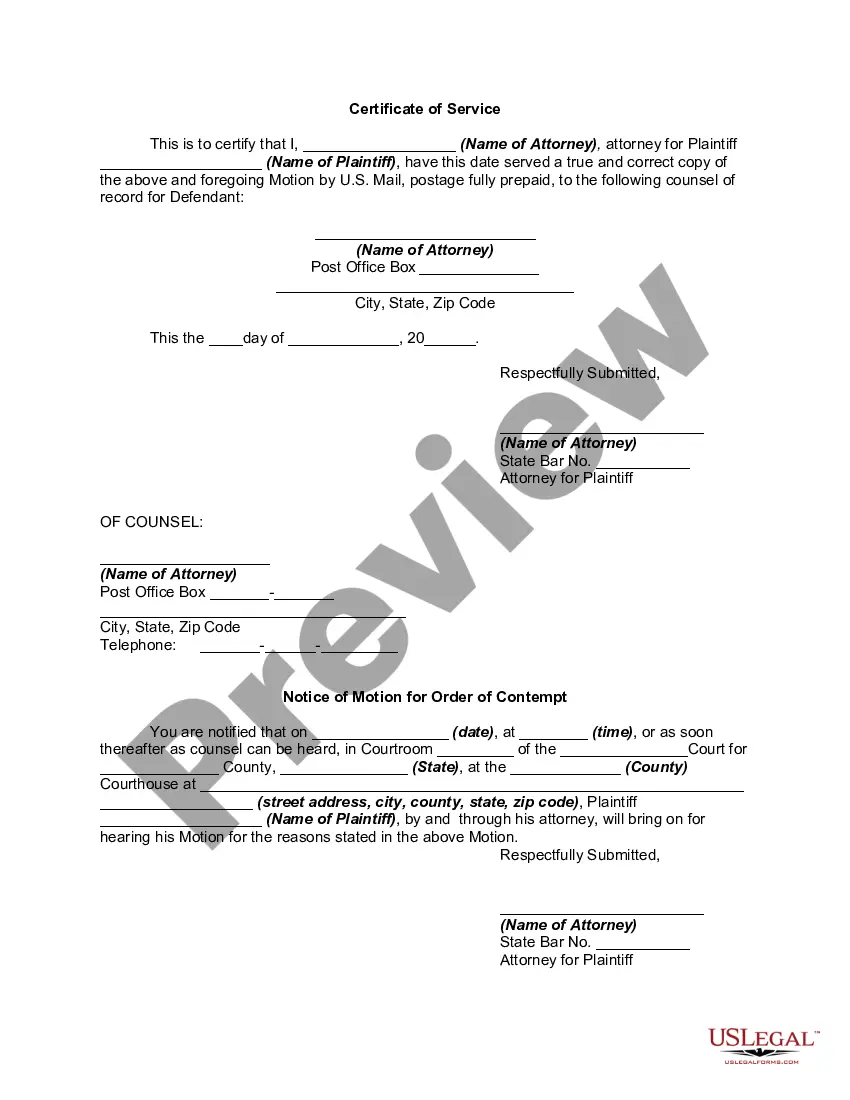

Contempt Motion Order Form California

Description

How to fill out Motion For An Order Of Contempt For Violation Of Injunction?

It’s well-known that you cannot become a legal authority in a short span of time, nor can you easily understand how to swiftly create a Contempt Motion Order Form California without possessing a unique set of capabilities.

Drafting legal documents is a lengthy endeavor necessitating specific training and expertise. Therefore, why not entrust the creation of the Contempt Motion Order Form California to qualified professionals.

With US Legal Forms, which boasts one of the largest legal document collections, you can find everything from court papers to templates for internal communication.

If you need any other template, start your search anew.

Create a no-cost account and select a subscription plan to acquire the form. Click Buy now. Once the payment is finalized, you can download the Contempt Motion Order Form California, complete it, print it, and forward it to the appropriate individuals or organizations. You can revisit your documents from the My documents tab anytime. If you are an existing customer, you can simply Log In and locate and download the template from the same section. Regardless of the reason for your paperwork—be it financial, legal, or personal—our site has everything you need. Explore US Legal Forms today!

- Recognize how crucial compliance and adherence to federal and state regulations are.

- Thus, on our platform, every form is tailored to specific locations and is current.

- Here’s how to begin with our site and acquire the document you need within moments.

- Locate the form you require using the search function at the top of the site.

- Examine it (if this feature is available) and review the accompanying description to determine if the Contempt Motion Order Form California is what you seek.

Form popularity

FAQ

The fee to file the Certificate is $200 and you will receive a stamped ?Filed? copy of your submitted document.

To revive a Delaware LLC, you'll need to file the Certificate of Revival with the Delaware Division of Corporations. You'll also have to fix the issues that led to your Delaware LLC's dissolution and pay any owed taxes.

To revive your voided corporation in Delaware, you must provide the completed Certificate of Renewal and Revival of Charter for a Voided Corporation form to the Department of State by mail, fax or in person, along with the filing fee and all back taxes and penalties.

When an entity has failed to pay their yearly taxes or maintain a Registered Agent, it may fall into a status other that good standing. To return your entity back into a good standing status, the Delaware Code requires that certain documents be filed and all back taxes and filing fees paid.

It is advisable to formally cancel a Delaware LLC if the company has ever been used in any capacity. The LLC will continue to accrue Delaware franchise tax year after year if the company is not properly canceled. The public cancellation filing stops the LLC from accruing future franchise tax, penalties, and interest.

The Division of Revenue links for online filing options are available at . Electronic filing is fast, convenient, accurate and easy. When completing a form electronically, please download the form prior to completing it to obtain the best results.

To revive your voided corporation in Delaware, you must provide the completed Certificate of Renewal and Revival of Charter for a Voided Corporation form to the Department of State by mail, fax or in person, along with the filing fee and all back taxes and penalties.

The 2022 Form 1100 is used to report your Delaware corporate income tax for calendar year 2022 or fiscal year beginning in 2022 and ending in 2023. If the corporation conducts business on a fiscal year basis, insert the beginning and ending dates of the fiscal year in a MM/DD/YY format.