Attorney Collection Provide For

Description

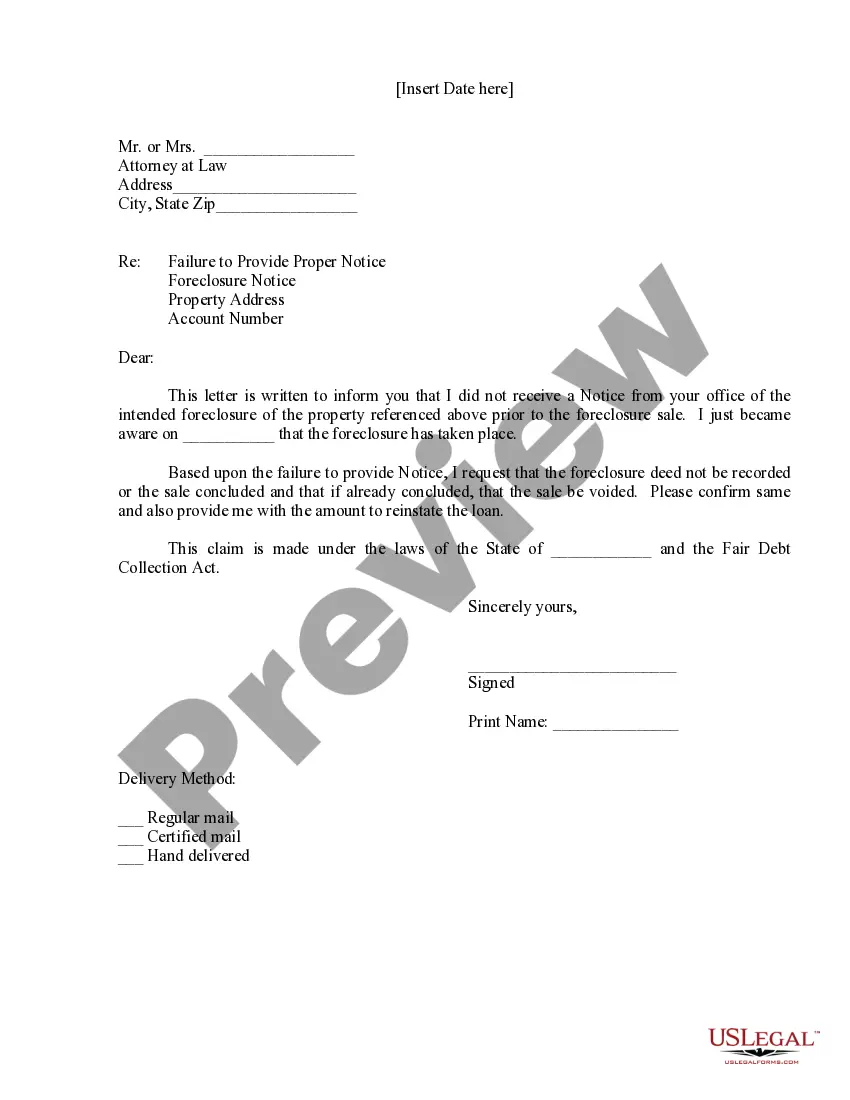

How to fill out Letter To Foreclosure Attorney - Fair Debt Collection - Failure To Provide Notice?

It’s no secret that you can’t become a law professional overnight, nor can you grasp how to quickly prepare Attorney Collection Provide For without having a specialized background. Putting together legal forms is a time-consuming venture requiring a certain training and skills. So why not leave the preparation of the Attorney Collection Provide For to the specialists?

With US Legal Forms, one of the most extensive legal template libraries, you can access anything from court paperwork to templates for internal corporate communication. We understand how crucial compliance and adherence to federal and state laws are. That’s why, on our platform, all templates are location specific and up to date.

Here’s how you can get started with our platform and get the form you need in mere minutes:

- Discover the form you need by using the search bar at the top of the page.

- Preview it (if this option provided) and check the supporting description to determine whether Attorney Collection Provide For is what you’re looking for.

- Begin your search over if you need a different template.

- Register for a free account and choose a subscription plan to purchase the form.

- Choose Buy now. Once the payment is through, you can download the Attorney Collection Provide For, fill it out, print it, and send or send it by post to the necessary people or entities.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your documents-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

When a debt collector contacts you about a debt, they are legally required to provide information about that debt, including the name of the creditor, the amount owed, and your right to dispute it. There are some limited exceptions to this rule.

Here's what every debt letter should include: Date of the letter. Lawyer's name, firm, and address. Client's name and address. A subject line that states its purpose. The precise amount the client owed your firm and the date when the payment was due. Instructions on how to pay the debt and the new deadline.

?Offering 25%-50% of the total debt as a lump sum payment may be acceptable. The actual percentage may vary depending on the circumstances of the borrower as well as the prevailing practices of that particular collection agency.? One benefit of negotiating settlement terms is likely to reduce stress.

Depending on the situation, debt settlement offers might range from 10% to 50% of what you owe.

You should dispute a debt if you believe you don't owe it or the information and amount is incorrect. While you can submit your dispute at any time, sending it in writing within 30 days of receiving a validation notice, which can be your initial communication with the debt collector.