Accident Claim File With Doordash

Description

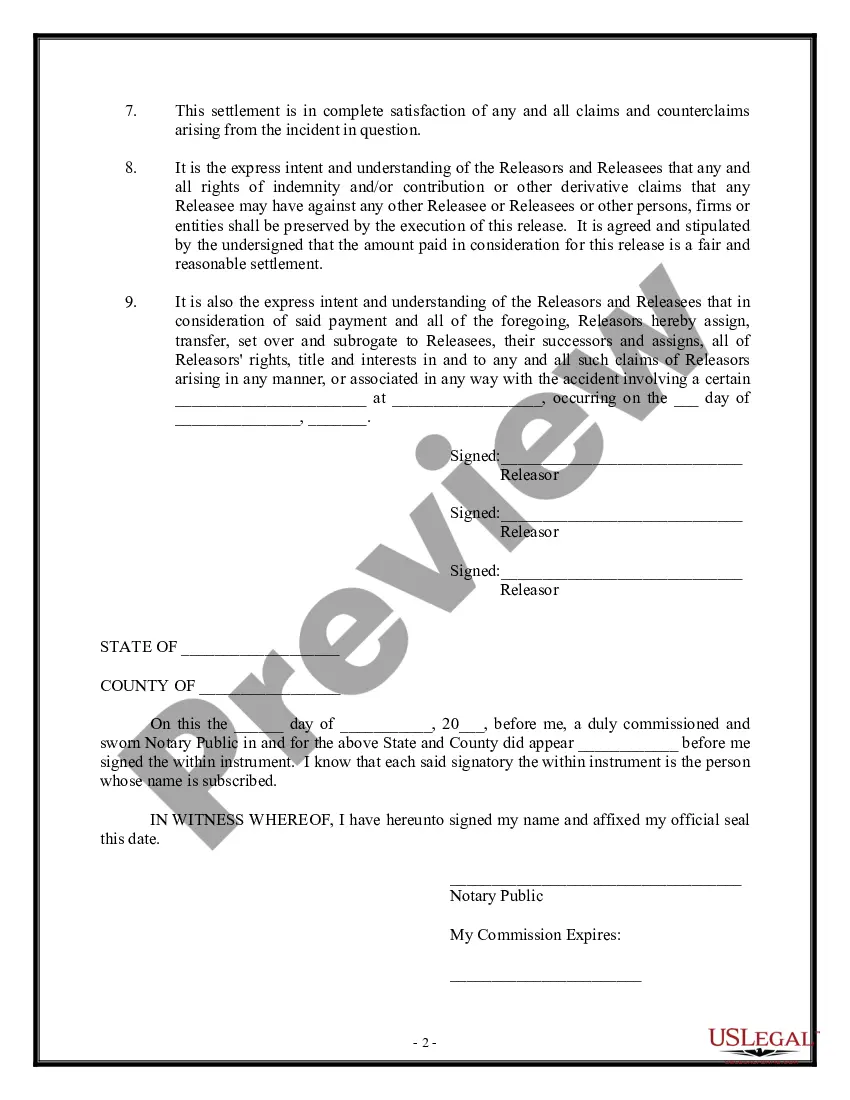

How to fill out Release Of All Auto Accident Claims?

Securing a reliable source for the latest and suitable legal templates is half the battle of dealing with bureaucracy.

Selecting the correct legal documents necessitates precision and meticulousness, which is why it is crucial to obtain samples of Accident Claim File With Doordash solely from trustworthy providers, such as US Legal Forms. An incorrect template will squander your time and prolong the issue at hand. With US Legal Forms, you have minimal concerns. You can access and verify all the specifics regarding the document’s applicability and significance for your situation and in your state or locality.

Once you have the form on your device, you can edit it with the editor or print it and fill it out manually. Eliminate the stress associated with your legal paperwork. Browse the extensive US Legal Forms library where you can discover legal templates, assess their relevance to your situation, and download them instantly.

- Utilize the catalog navigation or search bar to find your template.

- Examine the form’s description to ensure it aligns with the requirements of your state and county.

- Review the form preview, if accessible, to confirm that the form is indeed the one you seek.

- Return to the search and locate the appropriate document if the Accident Claim File With Doordash does not suit your needs.

- If you are certain about the form’s relevance, download it.

- If you are a registered user, click Log in to verify and access your chosen forms in My documents.

- If you do not have an account yet, click Buy now to obtain the template.

- Select the pricing plan that meets your requirements.

- Proceed to the registration to complete your acquisition.

- Finalize your purchase by choosing a payment method (credit card or PayPal).

- Choose the file format for downloading Accident Claim File With Doordash.

Form popularity

FAQ

Even if you do it only part time, driving for DoorDash is a commercial activity because you are using your car for business purposes. If you have an accident while you are online in the app, your insurance will probably not cover it given you used your vehicle for commercial purposes.

If you get into a traffic accident while out on a delivery for a service like , Doordash, or Grubhub, you should take the same steps that you would take in a regular accident: ensure your safety, check for injuries, call the authorities, exchange information, and gather evidence.

Yes. Vehicles that are used as part of a business have different rates. If you have an accident while driving for Door Dash, your insurance will not cover the damage, because you failed to tell them. Yes, if you are driving for DoorDash, you should inform your insurance company.

DoorDash is committed to creating a safe and inclusive platform for all members of our community. Contact our 24/7 Trust and Safety team at 1-855-431-0459 to report any safety-related incidents.

If you suffer an injury while making a delivery with DoorDash, you may be eligible for coverage. Dashers do not need to sign up or enroll for occupational accident insurance. There are no premiums, deductibles, or co-pays.