Retail Installment Contracts

Description

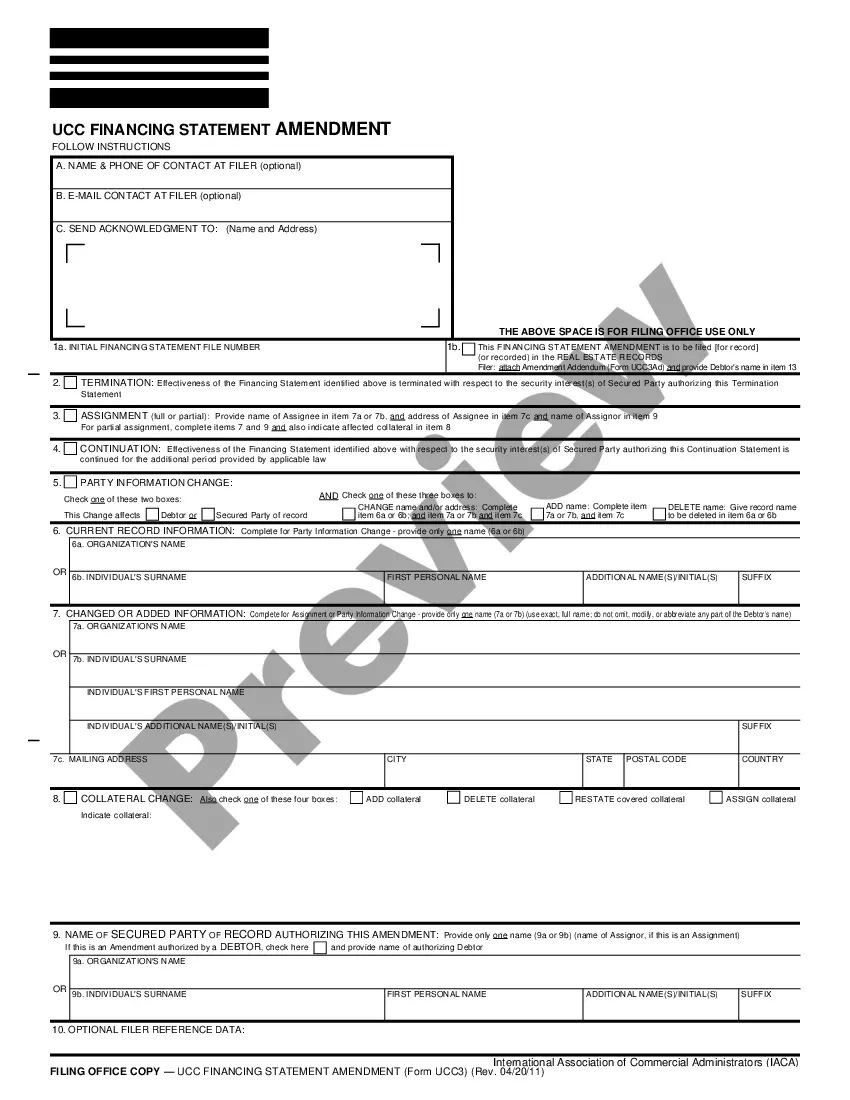

How to fill out General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures?

- Begin by checking the preview mode and reviewing the form description to confirm it satisfies your specific needs and local jurisdiction requirements.

- If the document isn't suitable, utilize the Search bar to find an alternative template that fits your criteria.

- Once you've found the right form, click the Buy Now button and select your preferred subscription plan to access the extensive library of over 85,000 legal forms.

- Complete your purchase by entering your credit card information or using your PayPal account for convenience.

- Download your selected form directly to your device. You can also find it anytime through the My Forms section of your profile.

US Legal Forms not only provides a vast collection of templates but also ensures that users have access to expert guidance for filling out forms correctly. This makes it an invaluable resource for both individuals and attorneys.

Start your journey towards hassle-free legal documentation today. Sign up with US Legal Forms and simplify your form acquisition process!

Form popularity

FAQ

A retail installment contract is not the title itself; rather, it is a financing agreement between the buyer and seller. This contract outlines the terms of repayment for a product purchased on credit. While the title is transferred after the final payment, the retail installment contract serves as the legal document governing the sale until complete payment is made.

The primary difference between a lease and a retail installment contract lies in ownership. With a lease, you are essentially renting, and you do not own the asset at the end of the term. In contrast, retail installment contracts lead to ownership once all payments are made. This distinction is vital when choosing your financing options, as retail installment contracts can provide a path to ownership that leasing cannot.

No, a sale contract differs from a bill of sale. A sale contract outlines the terms and conditions of a sale, while a bill of sale serves as proof of ownership transfer. Both documents play important roles in transactions, but they serve distinct purposes in retail installment contracts as well.

The assignee on a retail installment contract is typically a financial institution or lender who purchases the contract from the seller. This entity assumes the right to collect payments from the buyer. Understanding the role of the assignee helps clarify the financing aspects of retail installment contracts.

An installment sale contract is often referred to as a retail installment contract. Both terms signify the same underlying arrangement where a buyer makes periodic payments for purchased goods. This terminology is commonly used in the retail sector, facilitating easier understanding among consumers.

Examples of installment contracts include agreements for purchasing cars, home appliances, and furniture. These contracts specify payment terms, such as the number of payments and interest rates. In essence, any sale where the buyer pays over time can be considered an installment contract, including retail installment contracts.