Release Of Exemption To Non Custodial Parent

Description

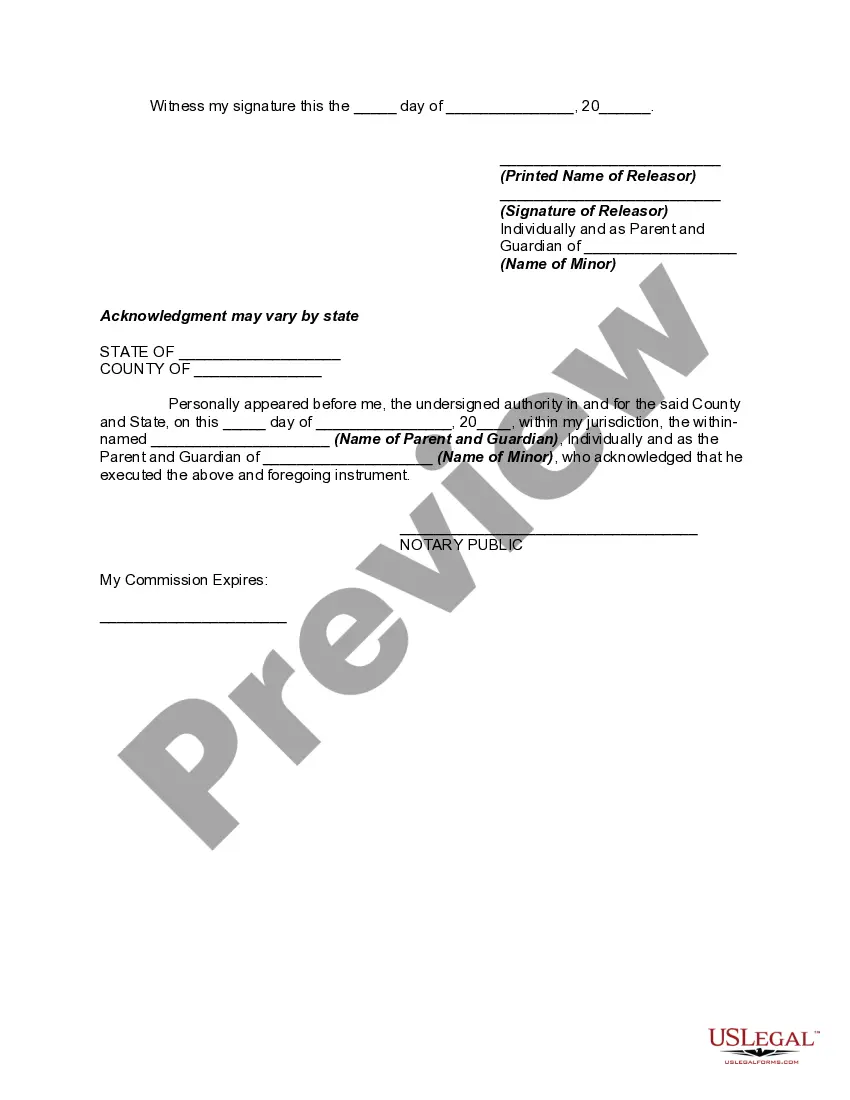

How to fill out Release By Parent On Behalf Of Child For Injuries Sustained In Accident?

The Release Of Exemption To Non Custodial Parent you see on this page is a reusable legal template drafted by professional lawyers in compliance with federal and regional laws. For more than 25 years, US Legal Forms has provided people, companies, and attorneys with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the quickest, simplest and most reliable way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Obtaining this Release Of Exemption To Non Custodial Parent will take you only a few simple steps:

- Search for the document you need and review it. Look through the file you searched and preview it or check the form description to ensure it suits your requirements. If it does not, use the search option to get the correct one. Click Buy Now once you have located the template you need.

- Subscribe and log in. Opt for the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to continue.

- Get the fillable template. Select the format you want for your Release Of Exemption To Non Custodial Parent (PDF, Word, RTF) and save the sample on your device.

- Complete and sign the paperwork. Print out the template to complete it by hand. Alternatively, use an online multi-functional PDF editor to rapidly and accurately fill out and sign your form with a legally-binding] {electronic signature.

- Download your paperwork one more time. Make use of the same document once again whenever needed. Open the My Forms tab in your profile to redownload any previously saved forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

How to file Form 8332 electronically Gather all of the necessary documents, including your tax return, Form 8332, and any supporting documentation. Visit the IRS e-file page and create an account if you do not already have one. Follow the prompts to complete and submit your tax return and Form 8332 online.

The custodial parent signs a Form 8332, Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent or a substantially similar statement, and. The noncustodial parent attaches the Form 8332 or a similar statement to his or her return.

Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. The form can be used for current or future tax years. Additionally, custodial parents can use tax Form 8332 to revoke the release of this same right.

If you are the custodial parent, you can use Form 8332 to do the following. Release a claim to exemption for your child so that the noncustodial parent can claim an exemption for the child. Revoke a previous release of claim to exemption for your child.