Discharge Garnishment With A Bank Statement

Description

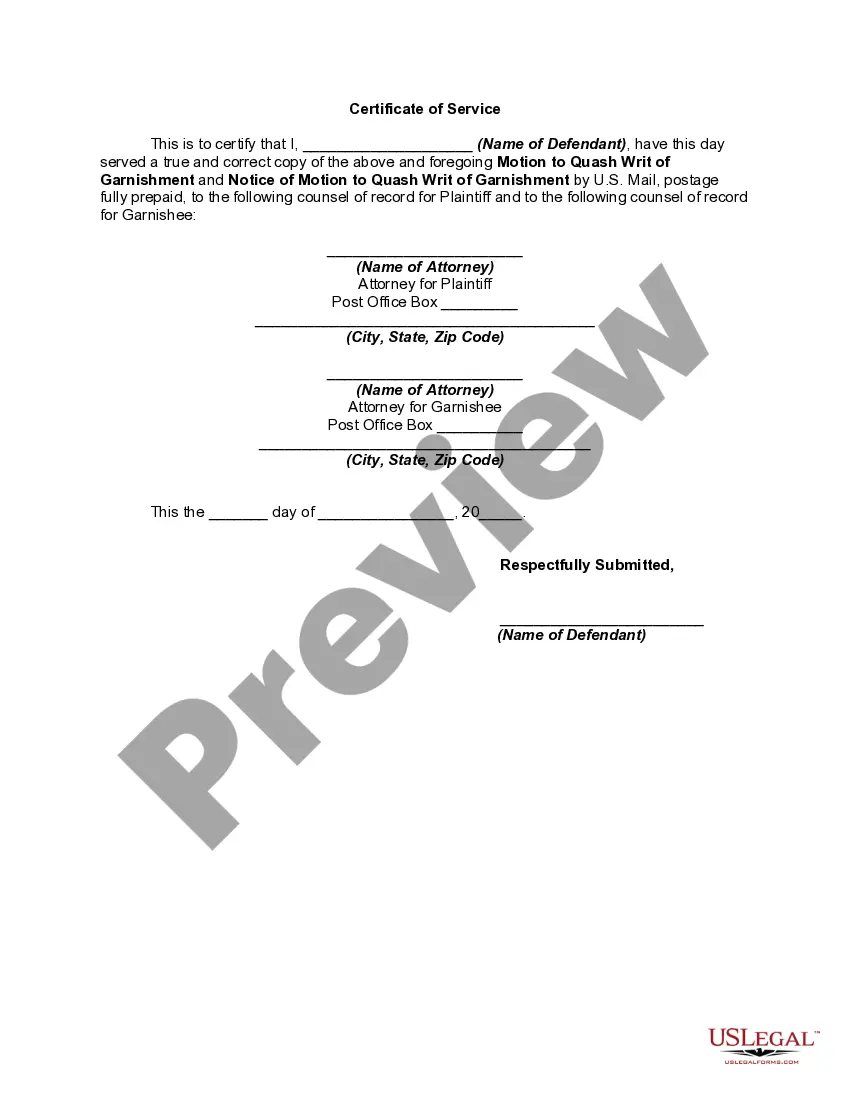

How to fill out Motion Of Defendant To Discharge Or Quash Writ Of Garnishment For Failure To Serve Copy Of Writ On Defendant And Notice Of Motion?

- If you have previously used US Legal Forms, log in to your account and download the appropriate form template by clicking the Download button. Ensure your subscription is active; renew it as necessary.

- For first-time users, start by checking the Preview mode and description of the forms available. Verify that you have selected the document that fits your needs and complies with local regulations.

- If the form does not meet your requirements, utilize the Search tab at the top to look for alternative templates. Once you find the correct one, proceed to the next step.

- Purchase the document by clicking the Buy Now button and selecting your preferred subscription plan. You will need to register an account to gain full access to the library.

- Complete your purchase by entering your credit card information or selecting your PayPal account for secure payment.

- Download the form to save it to your device for completion. You can also access your documents anytime from the My Forms section of your profile.

In conclusion, leveraging US Legal Forms streamlines the process of discharging a garnishment with a bank statement, providing a wealth of easily accessible legal resources. With professional support available, you can ensure that your documents are both accurate and compliant.

Start your journey with US Legal Forms today and simplify your legal needs!

Form popularity

FAQ

To open a bank account that cannot be garnished, look for banks that offer security features suitable for your needs, such as protected accounts or accounts designed for benefits. Research your state’s laws regarding exempt funds and accounts. Use this information to ensure you create a safe banking environment. You might also consider discussing your situation with a financial advisor to help you discharge garnishment with a bank statement effectively.

To protect your bank account from garnishment, consider setting up an exempt account. Some states allow certain types of accounts, like retirement or benefits accounts, to be shielded from creditors. Additionally, keep accurate documentation to prove your account's funds are exempt, such as a discharge garnishment with a bank statement. Regularly review your financial status to understand your protections.

To write a hardship letter to stop a garnishment, start by explaining your financial situation clearly. Describe how the garnishment affects your ability to meet essential expenses like rent, utilities, and food. Highlight any specific hardships you face, and mention how you plan to resolve the situation. Finally, express your request to discharge the garnishment with a bank statement as proof of your current financial state.

Garnishment can be seen as both good and bad, depending on your perspective. For creditors, it is a way to ensure they receive owed funds. However, for debtors, garnishment often leads to financial hardship. It's important to explore options to discharge garnishment with a bank statement, as this can help you navigate the effects of garnishment on your financial health.

A garnishment on a bank account is a legal procedure where a creditor can seize funds from your account to settle a debt. This typically occurs after a court has granted approval to the creditor. Understanding this process can help you protect your assets. Additionally, knowing how to discharge garnishment with a bank statement can be beneficial in managing your financial situation.

Yes, a garnishment can be taken from your bank account. When a creditor obtains a court order, they can access funds directly from your account. This process can create financial strain, so it's crucial to understand your rights. You might consider ways to discharge garnishment with a bank statement to regain control of your finances.

To stop your bank account from being garnished, you may need to negotiate with the creditor or seek a legal remedy. Filing for bankruptcy can also halt garnishments temporarily or permanently. Utilize resources like US Legal Forms to understand your options and learn how to discharge garnishment with a bank statement effectively.

Yes, wages can be garnished without prior service in some circumstances. If a creditor has obtained a judgment against you, they may initiate the garnishment process without personally notifying you beforehand. It’s crucial to be proactive if facing potential garnishments and explore options to discharge garnishment with a bank statement.

While it’s difficult to hide a bank account from garnishment legally, some individuals may choose to keep funds in specific types of accounts that are exempt from such actions. Strategies may include using retirement accounts or joint accounts. Always consider consulting a legal expert to help you discharge garnishment with a bank statement and protect your assets.

To find out who garnished your bank account, you can contact your bank and request details about the transaction or garnishment notice. Additionally, reviewing court records can provide you with the information you need. Understanding the process can help you discharge garnishment with a bank statement more effectively.