Application Apartment Rent For Salary

Description

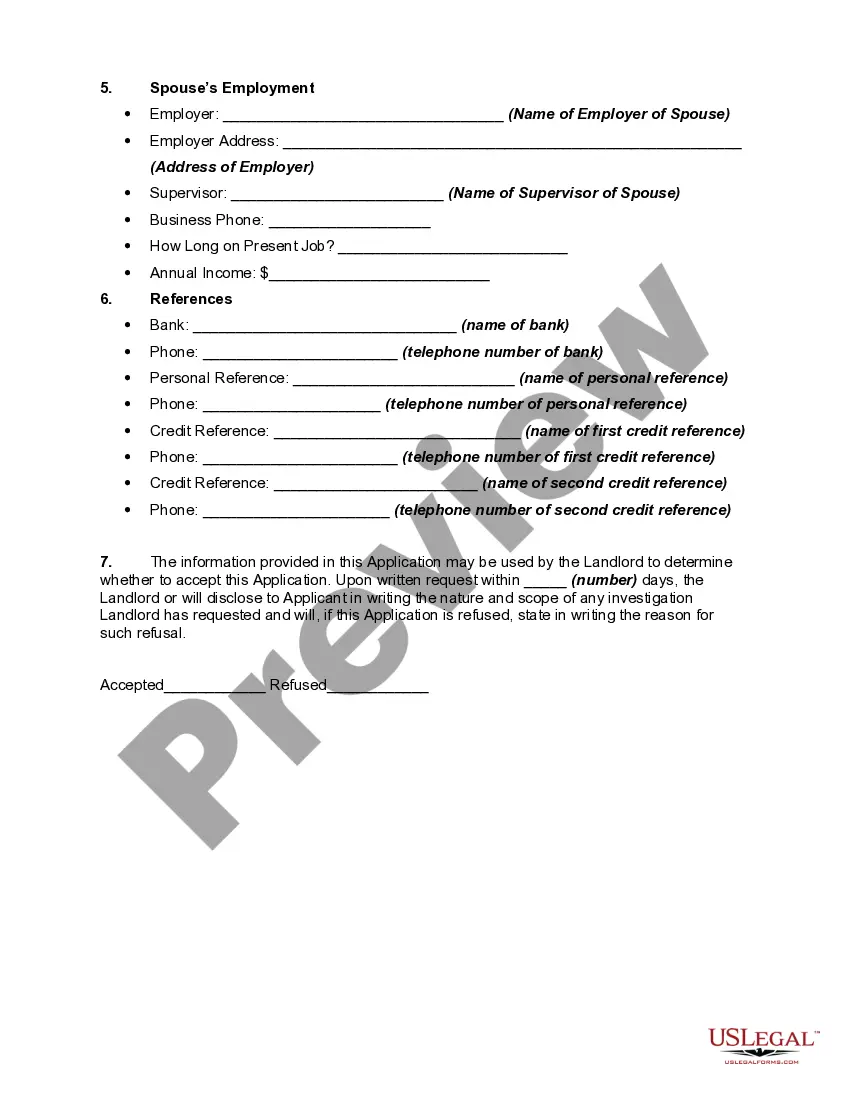

How to fill out Application To Lease An Apartment With Payment Of First Month's Rent As Deposit?

Managing legal documents and tasks can be an arduous addition to your daily routine.

Applications such as Apartment Rent For Salary and similar forms generally require you to search for them and comprehend the best methods to fill them out accurately.

Consequently, whether you are handling financial, legal, or personal issues, having a comprehensive and accessible online directory of forms at your disposal will be tremendously beneficial.

US Legal Forms is the leading online resource for legal templates, providing over 85,000 state-specific documents along with various tools to help you complete your paperwork effortlessly.

Is this your first time using US Legal Forms? Register and establish your account in a few moments, and you will gain access to the form directory and Application Apartment Rent For Salary. Then, follow the outlined steps below to fill out your form: Ensure you have the correct form by utilizing the Preview option and reviewing the form description. Select Buy Now when ready, and choose the subscription plan that fits your needs. Click Download, then complete, eSign, and print the form. US Legal Forms boasts 25 years of experience helping users manage their legal documents. Find the form you need today and simplify any process effortlessly.

- Explore the collection of relevant documents available to you with just one click.

- US Legal Forms provides state- and county-specific documents accessible at any time for download.

- Protect your document management processes with exceptional support that enables you to generate any form within minutes without any extra or concealed fees.

- Simply Log In to your account, find Application Apartment Rent For Salary, and download it immediately from the My documents section.

- You can also access forms you have previously downloaded.

Form popularity

FAQ

I am writing to express my interest in your property at [Address]. After viewing the listing, I am confident that it would be the perfect fit for me. I am a responsible and reliable individual, currently working as a [Your Job] at [Your Company] with a steady income to support the monthly rent payments.

Tax on rental Income in India is deducted under the head 'Income from House Property'. If you are receiving rental income from a vacant land then it will be taxed under 'Income from Other Sources'.

Rental income from a property in India is taxable as per an individual's tax slab rate. However, if the Gross Annual Value (GAV) is less than ? 2.5 lakh, zero tax would be applicable on rental income. Several deductions are available under the IT Act that reduces one's rental tax liability.

How to file ITR-1 with rental income? Details of an individual taxpayer. Upload form 16 for income from salaries. Details of other income. Details of house property. Details of capital gains and business or profession. Details of tax deductions. Details of taxes paid and tax filing.

Annual rent received/receivable. House tax, or municipal tax paid. Name of the tenant and PAN of the tenant. Interest paid/payable on housing loan on the property. Pre-construction period interest. Address of the property and details of co-owners if any.