Deed Lieu Agreement With France

Description

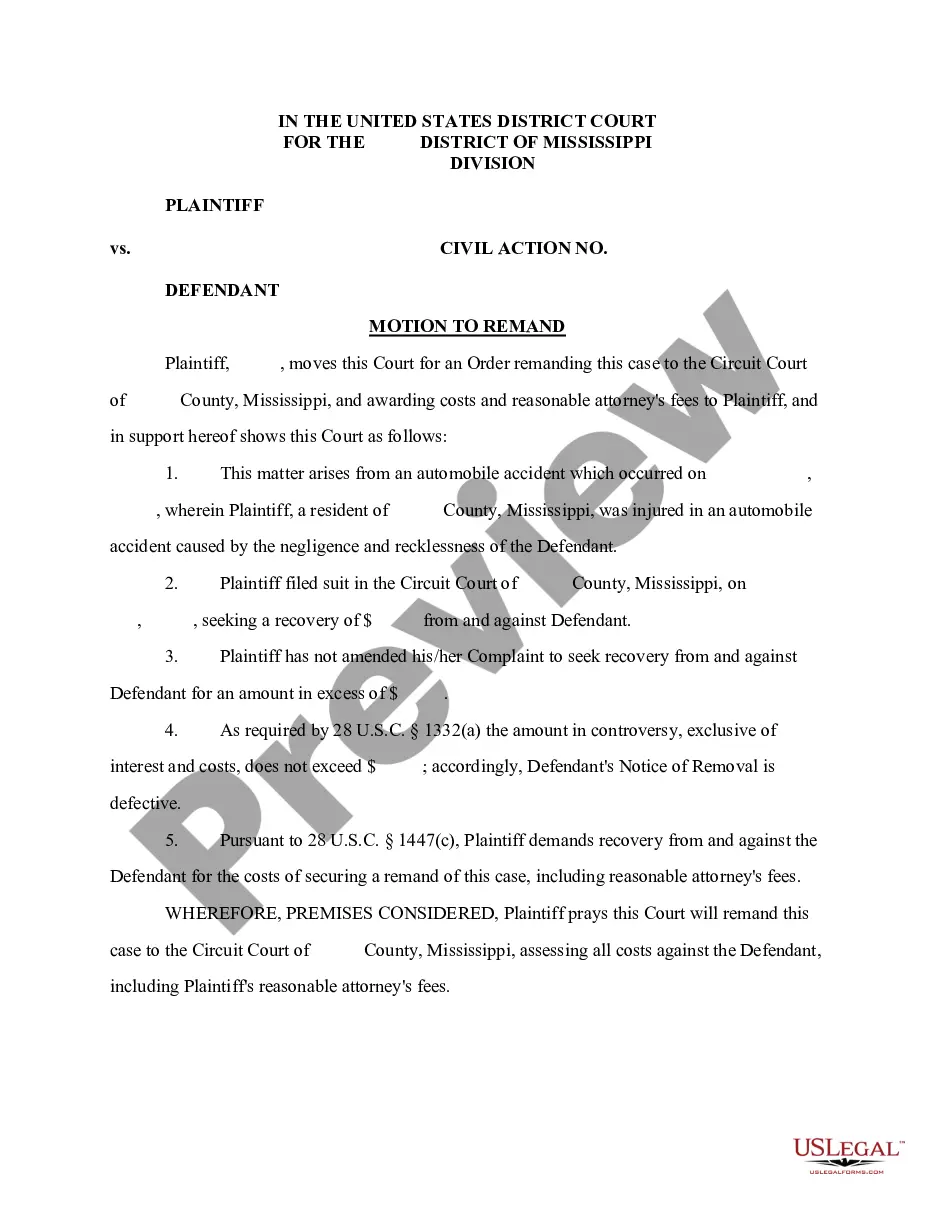

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

Whether for professional reasons or personal matters, everyone must confront legal situations at some stage in their lifetime.

Completing legal documents requires meticulous attention, starting with choosing the correct form template. For instance, if you choose an incorrect version of a Deed in Lieu Agreement With France, it will be turned down upon submission.

With an extensive US Legal Forms catalog available, you do not have to waste time searching for the right template online. Utilize the library’s straightforward navigation to find the suitable form for any occasion.

- Obtain the template you require using the search box or catalog navigation.

- Review the form’s details to ensure it aligns with your case, state, and county.

- Click on the form’s preview to examine it.

- If it is the incorrect form, return to the search option to find the Deed in Lieu Agreement With France template you need.

- Download the template if it suits your needs.

- If you already possess a US Legal Forms account, simply click Log in to retrieve previously stored documents in My documents.

- In case you don’t have an account yet, you can download the form by clicking Buy now.

- Select the suitable pricing choice.

- Fill out the account registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the file format you desire and download the Deed in Lieu Agreement With France.

- Once saved, you can complete the form using editing software or print it and finish it by hand.

Form popularity

FAQ

A deed in lieu is a mutual agreement between a homeowner and their lender, while in a foreclosure, the lender involuntarily takes back the property after an extended period of nonpayment by the homeowner.

On top of adding the deed in lieu indicator to the mortgage trade line, a ?deficiency balance? for the unrecovered amount will appear as the outstanding loan balance. The consequences will be worse for your score than a $0 balance ? with a higher dollar amount leading to a lower score.

Disadvantages to Lender A lender should also hesitate before accepting a lieu deed where there are outstanding subordinate liens or judgments against the property. In such a situation, the lender will have to foreclose its mortgage, with the attendant expense and time involved to obtain clear title.

A deed in lieu might make sense for you if: ? You're already behind on your mortgage payments or expect to fall behind in the near future. ? You're facing a long-term financial hardship. ? You're underwater on your mortgage (meaning that your loan balance is higher than the home's value).

Disadvantages of a deed in lieu of foreclosure You will have to surrender your home sooner. You may not pursue alternative mortgage relief options, like a loan modification, that could be a better option. You'll likely lose any equity in the property you might have.