Performance Appraisal Form For Staff

Description

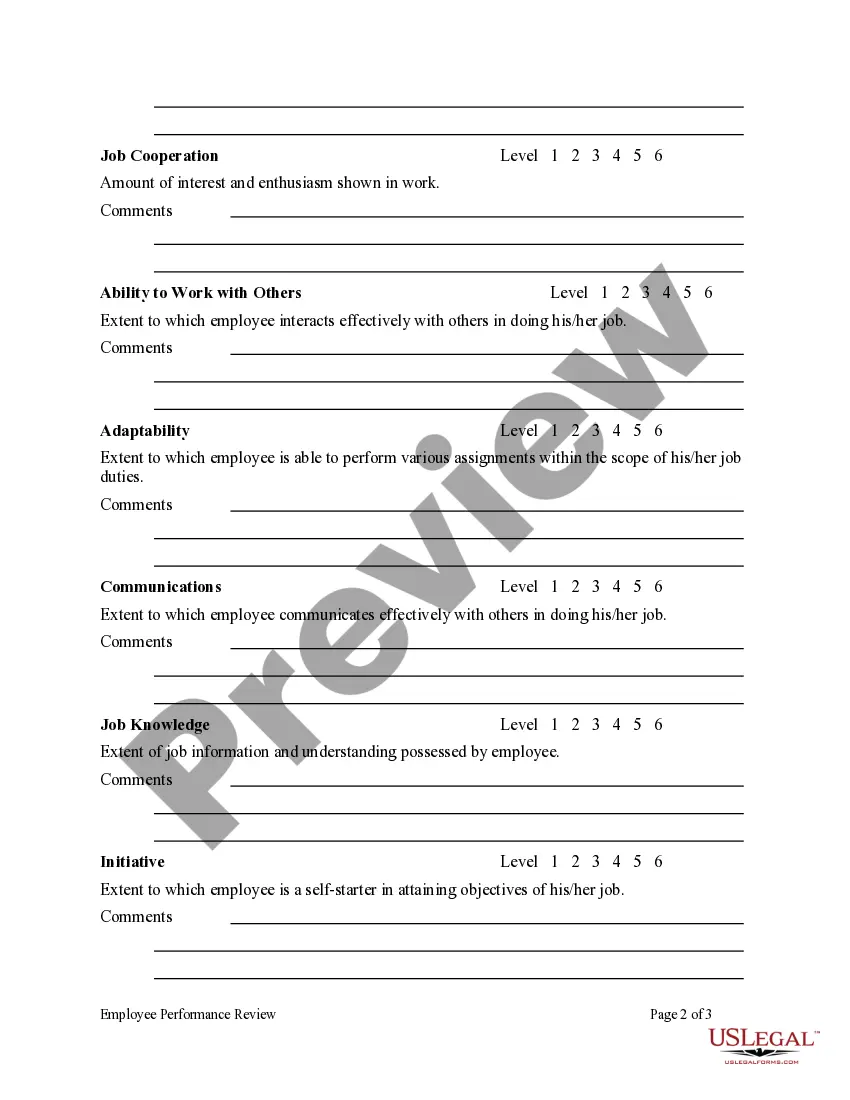

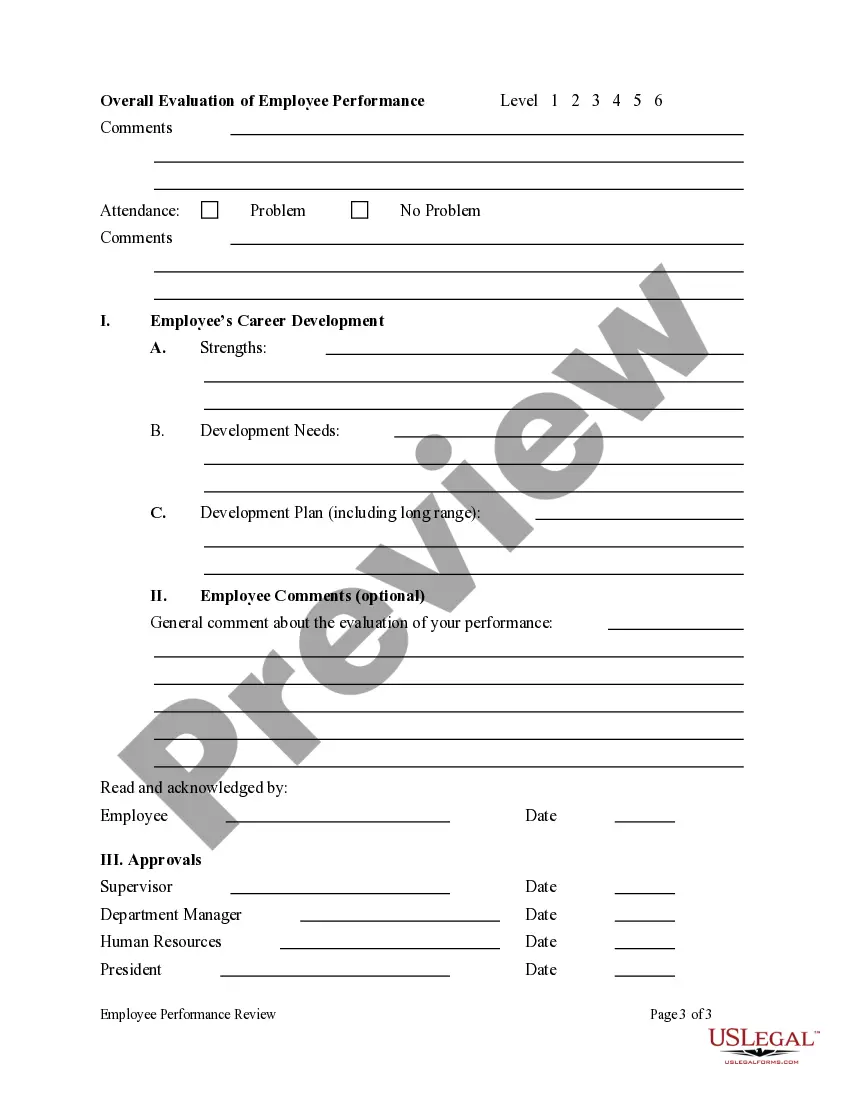

How to fill out Employee Performance Review?

Legal management can be daunting, even for experienced professionals.

When you are looking for a Performance Appraisal Form For Staff but lack the time to search for the correct and current version, the process can be frustrating.

US Legal Forms addresses all your needs, spanning from personal to business documentation—all in one convenient location.

Utilize advanced tools to fill out and manage your Performance Appraisal Form For Staff.

Here are the steps to follow after obtaining the form you need: Verify that this is the correct document by previewing it and reviewing its details.

- Gain access to a valuable resource hub of articles, guides, and materials relevant to your circumstances and needs.

- Save time and energy searching for the documents you require, and leverage US Legal Forms’ sophisticated search and Review feature to locate and download the Performance Appraisal Form For Staff.

- If you have a subscription, Log In to your US Legal Forms account, search for the document, and download it.

- Check your My documents tab to view the documents you have saved and organize your folders as needed.

- If this is your first experience with US Legal Forms, create an account to enjoy unlimited access to all platform benefits.

- Utilize a comprehensive online form library that could revolutionize how you handle these challenges.

- US Legal Forms stands as a top provider of digital legal documents, offering over 85,000 state-specific forms available around the clock.

- With US Legal Forms, you can access legal and business documents tailored to your state or county.

Form popularity

FAQ

Actual copies of your tax returns are also generally available for the current tax year and as far back as six years. The fee per copy is $50. Complete Form 4506 and mail it to the IRS office listed on the form for your area to request a copy of your tax return.

You may find the current year tax Indiana Individual forms online by going to .in.gov/dor/tax-forms/ and selecting the Individual Tax Forms download bar. To find individual tax forms online for prior years, go to .in.gov/dor/tax-forms/indiana-state-prior-year-tax-forms/ and select the year you need.

You may find the current year tax Indiana Individual forms online by going to .in.gov/dor/tax-forms/ and selecting the Individual Tax Forms download bar. To find individual tax forms online for prior years, go to .in.gov/dor/tax-forms/indiana-state-prior-year-tax-forms/ and select the year you need.

Order Tax Forms Online This service is provided free of handling fees. If you are ordering large quantities of forms, they may be limited due to availability. Forms for the upcoming tax year will be available for order after October 1. DOR will begin to fulfill form orders for the upcoming tax year after December.

Get federal tax forms Download them from IRS.gov. Order online and have them delivered by U.S. mail. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

Use Form 1040-X, Amended U.S. Individual Income Tax Return, and follow the instructions. You should amend your return if you reported certain items incorrectly on the original return, such as filing status, dependents, total income, deductions or credits.

How to file an amended tax return Download Form 1040-X from the IRS website. Gather the necessary documents. ... Complete Form 1040-X: Add your personal information, details of what's changed, and your explanation for the changes. ... Submit your completed amended return: You can send it by mail or e-file.