Trust A Trust B For Dogs

Description

How to fill out Marital Deduction Trust - Trust A And Bypass Trust B?

Acquiring legal templates that adhere to federal and state laws is essential, and the internet provides numerous alternatives to select from.

However, what is the benefit of spending time looking for the appropriate Trust A Trust B For Dogs template online if the US Legal Forms online library already has such documents gathered in one location.

US Legal Forms is the largest online legal repository with more than 85,000 fillable templates created by lawyers for any business and personal situation. They are easy to navigate with all files organized by state and intended use. Our experts stay updated with legal modifications, so you can always trust that your form is current and compliant when you obtain a Trust A Trust B For Dogs from our site.

All documents you find through US Legal Forms are reusable. To re-download and fill out previously obtained forms, access the My documents tab in your account. Enjoy the most comprehensive and user-friendly legal documentation service!

- Acquiring a Trust A Trust B For Dogs is quick and uncomplicated for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document sample you need in the desired format.

- If you are new to our website, follow the steps outlined below.

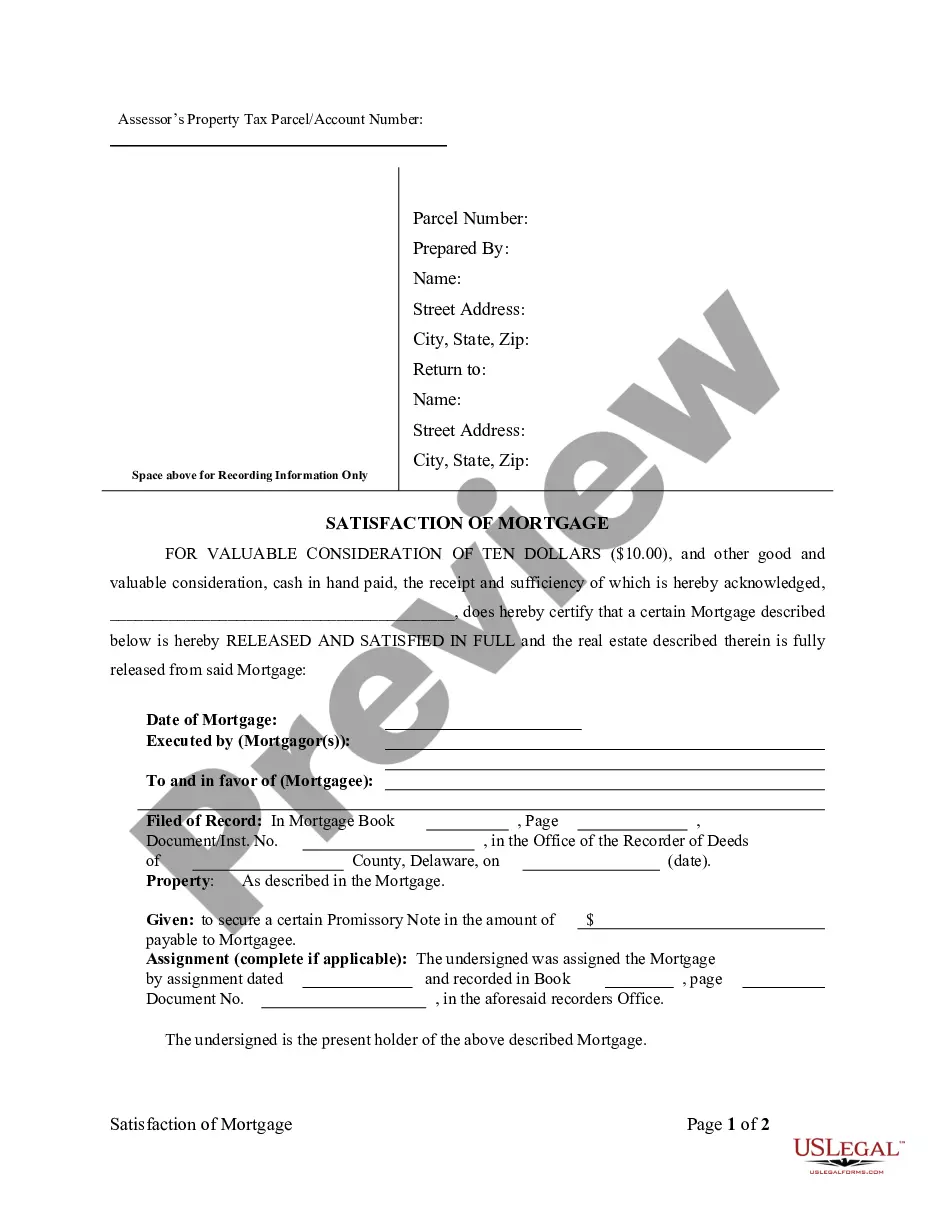

- Review the template using the Preview option or through the text description to confirm it satisfies your requirements.

- Search for another sample using the search function at the top of the page if necessary.

- Press Buy Now when you’ve found the appropriate form and choose a subscription plan.

- Set up an account or Log In and complete a payment via PayPal or a credit card.

- Select the format for your Trust A Trust B For Dogs and download it.

Form popularity

FAQ

Determine the amount of funds needed to adequately cover the expenses of administering the pet trust; Designate a remainder beneficiary in the event the funds in the pet trust are not exhausted; Provide instructions for the final disposition of your pet (for example, burial or cremation).

In California, a pet trust is primarily used to allocate funds and any wishes on behalf of a pet. This can be done in several different ways. A pet trust can be made through a will, as a part of a revocable living trust, or a stand-alone trust.

On average, if you've got a puppy from a breeder, it could take 3 weeks- 3 months to bond with your dog. Whereas if you've got it from a rescue or is an adult dog it could take a lot longer; the key is consistency!

Until relatively recently, most states didn't allow trusts for animals. Now, every state allows pet trusts, with no human beneficiary.

Trust Funds for Pets Make Headline News Pet trusts are not unheard of?a number of high-profile pet trusts have made national headlines, such as the case of Manhattan luxury-hotel queen Leona Helmsley, who left a $12 million trust to her dog, Trouble.