Abatement Contracts For Sale

Description

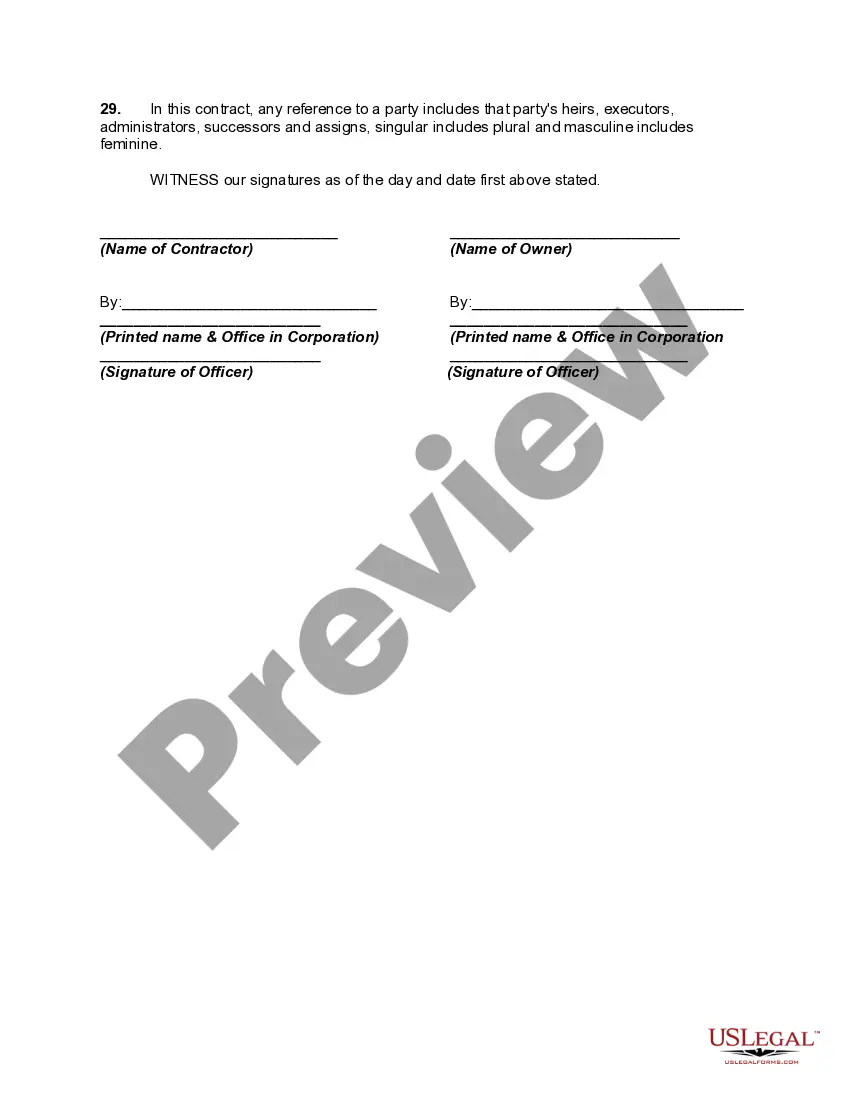

How to fill out Asbestos Removal And Remediation Agreement?

- If you're a returning user, log in to your account and download the required contract template instantly.

- If it's your first time, start by reviewing the Preview mode and form description to ensure you select the appropriate template that meets your jurisdiction's standards.

- Search for additional templates if necessary. If you find discrepancies, use the Search tab to locate the correct document.

- To purchase the desired document, click on the Buy Now button and choose a subscription plan that suits your needs. You will need to create an account to access the library.

- Complete your transaction by entering your credit card information or using your PayPal account for payment.

- Finally, download your document. Once saved on your device, you can access it anytime through the My Forms section of your profile.

By using US Legal Forms, you'll benefit from an extensive library of over 85,000 editable legal forms, ensuring you have access to more templates than competitors without breaking the bank.

Make the smart choice and streamline your legal document process today. Start with US Legal Forms to experience the easy and efficient way to manage your legal needs!

Form popularity

FAQ

An abatement agreement is a legal document that outlines the terms under which a party agrees to reduce or eliminate a tax obligation, generally in response to specific criteria being met. This agreement can effectively make financial obligations more manageable for property owners or taxpayers. By using abatement contracts for sale, individuals can gain clarity and guidance on how these agreements work and their potential benefits. Always consult a legal professional to ensure compliance and understanding.

To file an abatement with the IRS, you will first need to complete the necessary forms, specifically Form 843, which allows you to request an abatement of taxes. Make sure to provide thorough documentation to support your request, as the IRS typically requires solid evidence for approval. Once your form is completed, you can submit it to the appropriate IRS address based on your location. Utilizing abatement contracts for sale can also aid in understanding and streamlining this process.

The abatement process usually starts with a property owner identifying eligibility based on local guidelines. Following this step, the owner submits the appropriate application, which may go through a review process before approval. Once granted, the property owner must comply with any conditions to continue benefiting from the abatement. Familiarizing yourself with abatement contracts for sale through uslegalforms can provide great insight into navigating this journey.

To apply for tax abatement, you typically need to submit a formal application to your local tax authority. This application often requires documentation supporting your request, such as proof of property improvements or financial hardship. Engaging with the right forms can streamline this process, especially with tools offered by uslegalforms, guiding you effectively through abatement contracts for sale.

Abatement works by allowing property owners to reduce or eliminate certain taxes for a specified period. The local government usually approves these measures to encourage property improvements or development. When examining abatement contracts for sale, it is crucial to understand the limitations and benefits to make informed decisions. Use resources like uslegalforms for guidance through these contracts.

When a property is in abatement, it generally means that the property owner has been granted a temporary reduction in their tax obligations. This can occur due to various factors like renovations, compliance issues, or financial hardship. Properties in abatement can represent valuable opportunities, especially when considering abatement contracts for sale. Make sure to research the property’s status carefully.

Abatement rules vary by jurisdiction, but they typically set conditions that must be met to qualify for an abatement. These conditions often include property use, duration of ownership, and payment of taxes on the property. Understanding these rules is essential if you want to navigate the world of abatement contracts for sale successfully. Consulting with uslegalforms can help simplify this process.

Among the downsides of tax abatement are potential confusion about future tax obligations and the risk of over-reliance on reduced taxes. Once the abatement period ends, property owners may face sudden tax hikes that impact their finances. Understanding these aspects is essential when navigating the landscape of abatement contracts for sale.

Filling out an abatement form involves gathering relevant property information and accurately completing each section of the application. Be sure to include details about property usage, ownership, and why you qualify for the abatement. For a streamlined experience, consider utilizing platforms like uslegalforms to guide you through the process and ensure all necessary documentation is submitted.

Buyers should know about a property's tax abatement status to understand potential future costs. A current abatement might mean lower expenses in the short term, but it’s crucial to recognize that these contracts have expiration dates. Understanding these aspects allows buyers to make informed decisions regarding their investments and financial planning.