Marital Deduction Trust Form

Description

Form popularity

FAQ

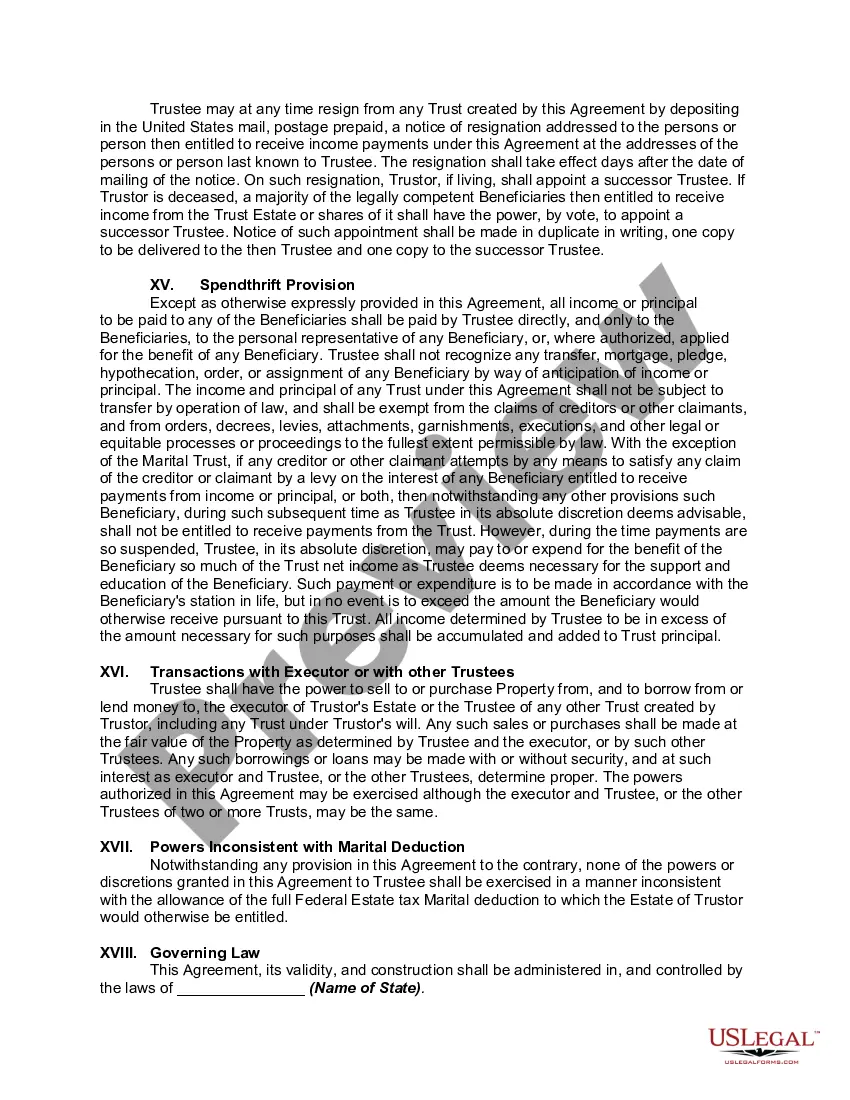

The marital deduction is not automatically applied. To benefit from this provision, you must correctly complete the marital deduction trust form as part of your estate planning. This form ensures that your assets transfer to your spouse without incurring federal estate tax, but it requires proper documentation. Therefore, it is crucial to consult with a legal professional or use a reliable platform like US Legal Forms to ensure accuracy and compliance.

A marital deduction trust functions by allowing one spouse to transfer assets into a trust for the benefit of the surviving spouse. This arrangement enables the surviving spouse to access trust income during their lifetime without incurring immediate estate taxes. Upon their passing, the assets in the trust may pass to the beneficiaries without additional taxation. Creating a marital deduction trust form through uslegalforms can simplify this process and help you achieve your estate planning goals.

Certain assets may not qualify for the marital deduction, including property that is not owned jointly or assets transferred through a third party. For instance, property held in a trust that does not benefit the surviving spouse is typically excluded. Additionally, any transfers made to non-citizen spouses do not qualify for the marital deduction. To protect your estate plan and ensure compliance, consider utilizing our marital deduction trust form.

While the unlimited marital deduction provides significant tax benefits, it can also lead to future estate tax issues. Transferring assets without immediate tax consequences may result in a larger taxable estate for the surviving spouse. This potentially increases the overall tax liability upon the second spouse's death. To navigate these complexities, utilizing a marital deduction trust form may provide a structured approach to managing your estate.

The use of a marital deduction is generally allowed when a spouse transfers assets to the other spouse, either during their lifetime or upon death. This deduction is crucial for ensuring that assets pass to your loved one without incurring immediate estate taxes. If the receiving spouse is a U.S. citizen, then the marital deduction applies seamlessly. Using a marital deduction trust form can help you arrange your estate effectively and ensure tax efficiency.

A QTIP trust, or Qualified Terminable Interest Property trust, provides income to the surviving spouse while ensuring the trust principal passes to other beneficiaries after their passing. In contrast, a marital deduction trust allows the surviving spouse full access to both income and principal. Understanding these differences can help you effectively use the marital deduction trust form to achieve your estate planning goals.

A family trust is designed to benefit multiple family members, while a marital trust specifically provides for the surviving spouse. The marital deduction trust form often allows for tax benefits that apply solely to the surviving spouse. Additionally, family trusts may include various assets destined for children or other relatives according to the parents' wishes. The key is understanding your needs and objectives when choosing between these options.

A marital trust can be an excellent financial planning tool for many couples. It provides benefits like avoiding probate and ensuring that assets are managed according to your wishes. However, it is essential to assess your unique situation and consult with a professional who understands the details of the marital deduction trust form. This approach will help you make informed decisions that align with your financial goals.

While marital trusts provide many benefits, they also come with disadvantages. One key drawback is the potential tax implications upon the surviving spouse's death, which can reduce the estate's value. Additionally, these trusts may restrict flexibility regarding changes in financial situations or beneficiary designations. Understanding these limitations is important when considering a marital deduction trust form.

One significant mistake parents make is not clearly outlining their intentions in the marital deduction trust form. Without clear instructions, beneficiaries may face confusion or disputes in the future. Moreover, failing to update the trust with life changes can lead to unintended consequences. It is crucial to review and, if necessary, revise the trust to ensure it meets your family's current needs.