Bad Debt Write Off For Tax Purposes

Description

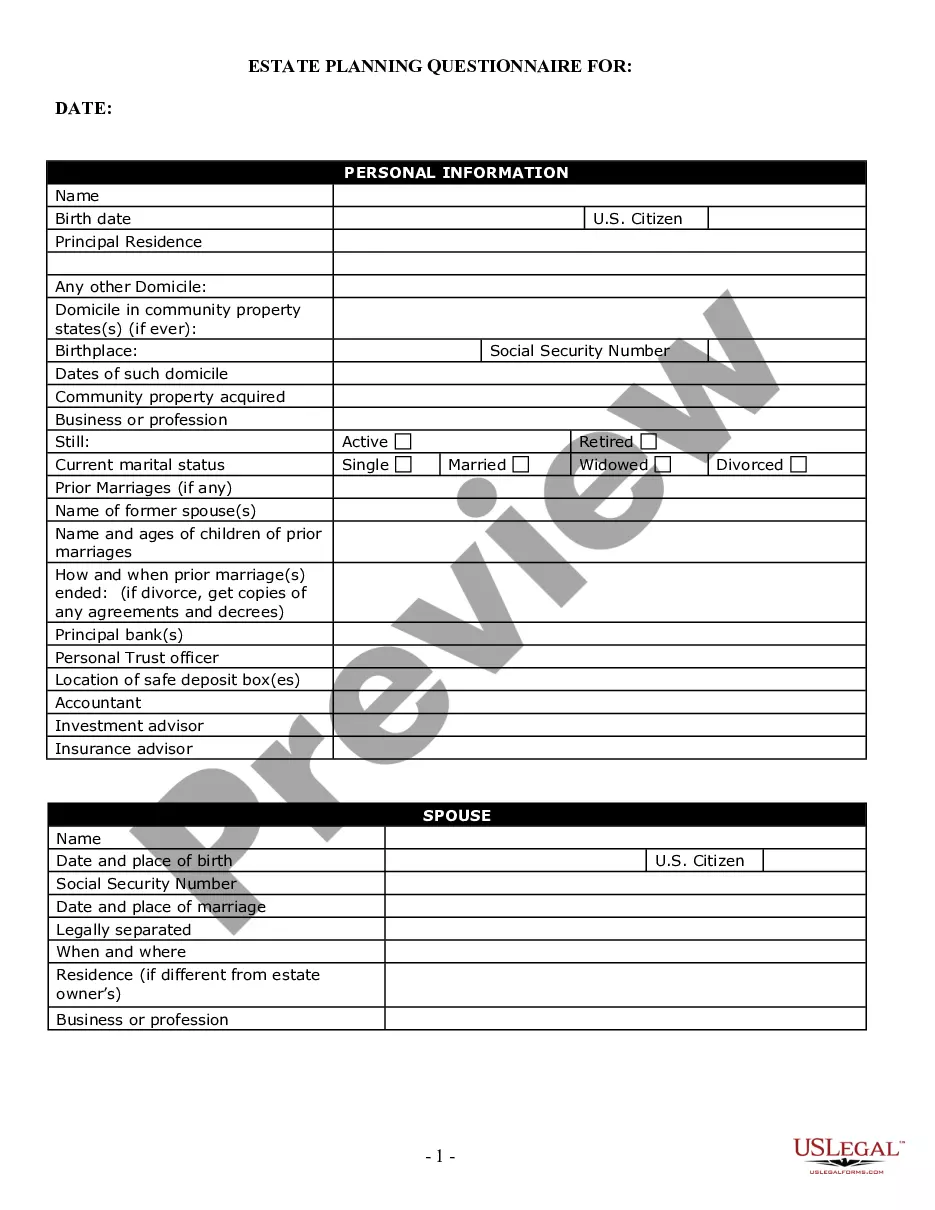

How to fill out Debtor's Affidavit Of Financial Status To Induce Creditor To Compromise Or Write Off The Debt Which Is Past Due - Assets And Liabilities?

Locating a preferred location to obtain the latest and pertinent legal templates constitutes a significant portion of dealing with bureaucracy.

Selecting the appropriate legal documents requires precision and meticulousness, which highlights the necessity to source Bad Debt Write Off For Tax Purposes exclusively from trustworthy providers, such as US Legal Forms.

Once you have the document on your device, you can edit it using the editor or print it out and fill it in by hand. Eliminate the complications associated with your legal documents. Explore the comprehensive US Legal Forms catalog where you can discover legal templates, assess their applicability to your circumstances, and download them instantly.

- Employ the catalog navigation or search box to locate your template.

- Review the description of the form to verify that it aligns with the specifications of your state and locality.

- Access the form preview, if offered, to ensure the form meets your search criteria.

- Continue searching and find the suitable template if the Bad Debt Write Off For Tax Purposes does not fulfill your specifications.

- If you are confident in the form's pertinence, download it.

- When you are a registered user, click Log in to verify and access your selected templates in My documents.

- If you do not possess an account yet, click Buy now to acquire the template.

- Choose the pricing option that fits your needs.

- Move forward to the registration to complete your transaction.

- Conclude your purchase by selecting a payment method (credit card or PayPal).

- Select the file format for downloading Bad Debt Write Off For Tax Purposes.

Form popularity

FAQ

Yes, bad debts are generally allowable for tax purposes, meaning you can write them off in your tax filings. This bad debt write off for tax purposes can significantly reduce your taxable income; however, you need to show that the debt was genuinely uncollectible. Companies tend to benefit from this process as it reflects better financial viability. Utilizing platforms like USLegalForms can streamline your documentation to ensure compliance and ease of claiming these deductions.

A bad debt write off typically qualifies when it is clear that a debt will not be repaid. Examples include personal loans, unpaid invoices, or loans to customers. In the context of a bad debt write off for tax purposes, these debts must be legally enforceable and must have been previously included in your taxable income. This helps you stay compliant while managing your finances.

Yes, you can write off bad debt expenses when you determine that a debt is worthless. This bad debt write off for tax purposes allows businesses to remove uncollectible amounts from their accounts. By accurately recording bad debts, you can lower your taxable income. This step is essential for maintaining your financial health.

When you write off a bad debt for tax purposes, you generally cannot claim a tax deduction for it. The IRS considers a bad debt write off for tax purposes as the elimination of an amount owed to you. This means that if you receive any payment for a previously written-off debt, that amount could be taxable. Understanding this can help you navigate your taxes effectively.

Bad debts are generally allowed as a deduction from gross income in the year they are deemed uncollectible. As a taxpayer, you need to demonstrate that you have made reasonable attempts to collect the debt before it is written off. This deduction not only helps reduce your taxable income but also represents the financial realities of your business. Use platforms such as USLegalForms to ensure you adhere to necessary tax regulations.

Indeed, bad debts written off are allowed under income tax if specific criteria are met. The IRS permits taxpayers to deduct debts that are totally worthless in the year they become uncollectible. Establishing this requirement requires proper documentation and evidence of efforts made to collect the debt. Services like USLegalForms can assist you in understanding the documentation necessary for compliance.

To record written off bad debts, you should create a journal entry that debits the bad debt expense account and credits the accounts receivable account. This entry effectively removes the uncollectible receivable from your books and acknowledges the loss. Maintaining accurate records is essential for your financial statements and tax filings. Platforms like USLegalForms can provide templates and examples for proper entry recording.

The tax form you use for a bad debt write off typically depends on your business structure. For sole proprietors, Schedule C is the appropriate form, while corporations may use Form 1120. It's important to ensure that the form accurately represents your financial situation to avoid issues with the IRS. Utilizing services like USLegalForms can help you determine the correct form for your specific case.

A taxpayer can deduct a bad debt from income when the debt becomes uncollectible, and you have actively made efforts to collect it. The deduction must be made in the year the debt is deemed worthless, and you should have documentation to prove this. Claiming a bad debt write off for tax purposes not only reduces your taxable income but also reflects your actual financial standing. Detailed guidance from USLegalForms can clarify this process further.

Yes, bad debts written off are typically reflected on the income statement as an expense. This helps in presenting a more accurate picture of your financial performance, as it adjusts your gross income downward. Incorporating this into your records ensures that you are reporting your profits accurately and complying with tax regulations. Using USLegalForms can assist you in preparing your financial statements correctly.