Final Estate Document For Sale

Description

How to fill out Contest Of Final Account And Proposed Distributions In A Probate Estate?

Finding a go-to place to access the most recent and appropriate legal templates is half the struggle of working with bureaucracy. Finding the right legal papers needs precision and attention to detail, which is the reason it is vital to take samples of Final Estate Document For Sale only from reputable sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to be concerned about. You can access and check all the details concerning the document’s use and relevance for your circumstances and in your state or county.

Consider the listed steps to finish your Final Estate Document For Sale:

- Use the catalog navigation or search field to locate your template.

- Open the form’s description to see if it fits the requirements of your state and region.

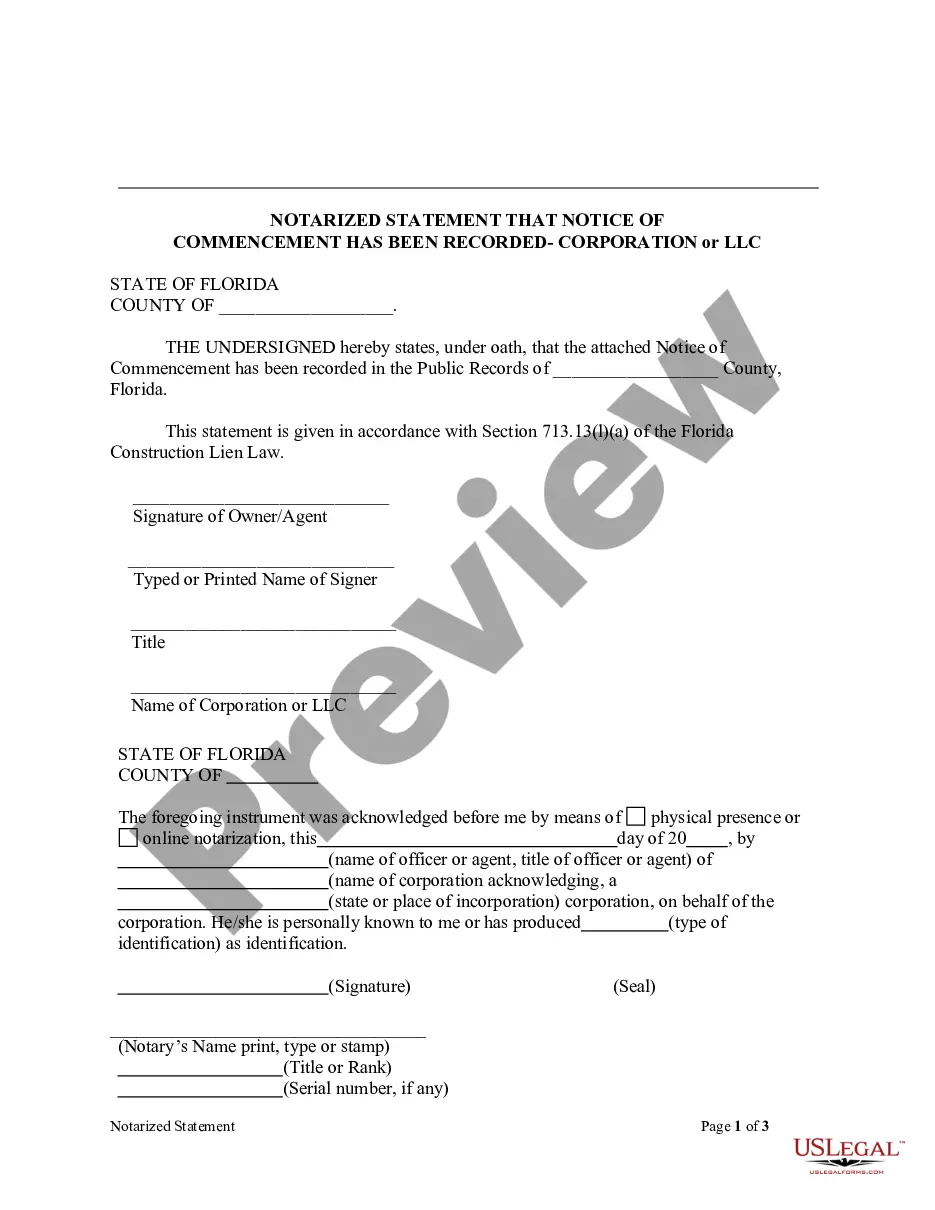

- Open the form preview, if there is one, to make sure the form is definitely the one you are looking for.

- Get back to the search and locate the appropriate document if the Final Estate Document For Sale does not fit your requirements.

- When you are positive regarding the form’s relevance, download it.

- If you are a registered user, click Log in to authenticate and access your picked templates in My Forms.

- If you do not have a profile yet, click Buy now to get the form.

- Select the pricing plan that suits your requirements.

- Proceed to the registration to complete your purchase.

- Finalize your purchase by picking a transaction method (bank card or PayPal).

- Select the document format for downloading Final Estate Document For Sale.

- When you have the form on your device, you may change it using the editor or print it and finish it manually.

Remove the inconvenience that comes with your legal documentation. Check out the comprehensive US Legal Forms collection to find legal templates, check their relevance to your circumstances, and download them on the spot.

Form popularity

FAQ

Once all the estate is distributed you can prepare the final estate accounts. These should be approved and signed by you and the main beneficiaries.

A Final Account is a complete record detailing the assets, receipts, and disbursements made during a probate administration.

All beneficiaries do not need to formally approve estate accounts; however, it is best practice for the Executor(s) and main beneficiaries to sign the estate accounts to show a legal agreement across all parties. Nevertheless, the beneficiaries are entitled to receive a copy of them and review the information.

While there is no set deadline for when an executor must settle an estate in North Carolina, as previously stated it can take several years for this to happen, the executor is responsible for meeting several key deadlines throughout probate proceedings.

Simple estates might be settled within six months. Complex estates, those with a lot of assets or assets that are complex or hard to value can take several years to settle. If an estate tax return is required, the estate might not be closed until the IRS indicates its acceptance of the estate tax return.