Foreclosure After Forbearance

Description

How to fill out Letter To Foreclosure Attorney - After Foreclosure - Did Not Receive Notice Of?

It’s well-known that you can’t become a legal authority instantly, nor can you learn how to swiftly prepare Foreclosure After Forbearance without having a specific expertise.

Drafting legal documents is a lengthy endeavor necessitating a particular education and skillset. So why not entrust the preparation of the Foreclosure After Forbearance to the professionals.

With US Legal Forms, one of the most extensive legal template collections, you can access everything from court documents to templates for internal communication.

You can regain access to your documents from the My documents tab anytime. If you’re a returning client, you can simply Log In and find and download the template from the same tab.

Regardless of the reason for your forms—whether they’re financial and legal, or personal—our platform has you supported. Experience US Legal Forms today!

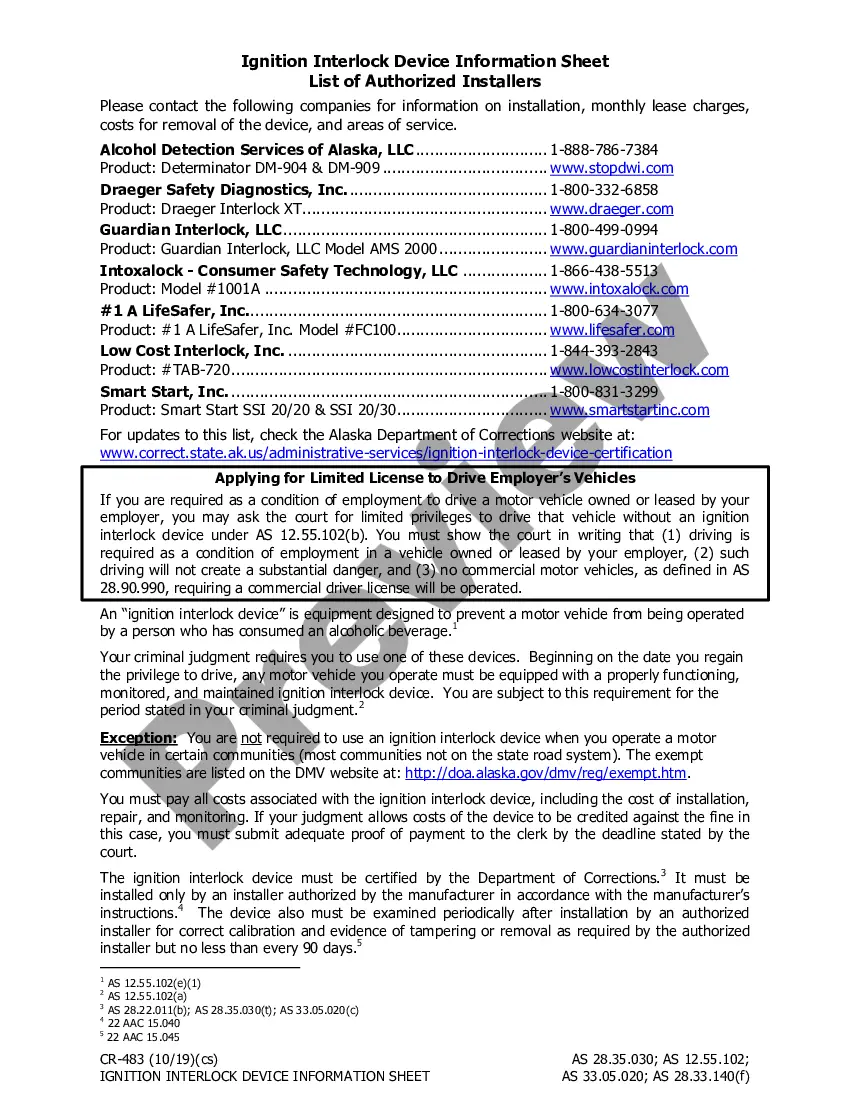

- Find the document you require by utilizing the search bar at the top of the page.

- View it (if this option is available) and review the accompanying description to ascertain whether Foreclosure After Forbearance is what you need.

- Restart your search if you're looking for another form.

- Create a free account and select a subscription plan to purchase the form.

- Select Buy now. Once payment is processed, you can download the Foreclosure After Forbearance, fill it out, print it, and deliver it or send it by mail to the required parties or organizations.

Form popularity

FAQ

A repayment plan can be an effective way to stop foreclosure, as it allows you to repay missed payments over a designated period. By entering into an agreement with your lender, you demonstrate your commitment to becoming current on your mortgage. However, it's essential to communicate openly with your lender to ensure the plan works for your financial situation. Taking action against foreclosure after forbearance with a repayment plan can help stabilize your housing situation.

The 120-day rule for foreclosure allows homeowners time to explore alternatives before the foreclosure process can begin. Lenders must wait at least 120 days from the date of delinquency before initiating foreclosure proceedings. This rule provides you with an opportunity to discuss your situation with your lender or seek help from professionals. Knowing about the 120-day rule can empower you during the often stressful period of facing foreclosure after forbearance.

While mortgage forbearance provides temporary relief, there are potential downsides to consider. After the forbearance period, you may face a lump sum payment or increased monthly payments that could strain your finances even further. Additionally, missing payments during forbearance could lead to foreclosure after forbearance if not addressed promptly. Awareness of these pitfalls can help you plan your next steps wisely.

Yes, you can stop a foreclosure once it begins, but timely action is crucial. You have several options, including negotiating with your lender or seeking legal advice. Engaging in a forbearance agreement might also help, as it can provide you with time to resolve your financial situation. Understanding the process of foreclosure after forbearance is important, as it gives you tools to combat foreclosure effectively.

Typically, forbearance can last for several months, depending on your lender's policies and your individual situation. Some programs allow for an initial pause of three to six months, with options for extension. It is crucial to communicate with your lender to determine the exact length of your forbearance. Prolonged forbearance may lead to complexities that can affect your chances of foreclosure after forbearance.

The foreclosure process in Massachusetts can take anywhere from several months to over a year, largely depending on the specifics of the case and whether the borrower contests the foreclosure. Each situation is unique, so consulting with an expert can help you navigate this challenging time, particularly when facing foreclosure after forbearance.

After your mortgage forbearance ends, you will need to start making regular payments again. You may also have to address any missed payments during the forbearance period, which could include a repayment plan. Understanding your options after forbearance is crucial, as failing to act could lead to foreclosure.

A forbearance plan can temporarily halt foreclosure proceedings by allowing borrowers to pause their payments. However, once the forbearance period ends, the borrower must manage any missed payments to prevent foreclosure after forbearance. It's essential to be proactive in communicating with your lender during this time.

Recent laws in Massachusetts have focused on enhancing borrower protections during the foreclosure process. Lenders must now engage in mediation and provide clearer communication about the options available to borrowers. Staying informed about these laws is vital, particularly for those concerned about foreclosure after forbearance.

In Massachusetts, the foreclosure process begins when a lender files a complaint in court after a borrower defaults on their mortgage. The borrower has a right to respond, and if the lender wins, the property is auctioned off. Considering the complexities of the process, it’s advisable to understand your options, especially concerning foreclosure after forbearance.