Deed In Lieu Of Foreclosure Ny Withholding Tax

Description

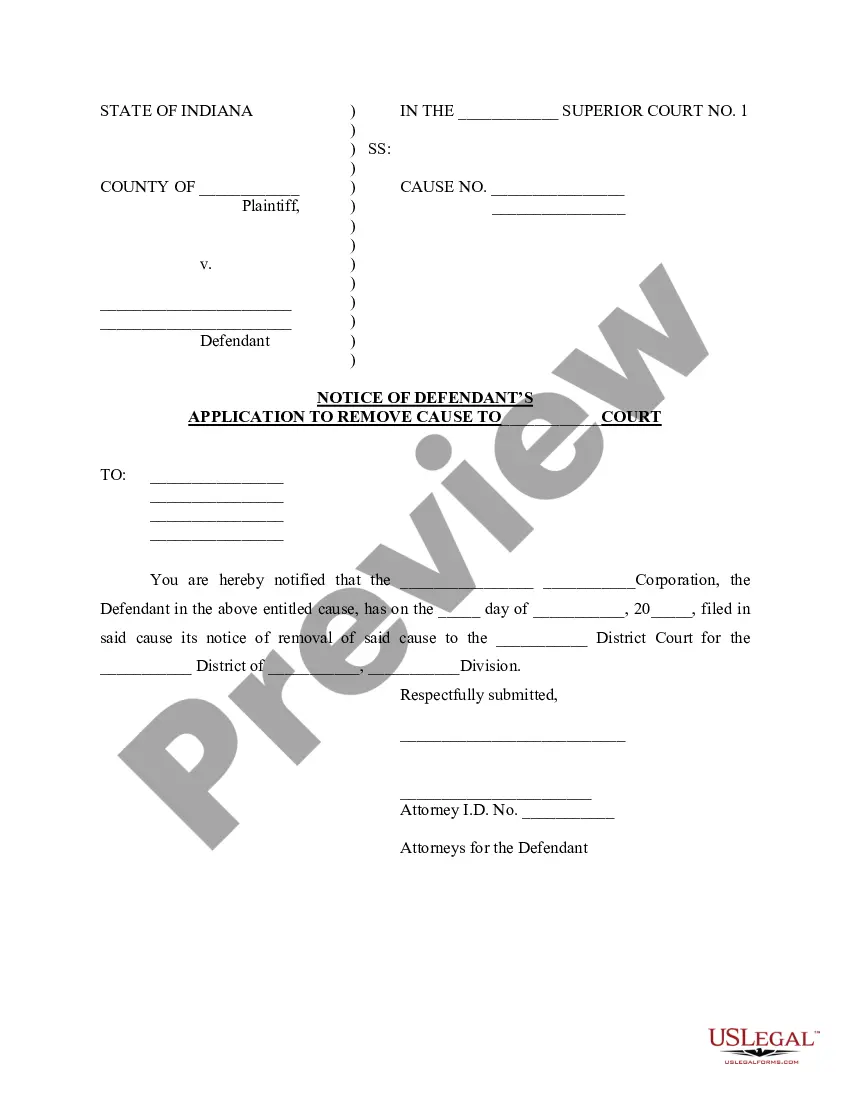

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

Creating legal documents from scratch can occasionally be intimidating.

Certain situations may require extensive research and substantial expenses.

If you are seeking a simpler and more economical method of preparing Deed In Lieu Of Foreclosure Ny Withholding Tax or any other documents without unnecessary complications, US Legal Forms is always available to assist you.

Our digital library of over 85,000 current legal forms covers nearly all aspects of your financial, legal, and personal concerns. With just a few clicks, you can quickly obtain state- and county-specific templates meticulously prepared by our legal professionals.

Ensure that the form you select adheres to the requirements of your state and county. Choose the most appropriate subscription option to obtain the Deed In Lieu Of Foreclosure Ny Withholding Tax. Download the form, complete it, certify it, and print it out. US Legal Forms has a solid reputation and over 25 years of experience. Join us now and simplify the document execution process!

- Utilize our website whenever you require dependable and trustworthy services through which you can easily find and download the Deed In Lieu Of Foreclosure Ny Withholding Tax.

- If you are familiar with our site and have previously created an account, simply Log In to your account, select the template, and download it or re-download it anytime later in the My documents section.

- No account? No problem. Setting it up requires minimal time, and navigating the catalog is straightforward.

- Before heading straight to downloading Deed In Lieu Of Foreclosure Ny Withholding Tax, consider these tips.

- Review the form preview and descriptions to confirm that you have located the correct form.

Form popularity

FAQ

While you can write your own will it is advisable that you seek legal counsel. Attorneys are familiar with the legal aspects of writing wills. A will in your own handwriting must be witnessed by two disinterested persons (persons who are not named in the written will). Your will should be signed and dated.

As Montana courts transition to a new centralized case management system, certain public records will become available through the Montana District Court Public Access Portal and the Montana Courts of Limited Jurisdiction Public Access Portal.

Montana Name Change Laws To obtain a legal name change in Montana, an applicant must submit a petition to the court. The applicant must publish notice of the hearing time and place in a county newspaper for four weeks. The applicant may request the petition and hearing to be sealed for their safety.

A will in your own handwriting must be witnessed by two disinterested persons (persons who are not named in the written will). Your will should be signed and dated. If you type your own will or use a computer software program to print your will you must also have two disinterested witnesses sign it.

No, in Montana, you do not need to notarize your will to make it legal. However, Montana allows you to make your will "self-proving" and you'll need to go to a notary if you want to do that. A self-proving will speeds up probate because the court can accept the will without contacting the witnesses who signed it.

Montana recognizes holographic (handwritten) wills so long as the signature and material portions of the document are in the testator's handwriting.

A written will is valid in Montana if executed (signed and witnessed) ing to Montana law, the law of the state or country where the will was executed, or the law of the place where, at the time of death, the testator is domiciled, has a place of abode, or is a national.

The Montana Judicial Branch operates a case search system called the Public Access Portal, which enables the general public to retrieve court case information from the Montana District Courts and the Montana Courts of Limited Jurisdiction.