Estate For Probate

Description

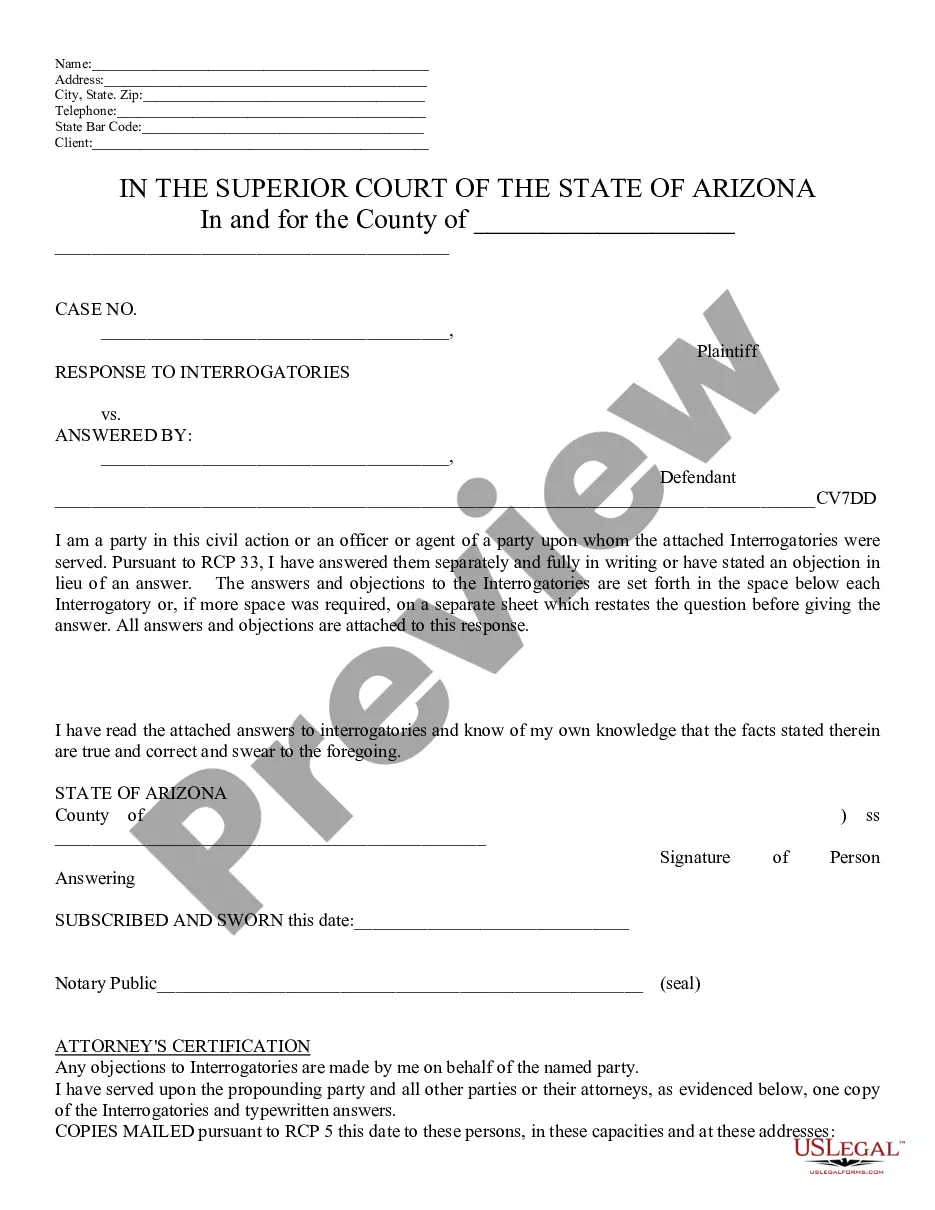

How to fill out Release Of Claims Against Estate By Creditor?

- Log into your US Legal Forms account if you're a returning customer. Ensure your subscription is active to access the necessary templates.

- Preview the available estate for probate forms and their descriptions. Confirm you pick the one that is appropriate for your specific needs and complies with local regulations.

- Conduct a search for additional templates if necessary. If you discover any discrepancies, use the Search tool to find a suitable alternative.

- Purchase your chosen document by clicking the Buy Now button, selecting your desired subscription plan, and registering for an account to unlock a wealth of resources.

- Complete the payment process using your credit card or PayPal to secure your subscription.

- Download your required form to your device for later use. Access it anytime through the My Forms section of your profile.

By leveraging US Legal Forms, individuals and attorneys can effectively execute legal documents without hassle. With a diverse array of over 85,000 editable legal forms at your fingertips, you can ensure accuracy and compliance in your estate proceedings.

Start your estate for probate journey today and experience the benefits of US Legal Forms. Visit us now and unlock legal peace of mind!

Form popularity

FAQ

The time allowed to settle an estate typically ranges from six months to a year, depending on the complexity of the estate and state-specific regulations. Promptly addressing estate for probate matters is essential to minimize delays and possible disputes among beneficiaries. Staying organized and compliant with legal requirements can facilitate a smooth settlement process.

To fill out a probate inventory, gather all necessary documentation related to the deceased's assets and liabilities. This includes real estate, bank accounts, investment accounts, and pending debts. Accurate completion of the probate inventory is vital, as it provides a detailed overview of the estate for probate and helps avoid future legal issues.

Probate is the legal process through which a deceased individual's estate, which includes all assets and debts, is settled and distributed. The estate itself is the totality of the deceased's wealth, including properties, bank accounts, and personal belongings. To simplify managing an estate for probate, it's essential to clearly understand both concepts, as they directly influence inheritance and tax considerations.

Gifts subject to the 3-year rule include any significant transfers made by the deceased to individuals that exceed certain monetary thresholds. This can also include real estate and valuables that were gifted before death. Understanding these rules is crucial during the probate process, as it helps clarify the overall value of the estate and any related tax responsibilities.

The 3-year rule works by including gifts given by the deceased within three years of their passing in the estate for probate. This means that any assets or gifts transferred must be reported when filing for probate, potentially affecting the value of the estate. Such inclusion helps determine the total value of the estate and the tax implications, ensuring compliance with estate tax laws.

The 3-year rule for a deceased estate refers to a specific period within which certain gifts made by the deceased may be taxed if they were given within three years of death. This rule ensures that any assets transferred before death are considered part of the estate for probate calculations. Failing to account for these gifts can complicate the probate process and increase taxes owed by the estate.

In Rhode Island, there is no minimum estate value for probate to be required; any estate that includes probate property must go through this process. However, smaller estates may qualify for simplified probate procedures that reduce complexity and costs. Understanding what qualifies as probate property is essential for effective estate planning. You may find that using USLegalForms can simplify these decisions and guide you through the estate for probate process.

Yes, Rhode Island law sets a timeframe for initiating probate proceedings. Generally, a personal representative should file the will within 30 days of the decedent's death. Delaying the process can lead to complications, including legal disputes among beneficiaries. Therefore, it's best to start the probate process promptly to ensure the estate for probate is managed smoothly.

While it is not mandatory to hire a lawyer for probate in Rhode Island, doing so can greatly simplify the process. A knowledgeable attorney can help navigate the complexities of Rhode Island's probate laws and prevent potential pitfalls. They can assist with filing documents, notifying heirs, and managing estate assets effectively. This support can be invaluable, making the estate for probate easier to handle.

To avoid probate in Rhode Island, you can consider several strategies for your estate. First, creating a living trust allows your assets to pass directly to beneficiaries without going through probate. Additionally, naming beneficiaries on accounts and ensuring your property is titled correctly can help streamline the process. Ultimately, planning ahead can simplify the management of your estate for probate and keep your affairs private.