Estate Creditor With Balance

Description

How to fill out Release Of Claims Against Estate By Creditor?

Accessing legal forms that adhere to federal and state regulations is essential, and the internet provides numerous options to select from.

However, what is the advantage of spending time hunting for the appropriate Estate Creditor With Balance example online when the US Legal Forms digital library already consolidates such templates in one location.

US Legal Forms is the largest online legal repository with over 85,000 editable templates created by attorneys for various business and personal situations. They are user-friendly with all documents categorized by state and intended use. Our experts keep up with legal changes, ensuring your form is current and compliant when obtaining an Estate Creditor With Balance from our site.

Click Buy Now once you have found the appropriate form and choose a subscription plan. Create an account or Log In and process your payment via PayPal or credit card. Choose the best format for your Estate Creditor With Balance and download it. All documents you find through US Legal Forms are reusable. To re-download and complete previously saved forms, access the My documents section in your account. Enjoy the most extensive and user-friendly legal document service!

- Acquiring an Estate Creditor With Balance is straightforward and quick for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document sample you require in the desired format.

- If you are new to our site, follow the steps below.

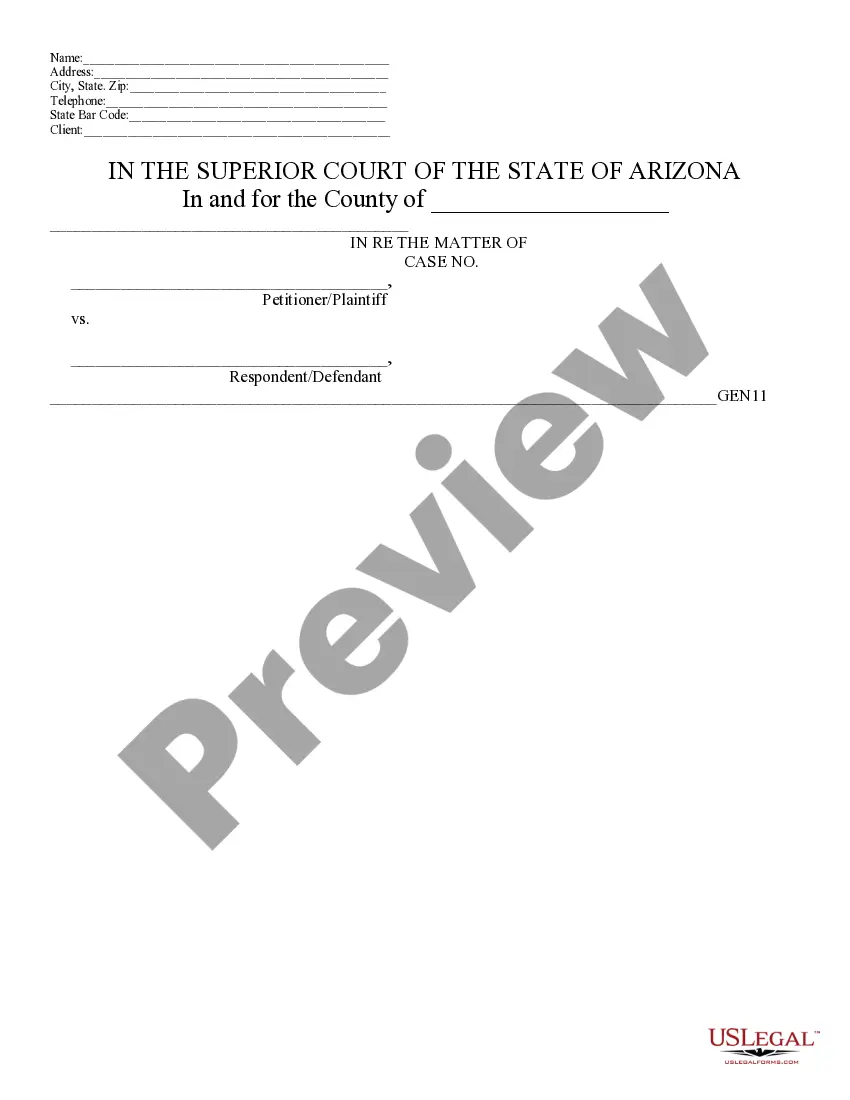

- Examine the template using the Preview function or through the text description to confirm it meets your requirements.

- Search for another sample using the search tool at the top of the page if necessary.

Form popularity

FAQ

To file a claim against an estate, a creditor must submit a formal claim to the estate's executor or administrator. This claim should detail the amount owed and the basis for the debt. The estate creditor with balance must be mindful of state deadlines to ensure their claim is considered. Platforms like US Legal Forms can provide the necessary templates and guidance to streamline this process.

When an estate has more debt than assets, it becomes insolvent. In this situation, the estate creditor with balance may not receive full payment for their claims. The executor must prioritize debts according to state laws, often paying secured debts first. If the estate cannot cover all debts, creditors may have to write off some losses.

If someone dies with outstanding debt, the estate creditor with balance will seek repayment from the deceased's estate during the probate process. The debts must be addressed before any distribution of assets to heirs or beneficiaries. In many cases, the estate's assets will cover these debts, but if there are insufficient funds, the remaining debts may go unpaid. Using a resource like US Legal Forms can help guide you through the necessary steps to handle such situations.

When an estate has more debt than assets, the estate creditor with balance may find that the debts exceed the total value of the estate. In such cases, the estate typically enters a process called probate, where the debts are settled according to state laws. Often, creditors may not receive full payment, or in some cases, they may not receive anything at all. It's essential to consult with a legal expert to navigate these situations effectively.

Unfortunately, ?(Detail Deceased's name) ?passed away on ?(Detail Date)?. I enclose a copy of their death certificate. They didn't leave behind any assets and there is no money to pay what they owe. Please consider writing off this debt because there is no prospect of you ever recovering any money towards it.

How do I obtain a credit report for a deceased person? The spouse or executor of the estate may request the deceased person's credit report by mailing a request to each of the credit reporting companies. Send a letter along with the following information about the deceased: Legal name.

The Government of Canada states that legal action cannot be taken to collect on a debt after 6 years of the debt last being acknowledged, but provincial rules are often different in respect to the Statute of Limitations.

Notice of Death Publication The purpose of this notice is designed to inform potential creditors of the death, and while details vary from province to province, creditors typically have from 1 to 6 months to contact the estate about any debt claims.

If accounts have not been passed after two years, a beneficiary can again apply to the court to require passing of the executor's accounts. The executor will need to explain why the estate has not yet been settled.