Final Estate Document Format

Description

How to fill out Contest Of Final Account And Proposed Distributions In A Probate Estate?

Legal papers management may be overpowering, even for the most experienced professionals. When you are interested in a Final Estate Document Format and do not have the time to devote looking for the appropriate and up-to-date version, the processes can be stress filled. A strong online form library could be a gamechanger for anyone who wants to take care of these situations successfully. US Legal Forms is a industry leader in web legal forms, with over 85,000 state-specific legal forms available to you at any moment.

With US Legal Forms, you are able to:

- Access state- or county-specific legal and business forms. US Legal Forms handles any requirements you could have, from personal to business papers, all-in-one location.

- Utilize innovative tools to complete and control your Final Estate Document Format

- Access a useful resource base of articles, tutorials and handbooks and materials related to your situation and needs

Save time and effort looking for the papers you will need, and employ US Legal Forms’ advanced search and Preview feature to find Final Estate Document Format and download it. In case you have a membership, log in in your US Legal Forms profile, look for the form, and download it. Take a look at My Forms tab to find out the papers you previously saved and also to control your folders as you see fit.

If it is the first time with US Legal Forms, register an account and have unlimited usage of all advantages of the library. Listed below are the steps for taking after downloading the form you want:

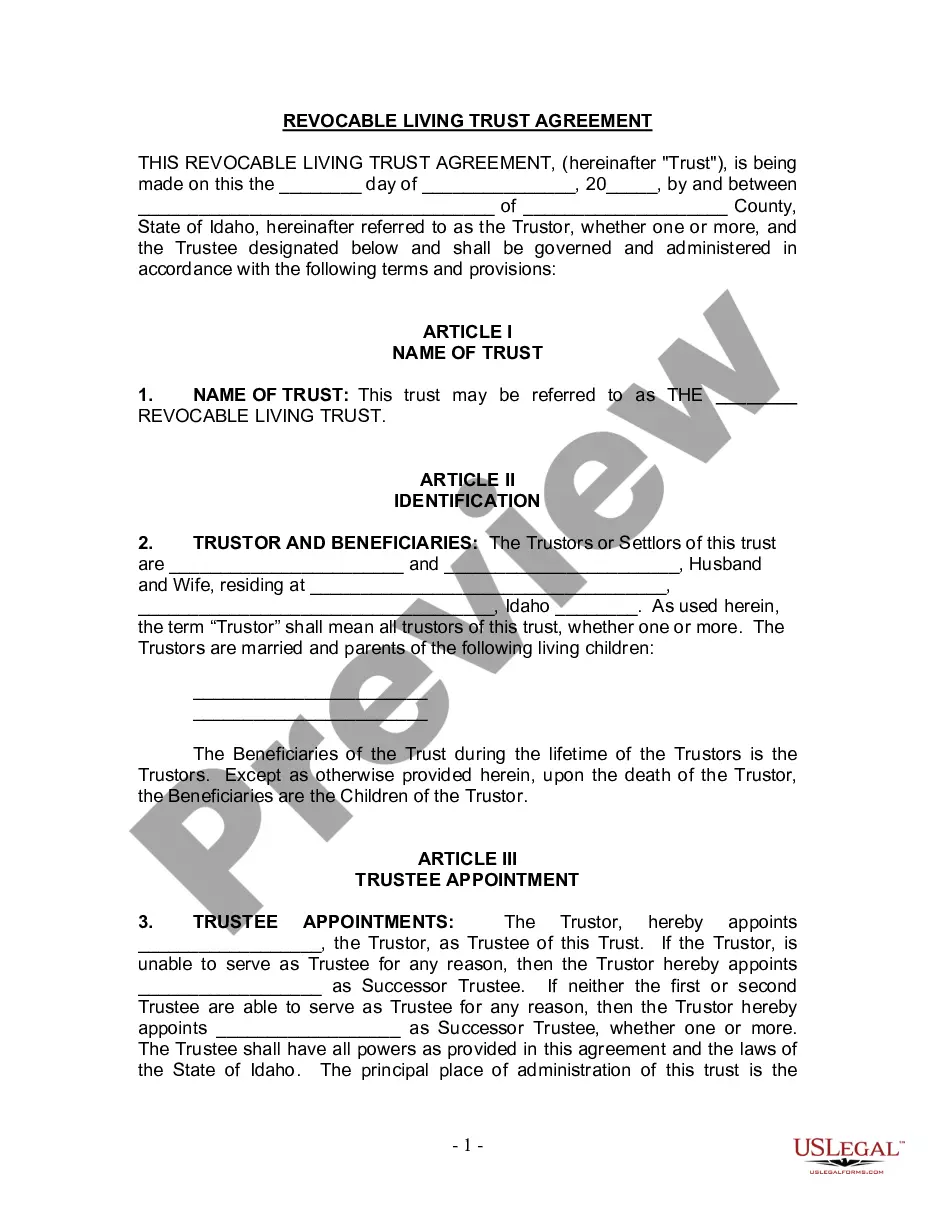

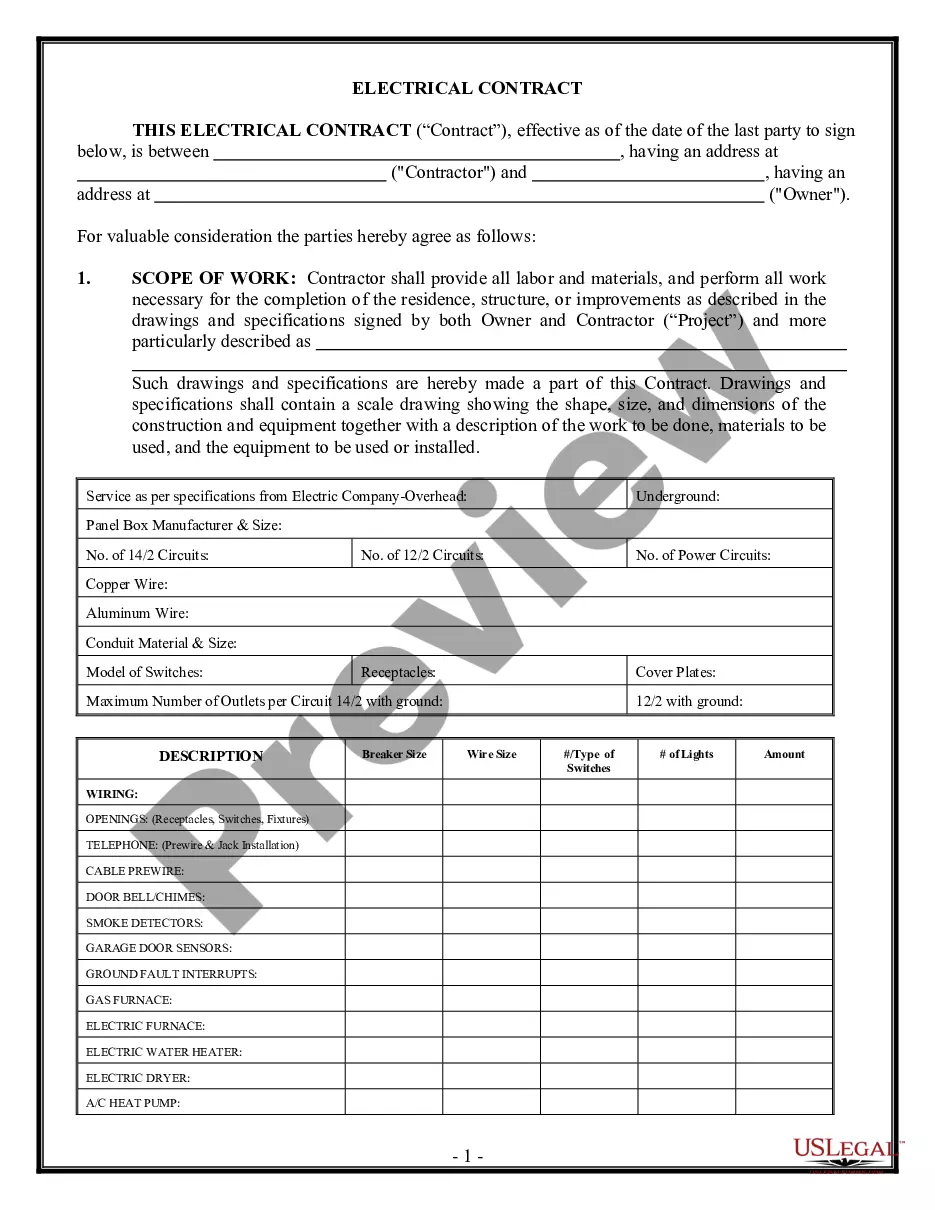

- Verify this is the right form by previewing it and looking at its description.

- Be sure that the sample is accepted in your state or county.

- Select Buy Now once you are ready.

- Select a subscription plan.

- Find the file format you want, and Download, complete, eSign, print and send out your papers.

Take advantage of the US Legal Forms online library, backed with 25 years of expertise and stability. Transform your day-to-day papers administration into a smooth and intuitive process today.

Form popularity

FAQ

An estate tax return (Form 706) must be filed if the gross estate of the decedent (who is a U.S. citizen or resident), increased by the decedent's adjusted taxable gifts and specific gift tax exemption, is valued at more than the filing threshold for the year of the decedent's death, as shown in the table below.

The administrator, executor, or beneficiary must: File a final tax return. File any past due returns. Pay any tax due.

All beneficiaries do not need to formally approve estate accounts; however, it is best practice for the Executor(s) and main beneficiaries to sign the estate accounts to show a legal agreement across all parties. Nevertheless, the beneficiaries are entitled to receive a copy of them and review the information.

Final expenses. Funeral, burial, cremation or interment costs can be considered part of estate expenses, though these may not be covered by estate assets. Instead, they may be paid out of the death benefit associated with the deceased person's life insurance policy.

A Final Account is a complete record detailing the assets, receipts, and disbursements made during a probate administration.