Deceased Decedent Estate With Sars

Description

How to fill out Release Of Claims Against Estate By Creditor?

Regardless of whether for commercial reasons or personal matters, everyone must confront legal circumstances at some point in their life. Completing legal paperwork requires meticulous attention, starting with selecting the correct form template. For instance, if you choose an incorrect version of the Deceased Decedent Estate With Sars, it will be rejected upon submission. Thus, it is vital to obtain a trustworthy source of legal documents such as US Legal Forms.

If you need to acquire a Deceased Decedent Estate With Sars template, follow these straightforward steps.

With an extensive US Legal Forms collection available, you do not need to waste time searching for the appropriate template across the web. Take advantage of the library’s straightforward navigation to discover the suitable form for any situation.

- Retrieve the template you require by using the search bar or catalog browsing.

- Review the form’s details to ensure it corresponds with your circumstances, state, and locality.

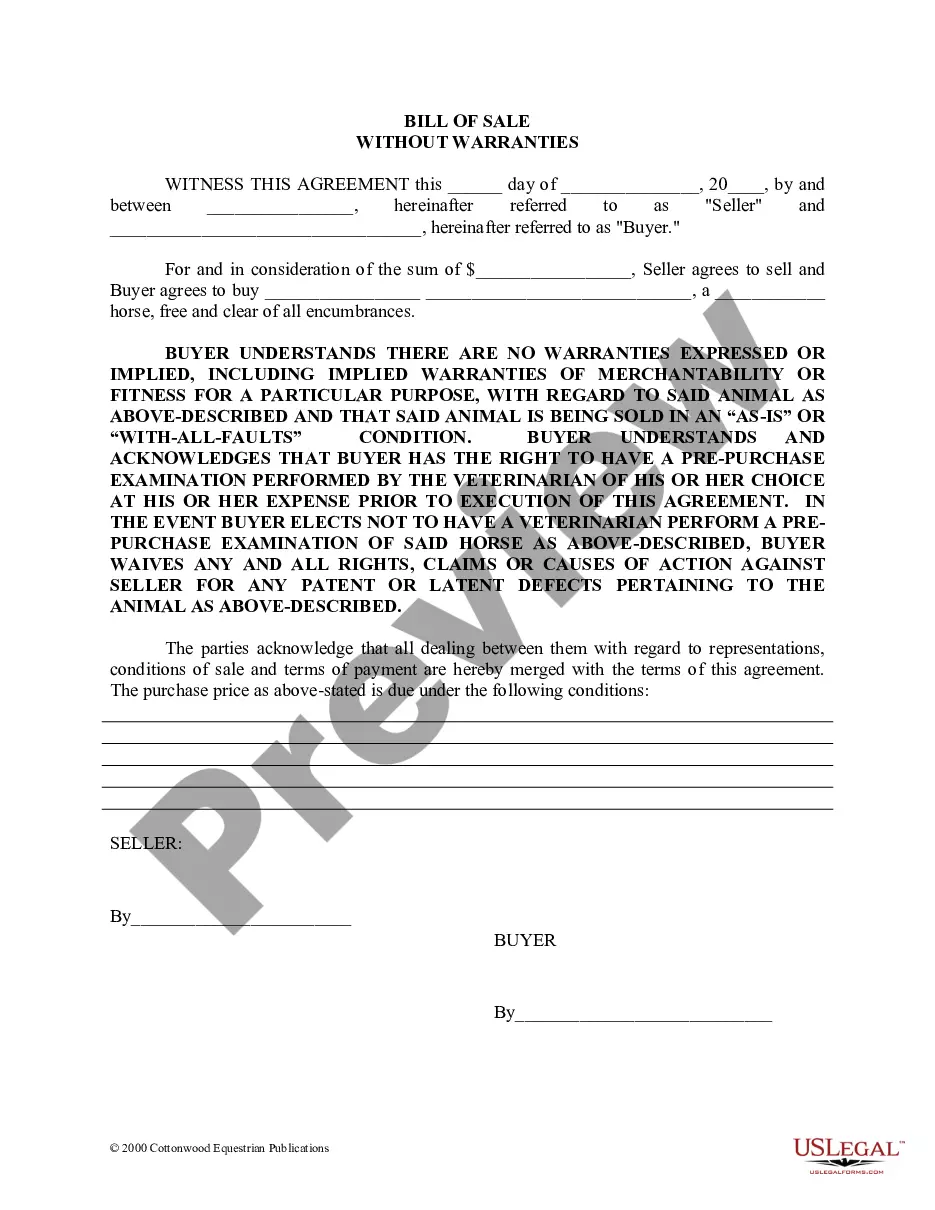

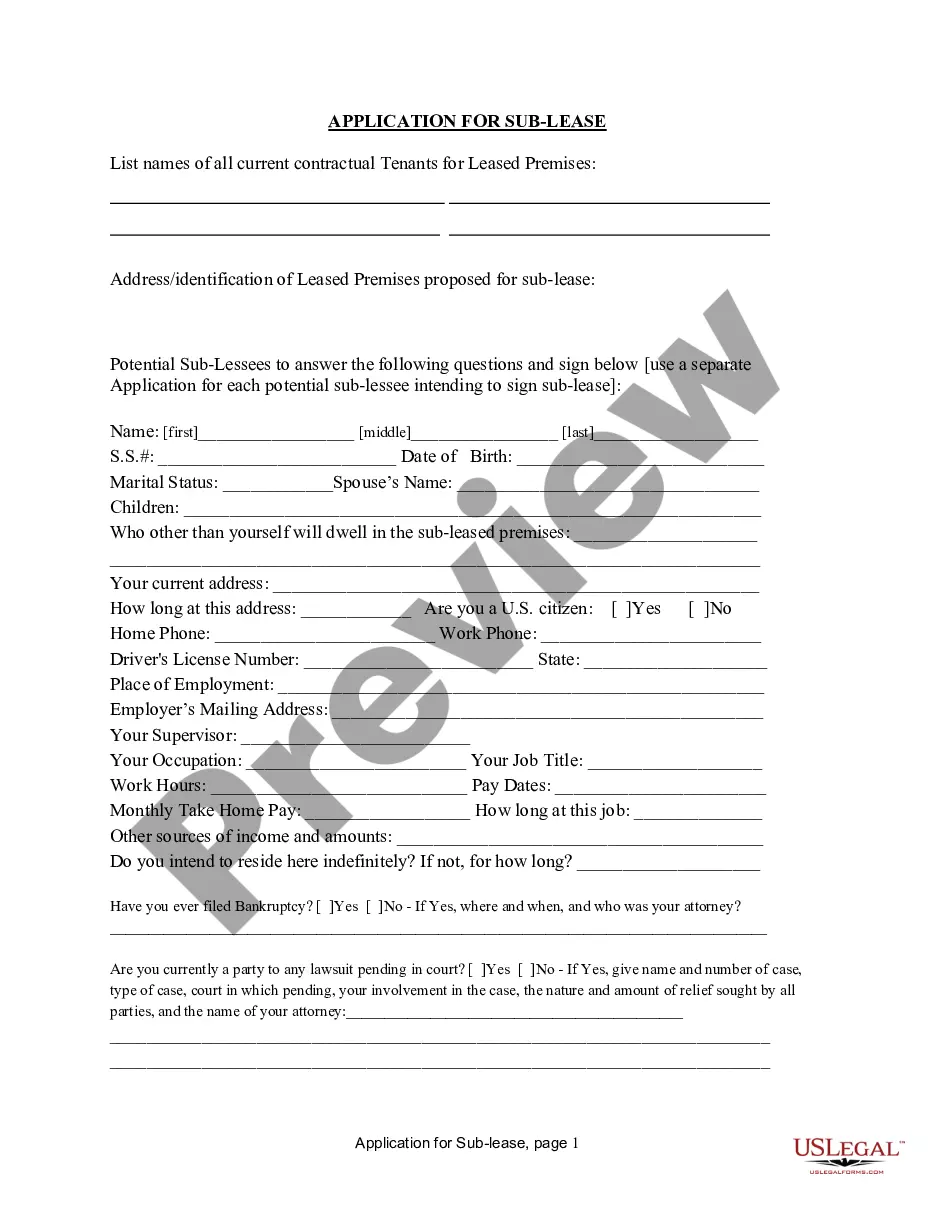

- Click on the form’s preview to examine it.

- If it is the wrong document, return to the search feature to locate the Deceased Decedent Estate With Sars template you need.

- Obtain the document if it meets your specifications.

- If you already possess a US Legal Forms account, click Log in to access previously stored documents in My documents.

- If you do not yet have an account, you can acquire the form by clicking Buy now.

- Choose the relevant pricing option.

- Fill out the profile registration form.

- Select your payment method: you can use a credit card or PayPal account.

- Choose the file format you prefer and download the Deceased Decedent Estate With Sars.

- Once downloaded, you can complete the form using editing software or print it and fill it out manually.

Form popularity

FAQ

To report a deceased estate in South Africa, the executor must submit a formal declaration to the Master of the High Court. This process includes providing details of the deceased decedent estate with SARS and any relevant documentation. Using platforms like USLegalForms can simplify this process by providing the necessary forms and guidance.

Deceased estates in South Africa are subject to estate duty and income tax on any income generated during the administration period. The value of the deceased decedent estate with SARS will determine the estate duty payable. Executors must ensure all tax obligations are met to facilitate a smooth distribution of assets.

An executor typically has 12 months to settle an estate in South Africa. However, depending on the complexity of the deceased decedent estate with SARS, this period could be extended. It is important for the executor to manage the estate efficiently and communicate with beneficiaries about the process.

To file a tax return for an estate, first determine if the deceased decedent estate with SARS has any outstanding tax obligations. You will need the estate's financial records and details about income generated during the estate administration. Completing and submitting the tax return accurately ensures compliance and helps avoid future complications.

In South Africa, you typically have 14 days to report a death. This timeframe is crucial for officially documenting the deceased decedent estate with SARS. Delays can complicate the process for settling the estate and may lead to penalties, so it's best to act promptly.

In South Africa, the executor of the will or an appointed administrator can report a deceased estate. They must officially notify SARS about the deceased decedent estate. If there is no will, any interested party, such as a family member, may step forward to handle the reporting process.

Yes, placing a deceased estates notice is generally required in South Africa. This notice informs creditors and beneficiaries about the deceased decedent estate with SARS. Filing this notice allows interested parties to claim any debts or assert their rights to the estate within a specified time frame.

To claim an estate of a deceased person, you must first identify the deceased decedent estate with SARS. You will need to gather necessary documents, including the death certificate and any relevant wills. After that, you can file the estate claim through the appointed executor or legal representative, who will guide you through the legal requirements.

Yes, the estate often must file a tax return if it meets certain income thresholds or if it has taxable distributions. Filing is essential for settling the estate properly and fulfilling legal obligations. Utilizing resources like USLegalForms can simplify the process of navigating the requirements for the deceased decedent estate with sars.

The minimum income for an estate to file taxes generally depends on the gross income threshold set by the IRS, which can change annually. As a rule of thumb, if the estate earns more than $600 in gross income, it will likely need to file a return. This requirement emphasizes the importance of managing the deceased decedent estate with sars effectively.