Escrow Taxes In Texas

Description

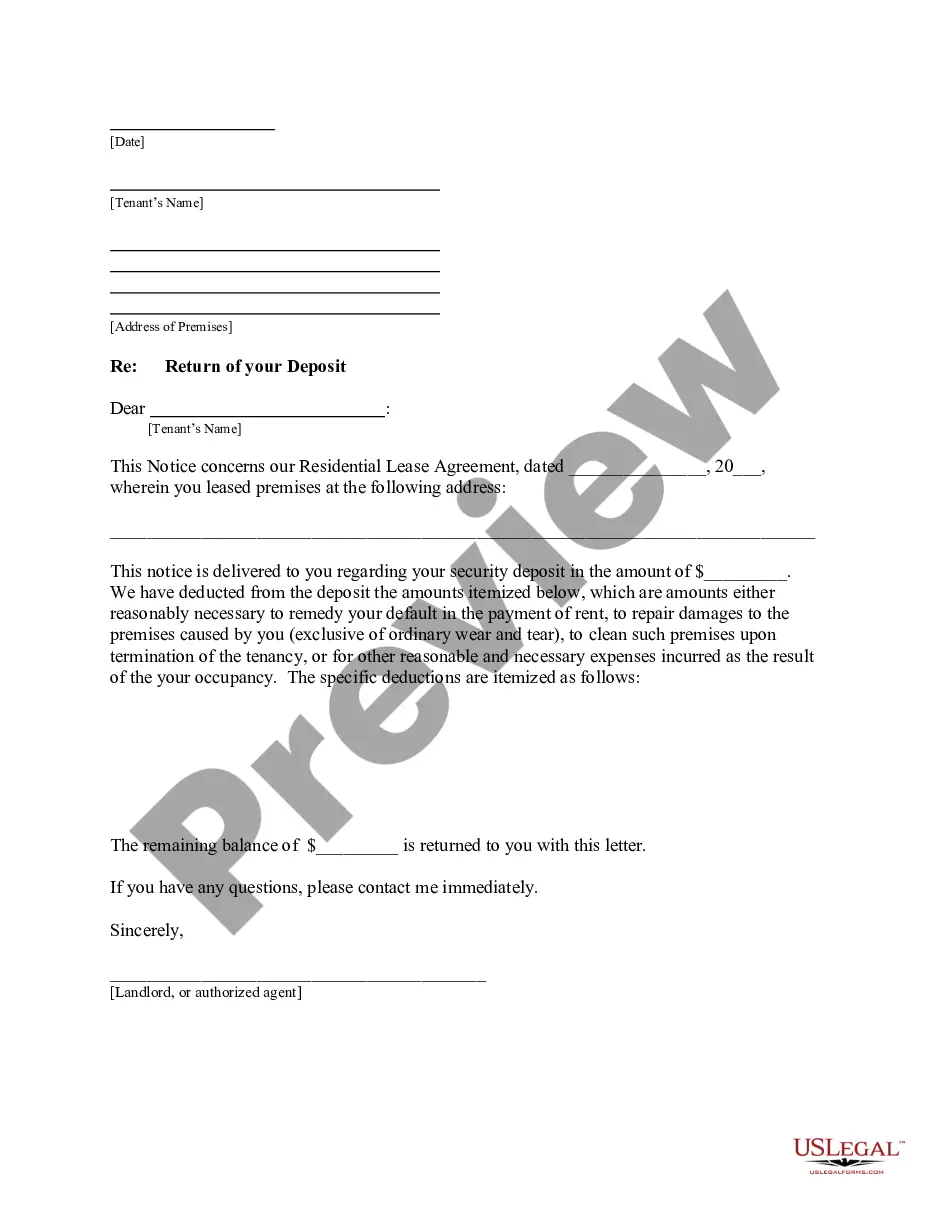

How to fill out Agreement For Direct Payment Of Taxes, Assessments, And/or Insurance And Waiver Of Escrow To Be Held By Lender?

It’s clear that you cannot instantly become a legal authority, nor can you quickly learn how to draft Escrow Taxes In Texas without a specialized background.

Producing legal documents is a lengthy process that requires a particular education and expertise.

So why not entrust the drafting of the Escrow Taxes In Texas to the professionals.

Preview it (if this option is available) and review the accompanying description to see if Escrow Taxes In Texas is what you’re looking for.

If you need a different template, begin your search anew.

- With US Legal Forms, one of the most comprehensive legal document repositories, you can discover anything from judicial documents to templates for internal business communication.

- We recognize how vital compliance and adherence to federal and local statutes and regulations are.

- That’s why, on our platform, all forms are location-specific and current.

- Here’s how to start with our platform and obtain the document you need in just minutes.

- Find the form you require using the search bar at the top of the page.

Form popularity

FAQ

In Texas, escrowing property taxes is not a legal requirement, but many lenders prefer it. By choosing to escrow, you allow your lender to manage tax payments on your behalf, reducing the risk of late fees. This arrangement can provide peace of mind, knowing that your escrow taxes in Texas are handled efficiently. If you're considering this option, platforms like US Legal Forms can help you understand your rights and responsibilities.

To claim escrow on taxes, you need to understand the process that involves your mortgage lender. First, gather your tax documents and any relevant escrow account statements. Next, contact your lender to request a review of your escrow account, ensuring they have accurately accounted for your property taxes. Once verified, you can claim any excess funds when your escrow taxes in Texas exceed the required amount.

The new law in Texas focuses on providing property tax relief to homeowners by limiting the amount taxes can increase each year. This legislation aims to make housing more affordable and predictable for residents. Staying informed about these changes is crucial, as they can impact your escrow taxes in Texas, especially regarding how much you need to set aside in your escrow account.

Yes, you may be able to remove the escrow from your mortgage in Texas, but this usually requires a formal request to your lender. You will need to demonstrate that you meet specific criteria, such as having a good payment history and sufficient equity in your home. Removing escrow can give you more control over your finances, but remember that you will need to manage your property taxes in Texas independently.

In Texas, escrow is calculated based on your annual property taxes and homeowners insurance premiums. Your lender estimates these costs and divides the total by 12 to determine your monthly escrow payment. It’s important to review your escrow account regularly to ensure that the calculations remain accurate, especially considering changes in property taxes in Texas.

Yes, you can waive escrows in Texas under certain conditions. Typically, this option is available when you have a significant amount of equity in your home or if your mortgage lender allows it. However, keep in mind that waiving escrow means you will be responsible for paying your property taxes directly. It is essential to weigh the pros and cons before making this decision, especially regarding escrow taxes in Texas.

Your lender will likely escrow for them at closing, and while the buyer is generally only responsible for a small cushion of the taxes in their escrow, the exact amount is dependent on how closing costs, property taxes, and other fees are calculated.

How does an escrow account work? To set up your mortgage escrow account, the lender will calculate your annual tax and insurance payments, divide the amount by 12 and add the result to your monthly mortgage statement.

Escrow accounts are valid for the duration of your mortgage, regardless of the term of the loan. Once the mortgage is paid off, your escrow account will be closed. If this is the case, the municipality will send tax bills directly to you as you will have to pay them even after your mortgage is paid off.