Deed In Lieu Template With Foreclosure/deed

Description

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

Acquiring legal document examples that adhere to national and local laws is vital, and the web provides many choices to select from.

However, what’s the value in squandering time searching for the suitable Deed In Lieu Template With Foreclosure/deed example online if the US Legal Forms digital library already has such templates gathered in one location.

US Legal Forms is the largest digital legal resource with more than 85,000 customizable templates created by lawyers for any business and personal situation. They are easy to navigate with all documents categorized by state and intended use. Our experts stay current with legal updates, so you can always ensure your documents are current and compliant when acquiring a Deed In Lieu Template With Foreclosure/deed from our site.

Click Buy Now when you’ve found the correct form and select a subscription option. Create an account or Log In and process payment with PayPal or a credit card. Choose the format for your Deed In Lieu Template With Foreclosure/deed and download it. All templates available through US Legal Forms are reusable. To re-download and fill out previously saved forms, access the My documents section in your profile. Take advantage of the most extensive and user-friendly legal document service!

- Obtaining a Deed In Lieu Template With Foreclosure/deed is quick and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and store the document example you require in your preferred format.

- If you are new to our website, follow the instructions below.

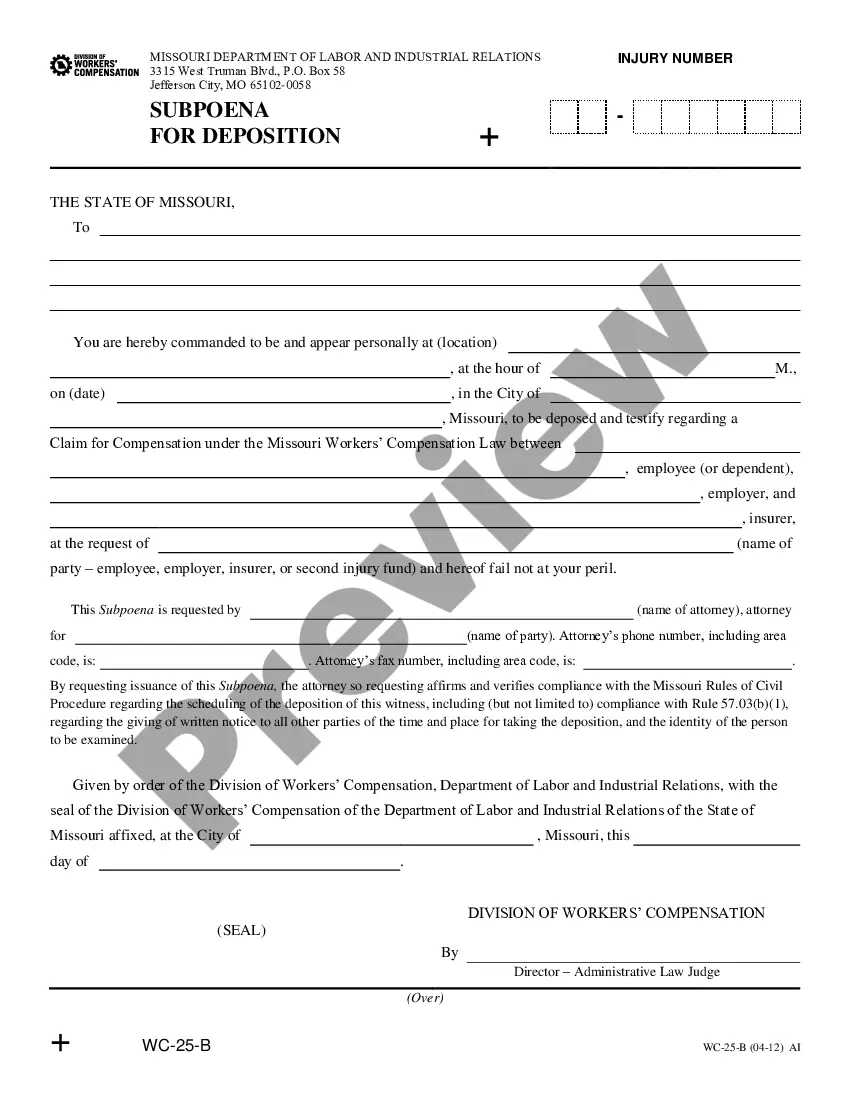

- Review the template using the Preview feature or through the text outline to ensure it fulfills your requirements.

- Search for another sample using the search bar at the top of the page if necessary.

Form popularity

FAQ

A deed in lieu of foreclosure is a document that transfers the title of a property from the property owner to their lender in exchange for relief from the mortgage debt. Choosing a deed in lieu of foreclosure can be less damaging financially than going through a full foreclosure proceeding.

Deed-in-Lieu of Foreclosure, Preforeclosure Sale, and Charge-Off of a Mortgage Account. A four-year waiting period is required from the completion date of the deed-in-lieu of foreclosure, preforeclosure sale, or charge-off as reported on the credit report or other documents provided by the borrower.

Damage to your credit: While less severe than a foreclosure, a deed in lieu of foreclosure damages your credit significantly, and can make it difficult to qualify for another mortgage for several years.

Advantages to a borrower in offering a lieu deed include, first, the release of the borrower and all other persons who may owe payment or the performance of other obligations secured by the mortgage. However, such persons remain liable if they agree to do so contemporaneously with the lieu deed transaction.

A Deed in Lieu does not clear second (or even third) mortgages, and therefore will not allow the lender to take clear title to the property. (These are sometimes referred to as junior liens.) And if the Deed in Lieu is accepted, the secondary lender may come after you for the deficiency.