Estate Deceased Executor With No Reason

Description

How to fill out Release Of Claims Against Estate By Creditor?

- Log into your US Legal Forms account if you're a returning user. Ensure your subscription is active; if not, renew it as needed.

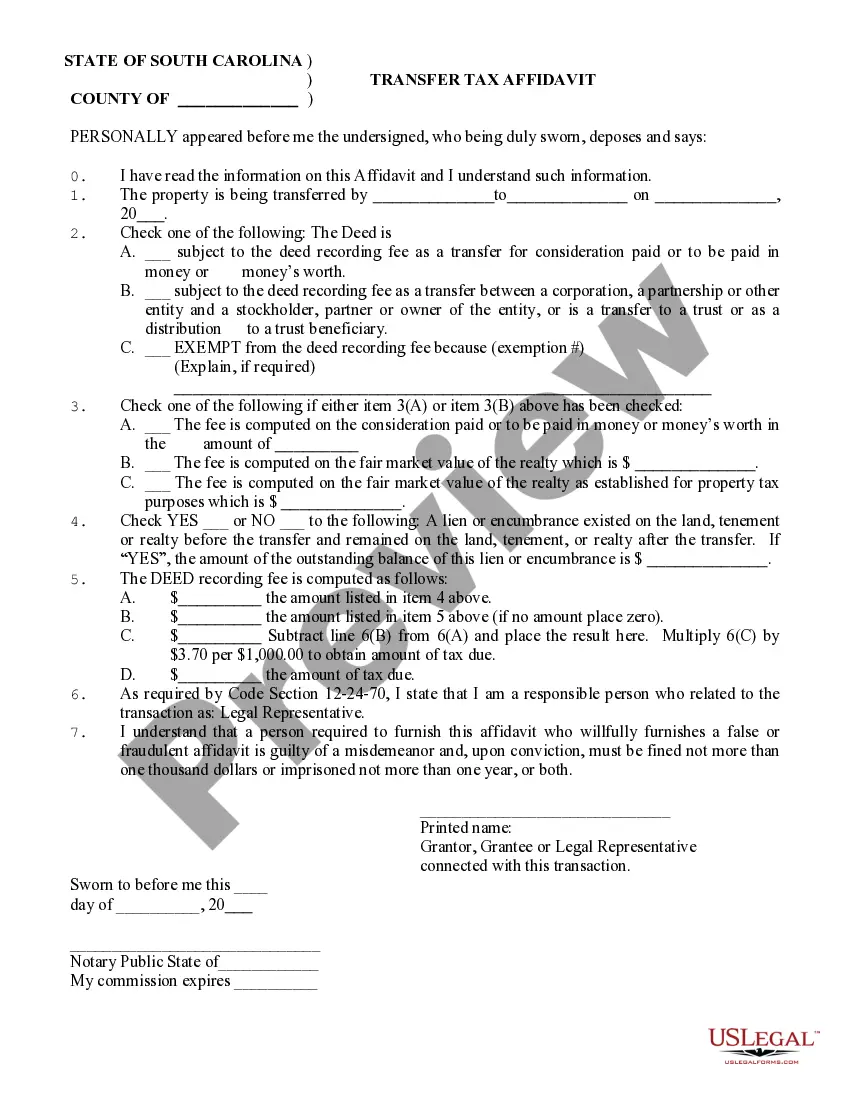

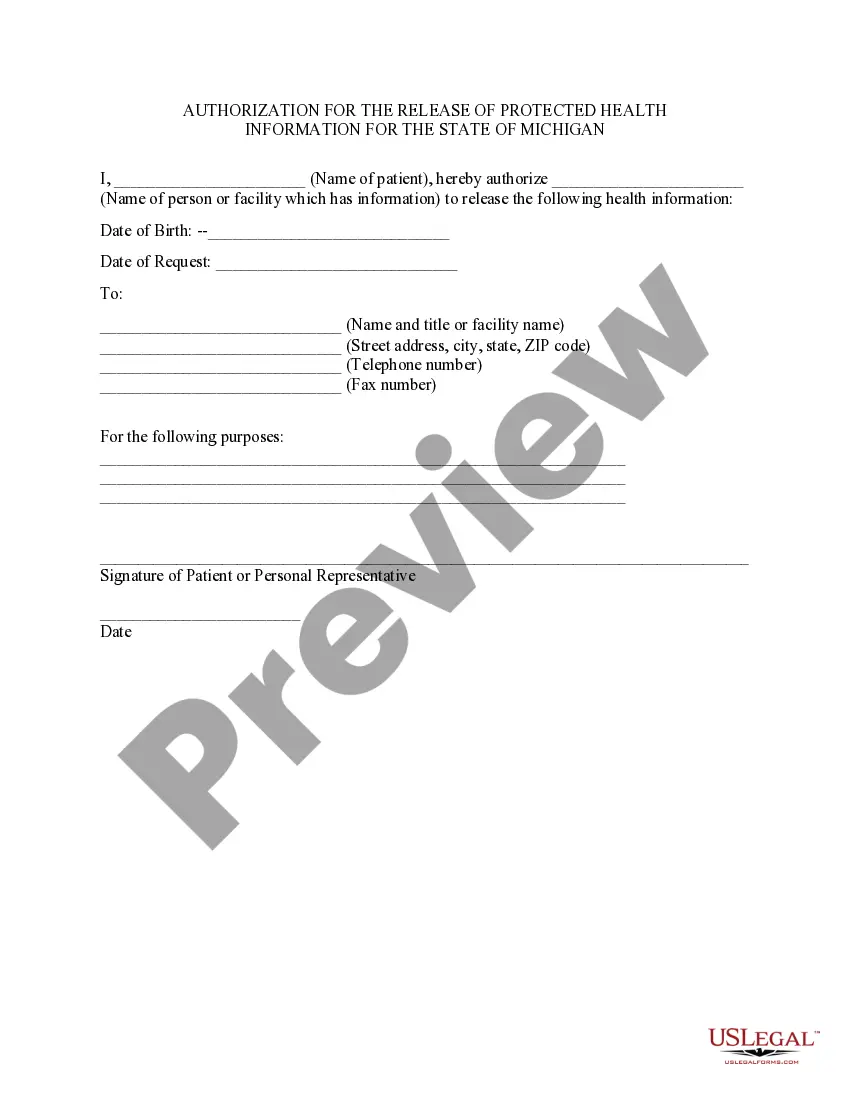

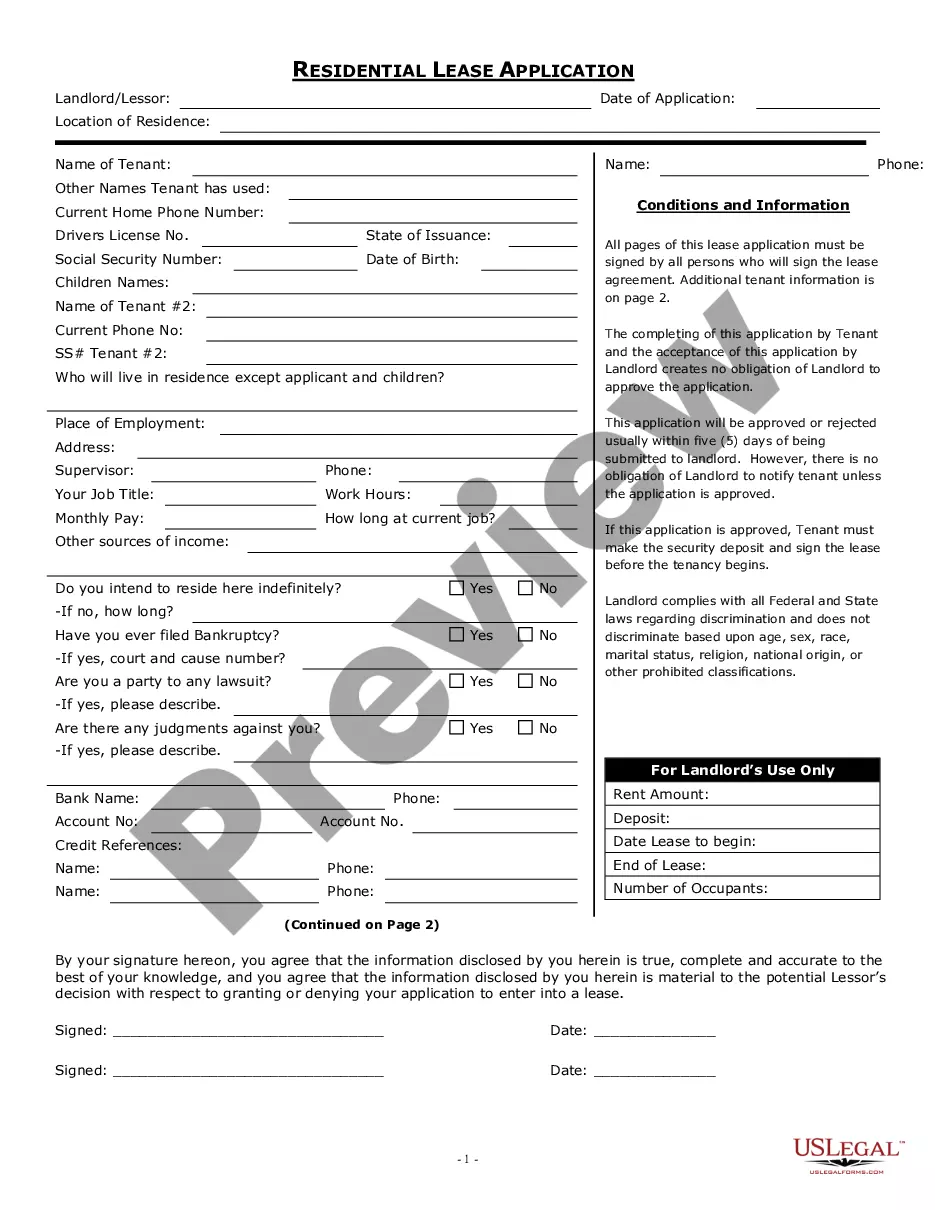

- Browse the extensive library. Use the preview mode to scrutinize the forms available and make sure you select one that aligns with your local jurisdiction’s requirements.

- Utilize the search feature if needed. If you encounter any inconsistencies, easily find the right template by searching through the library.

- Complete your purchase. Choose the appropriate subscription plan and register an account to access a range of legal resources.

- Make your payment. Enter your credit card information or opt for PayPal to finalize your subscription.

- Download your completed form. Save it on your device for easy access to complete it later, available in your 'My Forms' section.

By following these straightforward steps, you can confidently access the forms necessary for your responsibilities as an executor. US Legal Forms empowers you with a well-organized and user-friendly legal document collection.

Don't hesitate to get started today—visit US Legal Forms to simplify your legal documentation needs!

Form popularity

FAQ

If the executor of a will is not executing their duties, beneficiaries have options available. You can address the issue through direct communication or seek legal recourse. Platforms like US Legal Forms can provide resources to prepare necessary documents for addressing executor inaction and protecting your interests.

You cannot directly force an estate deceased executor to probate a will, but you can petition the court for action. If the executor refuses or unduly delays probate, beneficiaries can file a petition to compel the executor to fulfill their duties. It is advisable to consult with legal professionals to facilitate the process effectively.

In the event that the estate deceased executor becomes incapacitated, the court may appoint a successor executor. This ensures that the responsibilities of managing the estate continue without delay. Beneficiaries should be prepared to address this situation, seeking legal representation if necessary to navigate the transition smoothly.

If the estate deceased executor takes no action, the beneficiaries may feel significant frustration. Inactive executors can be legally challenged or replaced by the court. It is crucial for beneficiaries to advocate for their rights to ensure the estate is administered effectively, particularly when timelines are sensitive.

An executor is held accountable through legal obligations to act in the best interest of the estate and its beneficiaries. If they fail to adhere to these duties, they can face lawsuits or removal from their position. In serious cases, they may even face criminal charges depending on the nature of their misconduct.

To prove executor misconduct, gather evidence demonstrating negligence or self-dealing. For instance, improper handling of estate funds or failing to communicate with beneficiaries can indicate misconduct. Documenting any discrepancies can help build a case. If necessary, consider legal advice to understand the proper steps to take.

An estate deceased executor can be named in a will without prior notification. This can happen if the deceased believed the individual would accept the role or if they were acting in trust. However, it is essential for the named executor to be informed promptly, as they will need to fulfill various responsibilities in managing the estate.

Filing taxes as the executor of an estate can be straightforward, but it requires attention to detail. As the estate deceased executor with no reason, you must report any income generated by the estate during the probate process. This includes income from assets like rental properties or investments. Familiarity with tax requirements is crucial, and platforms like US Legal Forms can guide you through the forms and stipulations, ensuring compliance and reducing stress.

An executor typically gains access to the deceased's bank accounts as part of their duties. When acting as the estate deceased executor with no reason, your role includes managing the deceased's assets, which often involves accessing bank accounts. However, you'll need to present proper documentation, such as a death certificate and a grant of probate, to the bank to gain this access. It's wise to consult legal resources, such as US Legal Forms, to streamline this process.

Yes, an executor can withdraw funds from the deceased's estate, but they must do so responsibly. As the estate deceased executor with no reason, your actions should align with the court's instructions and the preferences outlined in the deceased's will. It's essential to keep accurate records of all transactions to maintain transparency and avoid disputes among heirs. Using a platform like US Legal Forms can help you navigate the necessary documentation.