Trust-office

Description

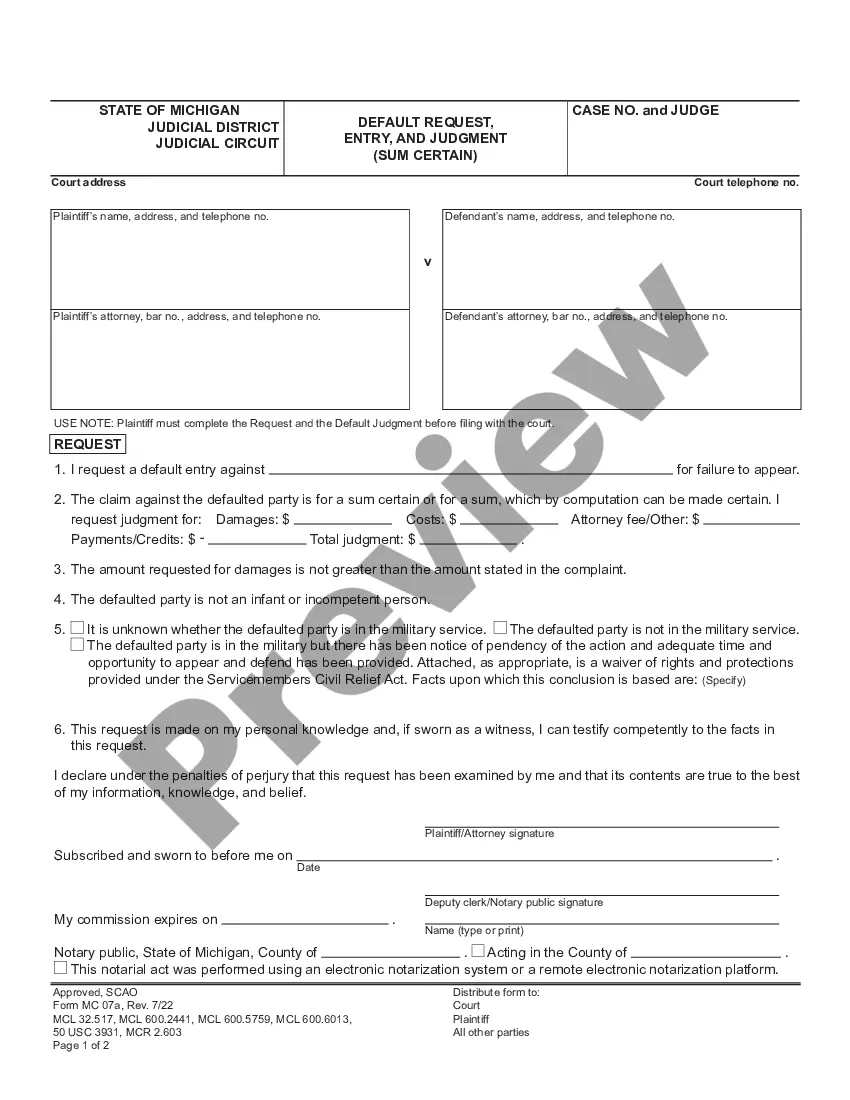

How to fill out Irrevocable Trust Agreement For Benefit Of Trustor's Children And Grandchildren With Spendthrift Trust Provisions?

- If you're a returning user, log in to your account and download the required form by clicking the Download button. Verify that your subscription is active; if it's not, renew according to your chosen payment plan.

- For first-time users, begin by reviewing the Preview mode and form descriptions to find the template that meets your legal requirements and local jurisdiction standards.

- Should you need a different template, utilize the Search tab to locate the appropriate form. Once you find an accurate form, proceed to the next step.

- Purchase your document by clicking the Buy Now button and choose a subscription plan that fits your needs. Registration for an account is necessary to access the library.

- Complete your transaction by entering your credit card information or logging into your PayPal account for payment.

- Finally, download the form to your device, enabling you to fill it out at your convenience. Access it anytime from the My Forms section in your profile.

Utilizing US Legal Forms allows for swift and secure execution of legal documents, all while providing the backing of premium experts for accurate form completion.

Don’t hesitate; start your journey with US Legal Forms today and unlock the potential of a streamlined legal documentation process!

Form popularity

FAQ

The new IRS ruling on irrevocable trusts outlines how income generated by these trusts is taxed, emphasizing the importance of careful tax planning. It's crucial for trust creators to understand these implications to avoid unexpected tax liabilities. A Trust-office can provide insights into these new rulings and assist with strategic trust management.

Yes, trust tax returns can be filed electronically with the IRS, provided you follow specific guidelines. This method often speeds up the process and allows for easier tracking of your submission. Utilizing a Trust-office can simplify the electronic filing process and ensure compliance with current regulations.

To avoid capital gains tax in an irrevocable trust, you should consider strategies such as holding assets in the trust until death or utilizing specific tax exclusions. Additionally, discussing options with a financial advisor can help you make informed decisions. A comprehensive Trust-office can provide resources to navigate these strategies efficiently.

The best person to set up a trust is usually an estate planning attorney who specializes in trusts. They have the knowledge to ensure that your trust meets legal requirements and reflects your intentions. Trust-office platforms can also connect you with qualified professionals to streamline this process.

The new IRS $600 rule requires that any business that pays $600 or more to a contractor must issue a Form 1099. This rule aims to improve tax compliance and reporting. If you have a Trust-office, understanding and adhering to these filing requirements can help you manage your trust's responsibilities effectively.

To file a trust, you typically need IRS Form 1041, which is used for income tax returns for estates and trusts. This form helps declare income earned by the trust to the IRS. When using a Trust-office service, you can find detailed guidance to ensure all necessary forms are completed correctly.

To become a trust officer, beginning with a strong educational background in finance, law, or business is recommended. Gaining relevant experience in banking or financial planning can also be advantageous. Furthermore, pursuing certifications specific to fiduciary management will enhance your qualifications and may provide you with opportunities in a trust-office environment.

While many people can serve as trust administrators, it's essential they understand the responsibilities and legal obligations involved. Typically, individuals should possess knowledge of finance, estate planning, and trust management to effectively handle the role. If you're considering this path, consider resources from US Legal Forms to better prepare yourself.

A trust office manages and administers trusts, ensuring that the terms established by the grantor are followed. This includes handling investments, processing distributions, and maintaining communication with beneficiaries. Trust offices also provide guidance on estate planning and tax implications, making them invaluable for effective wealth management.

The salary of a trust officer can vary based on experience, location, and the specific organization they work for. On average, trust officers earn a competitive salary, often exceeding $70,000 annually, with opportunities for bonuses and advancement in a trust-office setting. Conducting market research can provide you insight into salary expectations in your area.