Spendthrift Trust Sample For Customer Support

Description

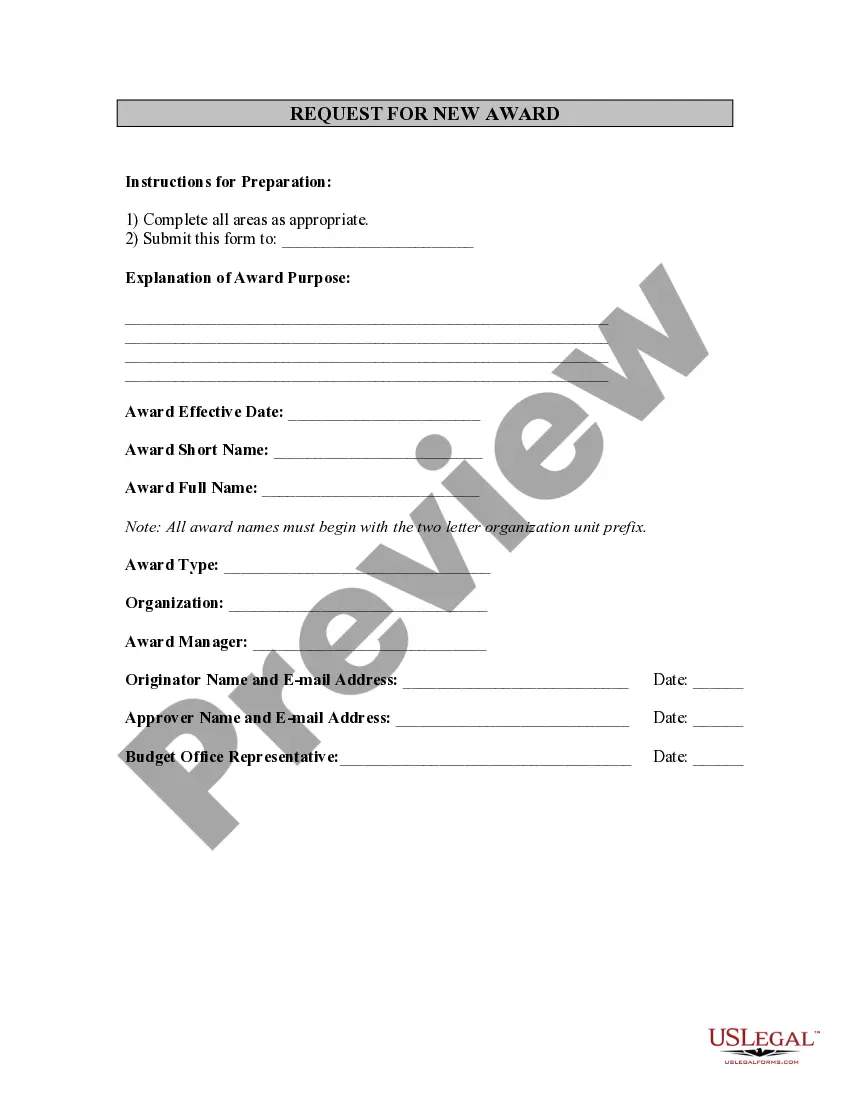

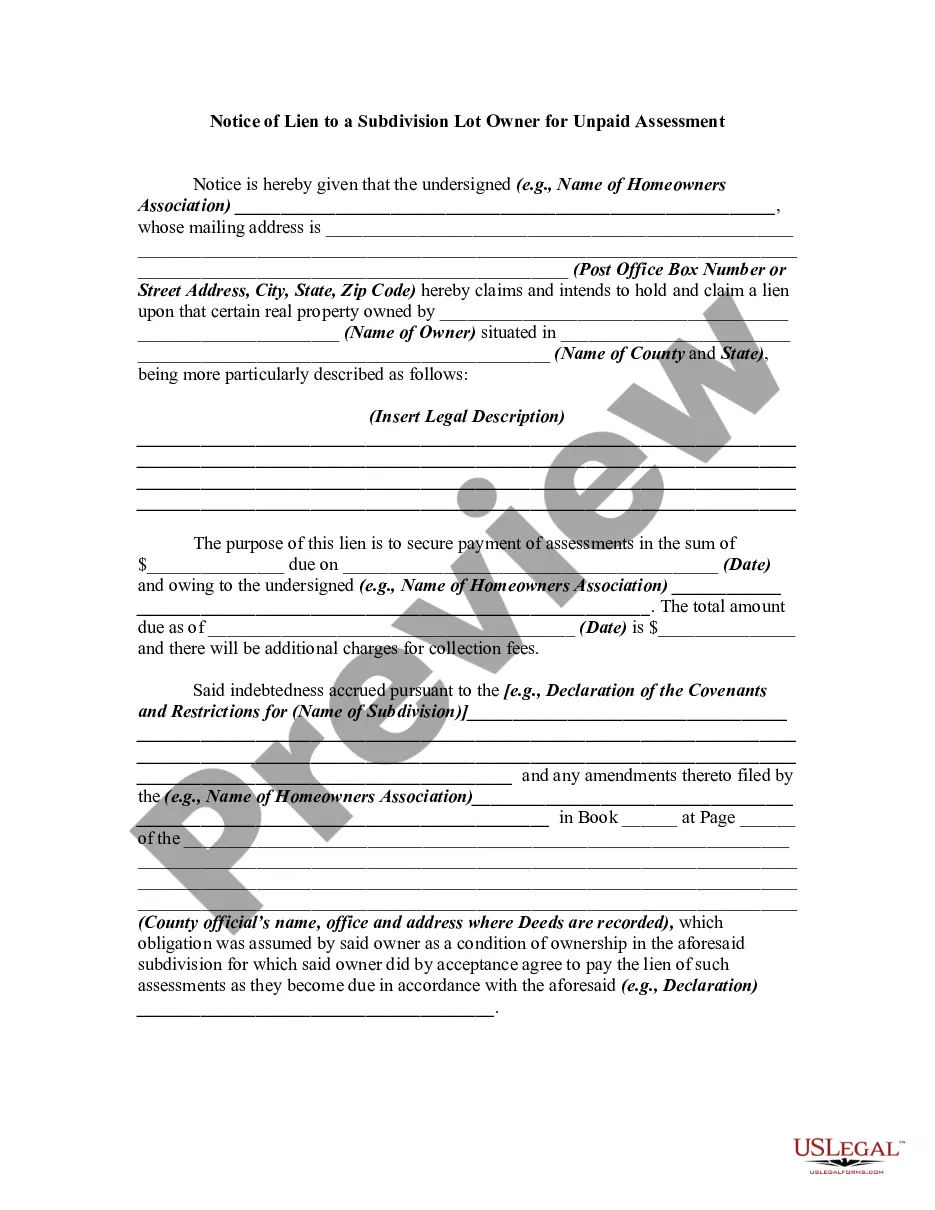

How to fill out Irrevocable Trust Agreement For Benefit Of Trustor's Children And Grandchildren With Spendthrift Trust Provisions?

- If you are a returning user, log into your account and ensure your subscription is active to access the necessary template.

- For first-time users, start by exploring the preview mode and reading the form description to confirm it matches your requirements and local jurisdiction.

- Should you need a different template, utilize the search function at the top to find alternatives that better suit your needs.

- Once satisfied with your selection, click on the 'Buy Now' button and choose your preferred subscription plan. Registration is required to access the complete library.

- Complete your payment using a credit card or PayPal, and then download your form directly to your device.

- Access your downloaded templates anytime through the 'My Forms' section in your profile for easy completion.

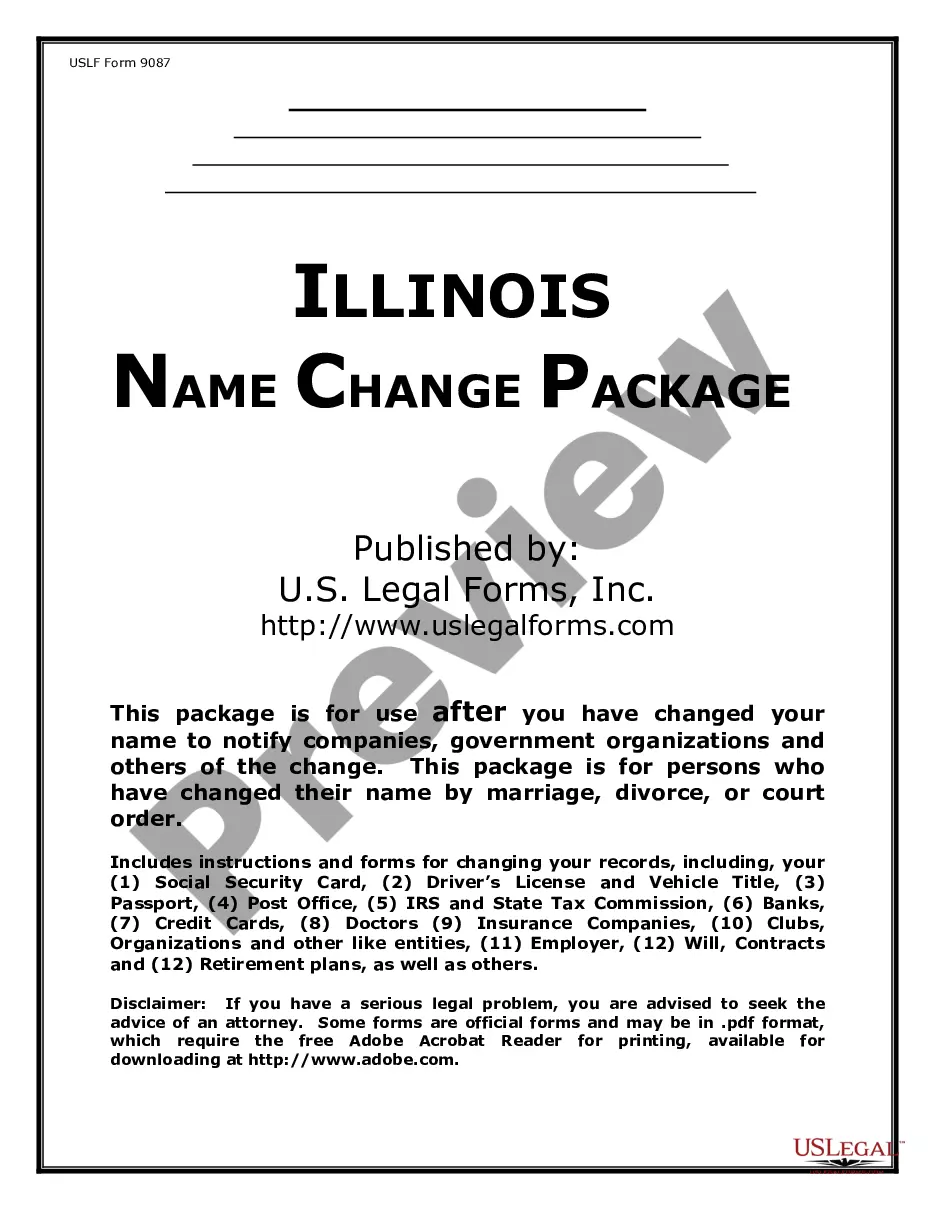

US Legal Forms empowers users with a robust collection of over 85,000 legal documents, making it simpler to find exactly what you need. Their platform ensures that both individuals and professionals can execute documents that are precise and tailored to their needs.

Start leveraging US Legal Forms to enhance your legal documentation experience today! Don’t hesitate to explore the available resources that guarantee accuracy and peace of mind.

Form popularity

FAQ

To establish a spendthrift trust, certain legal requirements must be met, including clear language in the trust document that indicates the spendthrift nature. The trust must have a designated trustee to manage the assets responsibly. Additionally, it should specify the beneficiaries and the rules for fund distribution. For detailed guidance, utilizing a spendthrift trust sample for customer support can provide insights into these necessary elements.

A common provision in a spendthrift trust prevents beneficiaries from transferring their interest in funds or using them as collateral. This means creditors cannot claim these assets, giving beneficiaries peace of mind. For a more concrete understanding, looking at a spendthrift trust sample for customer support can illustrate how such provisions work. It effectively illustrates the trust’s purpose and provides a practical framework.

While spendthrift trusts offer protection, they come with some drawbacks. Beneficiaries may not have immediate access to their funds, as the trust controls distribution. This setup can cause frustration if beneficiaries face an urgent financial need. To weigh the pros and cons properly, consider reviewing a spendthrift trust sample for customer support that lays out these factors clearly.

Creating a spendthrift trust allows individuals to protect assets from creditors while providing controlled access to beneficiaries. This type of trust helps safeguard the inheritance of vulnerable beneficiaries against their own financial mismanagement. With a spendthrift trust sample for customer support, you can see how easy it is to secure your loved ones’ financial future. It promotes responsible financial behavior while providing necessary funds.

Generally, the IRS cannot attach a spendthrift trust’s assets to satisfy a beneficiary's debts. This feature protects trust assets from creditors, allowing beneficiaries to manage their inheritance responsibly. However, there are exceptions, especially concerning tax obligations. For further clarity and examples, consider exploring a spendthrift trust sample for customer support through our platform.

Setting up a trust fund on your own is possible but may require extensive knowledge about legal requirements and financial implications. Many individuals opt for guidance to ensure the trust meets legal standards and effectively fulfills their goals. By consulting a spendthrift trust sample for customer support, you can access resources and templates that simplify the process of creating a trust fund, whether you choose to go solo or seek assistance.

Yes, you can create a spendthrift trust for your own benefit, allowing you to manage your assets while limiting access to ensure financial stability. However, it is crucial that you appoint an independent trustee to uphold the trust's integrity and compliance with its terms. A spendthrift trust sample for customer support can provide insights and templates to help you establish this arrangement properly.

Filling out a trust fund typically begins with selecting a trustee and beneficiaries, as well as documenting the assets that will be included. You must ensure the trust document accurately outlines the terms and conditions for asset distribution. Utilizing a spendthrift trust sample for customer support can streamline this process, providing clear templates and steps to guide you through the necessary paperwork.

One major mistake parents often make is failing to clearly define the terms and purpose of the trust fund. They may overlook specific guidelines that direct how the assets should be used or distributed, which can lead to misunderstandings among beneficiaries. A detailed spendthrift trust sample for customer support can help parents ensure they set up their trusts effectively, safeguarding their assets for intended use.