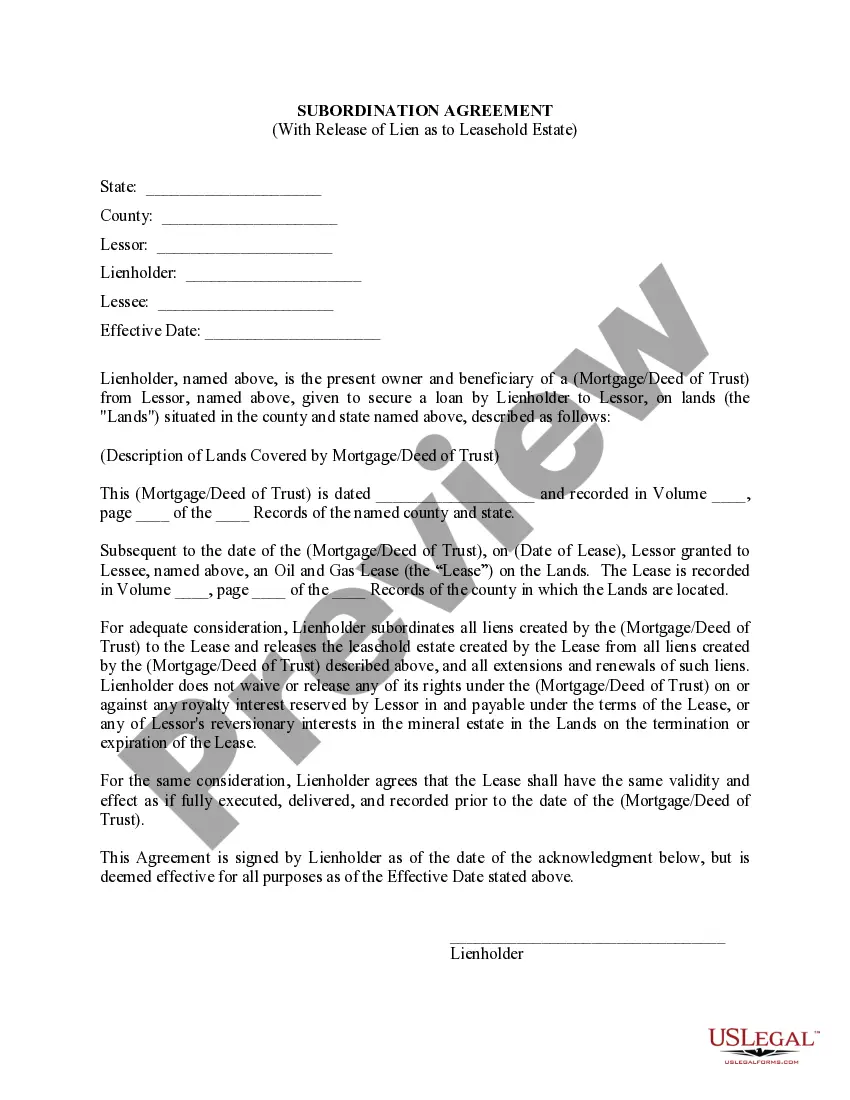

How to fill out Contest Of Final Account And Proposed Distributions In A Probate Estate?

Getting a go-to place to take the most recent and appropriate legal templates is half the struggle of handling bureaucracy. Discovering the right legal documents needs precision and attention to detail, which is the reason it is crucial to take samples of Final Estate Sample Withholding Tax only from reliable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to be concerned about. You may access and check all the information about the document’s use and relevance for the circumstances and in your state or county.

Consider the listed steps to finish your Final Estate Sample Withholding Tax:

- Use the catalog navigation or search field to locate your sample.

- Open the form’s information to see if it matches the requirements of your state and county.

- Open the form preview, if there is one, to make sure the template is definitely the one you are searching for.

- Get back to the search and look for the appropriate template if the Final Estate Sample Withholding Tax does not match your needs.

- If you are positive about the form’s relevance, download it.

- If you are a registered user, click Log in to authenticate and access your picked templates in My Forms.

- If you do not have a profile yet, click Buy now to get the template.

- Pick the pricing plan that suits your requirements.

- Go on to the registration to finalize your purchase.

- Finalize your purchase by choosing a payment method (bank card or PayPal).

- Pick the file format for downloading Final Estate Sample Withholding Tax.

- When you have the form on your device, you may alter it with the editor or print it and complete it manually.

Get rid of the inconvenience that comes with your legal documentation. Discover the extensive US Legal Forms library where you can find legal templates, check their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

Death benefits from life insurance policies are not subject to ordinary income tax. Beneficiaries may have the option of taking a death benefit in installments or as a lump sum.

A final return cannot be submitted electronically via NETFILE. You must mail it to the deceased tax centre. Find the appropriate mailing address here.

A Final Return must be filed for every person who dies. In addition, you may be able to reduce or eliminate tax by reporting income from specific sources earned during specific time periods in optional T1 returns.

As the legal representative, you are responsible for filing a return for the deceased for the year of death. ... If you have to file a return for a year before the year of death, use an Income Tax and Benefit Return for that year. ... You have to file a T3 return to report the income the estate earned after the date of death.

The amount is taxable in most circumstances. The CPP death benefit is normally included in the estate's income and reported on the estate's trust return for the year the amount was received.