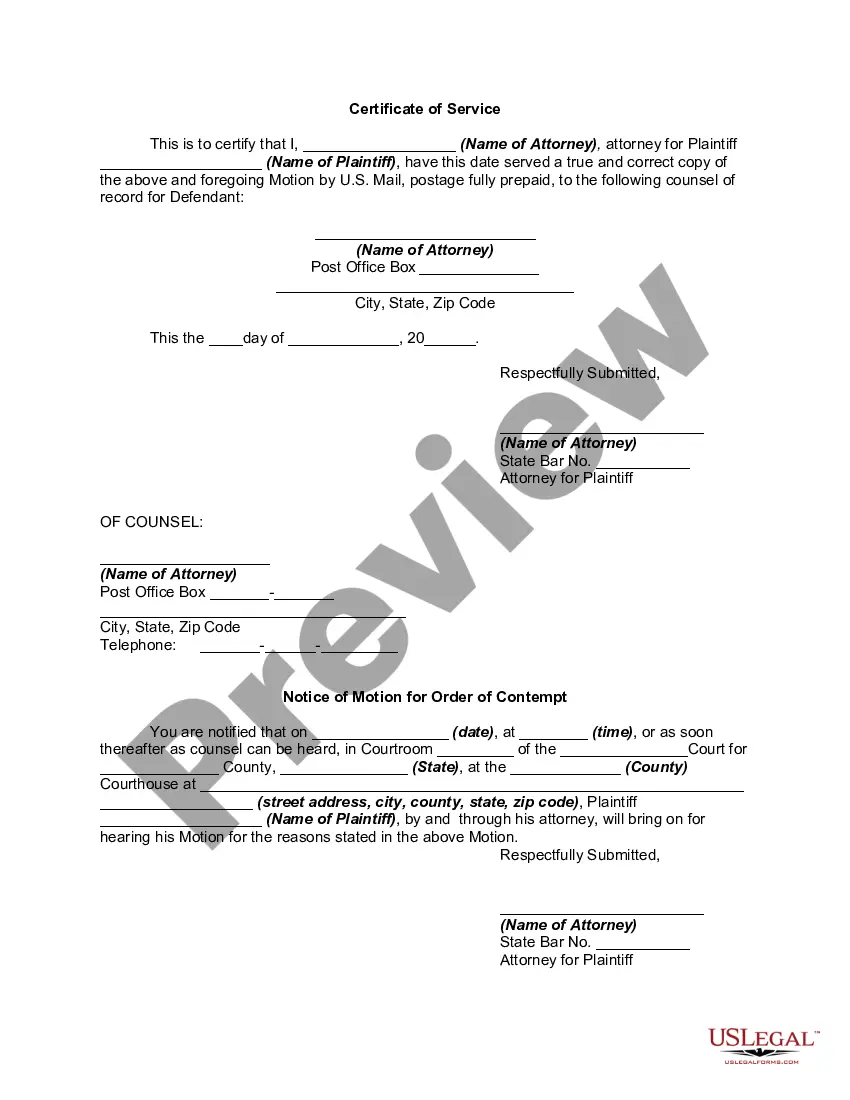

Contempt Motion Order For Child Support

Description

How to fill out Motion For An Order Of Contempt For Violation Of Injunction?

Legal administration can be daunting, even for proficient experts.

When seeking a Contempt Motion Order For Child Support and lacking the opportunity to invest in finding the correct and current version, the processes can be taxing.

Access a valuable resource database of articles, guides, and manuals relevant to your circumstances and requirements.

Save time and energy searching for the documents you require, and take advantage of US Legal Forms’ sophisticated search and Preview feature to locate Contempt Motion Order For Child Support and obtain it.

Ensure that the template is recognized in your state or county. Select Buy Now when you are ready. Choose a subscription plan. Select the file format you require, and Download, complete, eSign, print, and send your documents. Leverage the US Legal Forms online library, supported by 25 years of experience and reliability. Transform your daily document management into a seamless and user-friendly process today.

- If you possess a monthly subscription, Log In to your US Legal Forms account, look for the form, and acquire it.

- Examine your My documents section to view the documents you previously downloaded and manage your folders as needed.

- If it's your initial experience with US Legal Forms, create an account and gain unlimited access to all the platform's benefits.

- Here are the actions to follow after downloading the needed form.

- Verify it is the correct form by previewing it and reviewing its details.

- Access state- or county-specific legal and organizational forms.

- US Legal Forms meets any requirements you may have, from personal to business documents, in one location.

- Utilize advanced tools to complete and manage your Contempt Motion Order For Child Support.

Form popularity

FAQ

How much does a Delaware Certificate of Good Standing cost? To register as a Delaware Corporation. $50 for normal processing. $1,000 for Priority 1 expedited processing.

PROCESSING FEES: $205 To dissolve, withdraw or cancel a Delaware company, you must submit the appropriate documentation along with all required fees for your type of business. A company must be in good standing before the dissolution, withdrawal or cancellation can be processed.

The filing fee for filing an Annual Report or Amended Annual Report for exempt domestic corporations is $25. For an Annual Report or Amended Annual Report for non-exempt domestic corporations the filing fee is $50. Taxes and Annual Reports are to be received no later than March 1st of each year.

Do bylaws need to be signed? While Delaware statutes do not explicitly state that bylaws need to be signed, including the names and signatures of all board members and officers adds to your corporation's legitimacy. Signing bylaws is standard practice.

Delaware corporate bylaws are not on the public record. This document doesn't need to be submitted to the state of Delaware. Instead corporate bylaws should remain on record internally, where they can be modified over time as the business evolves.

The Delaware Franchise Tax is $300 per year, due on June 1. This annual $300 Delaware LLC fee is standard protocol for every LLC, regardless of its age, gross sales, activity or periods of inactivity.

The filing fee for a Delaware Certificate of Revival is $200. You'll also have to pay any overdue taxes, including the franchise tax ($300 per year) plus the late penalty ($200) and any interest accrued.

To revive your voided corporation in Delaware, you must provide the completed Certificate of Renewal and Revival of Charter for a Voided Corporation form to the Department of State by mail, fax or in person, along with the filing fee and all back taxes and penalties.