Escrow Agent

Description

How to fill out Escrow Agreement For Sale Of Real Property And Deposit To Protect Purchaser Against Cost Of Required Remedial Action?

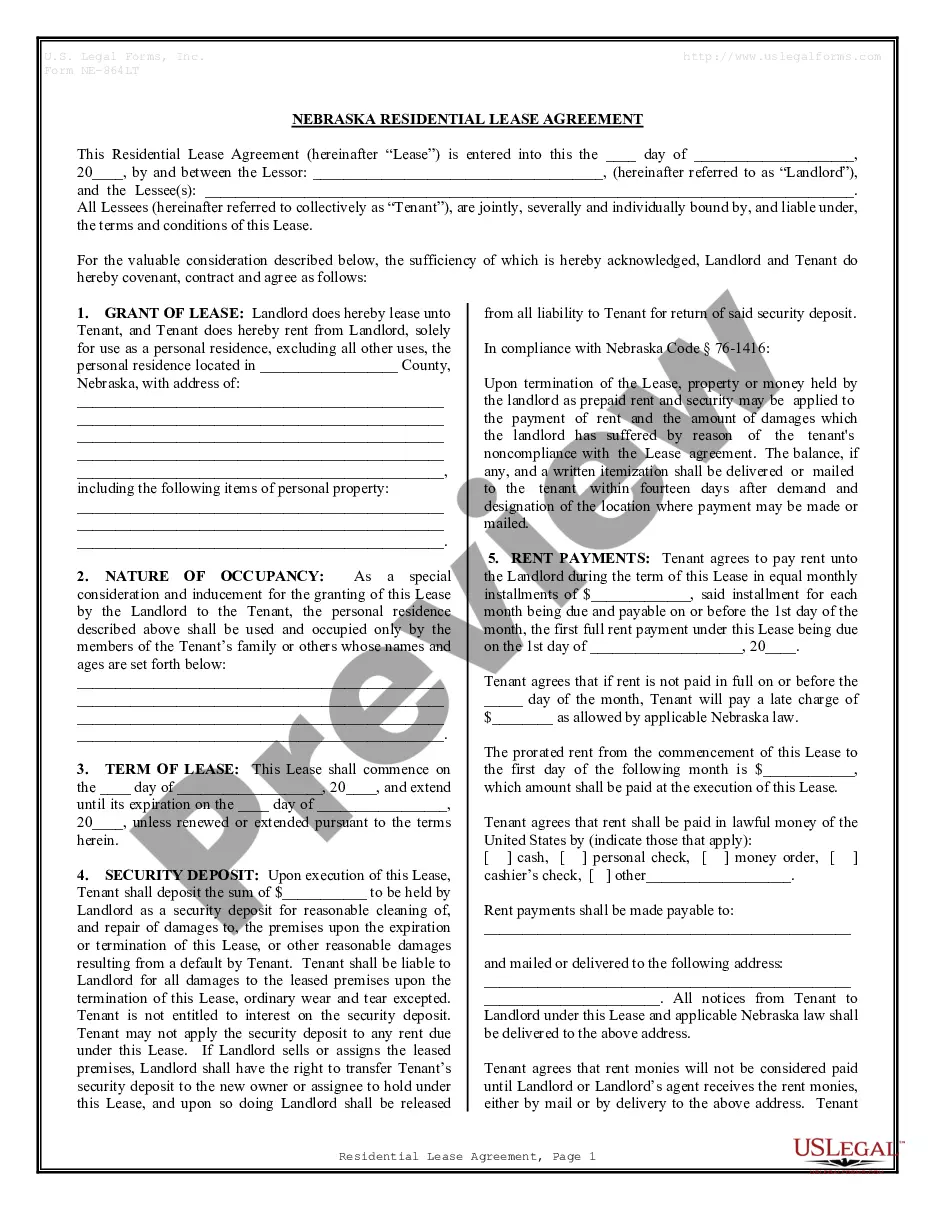

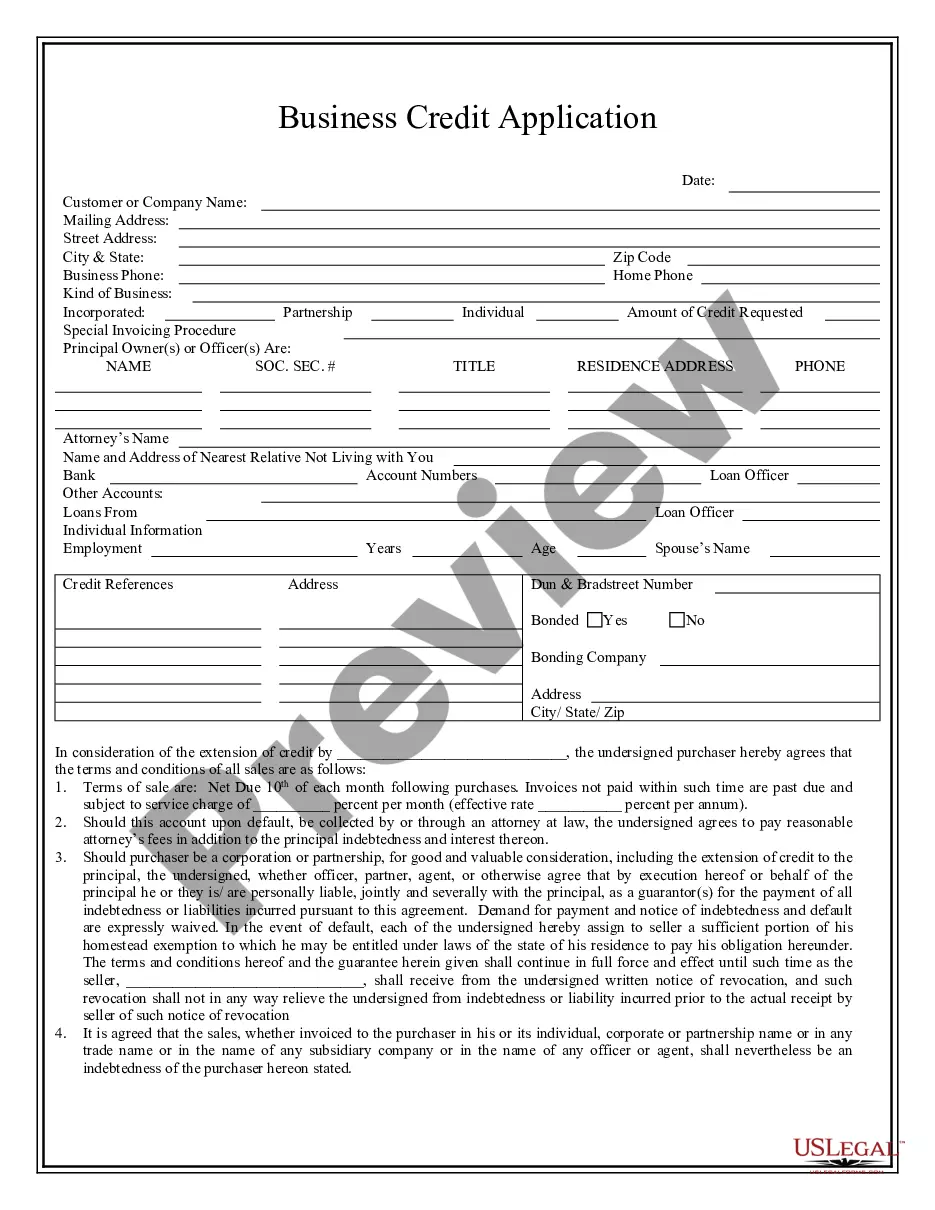

- If you're an existing user, log in to your account to access the form templates. Ensure your subscription is active; renew if necessary.

- Review the Preview mode and form descriptions carefully to confirm that the chosen document meets your local legal requirements.

- If the current document isn’t suitable, utilize the Search tab to find an alternative that fits your needs.

- Proceed to purchase the document by clicking the Buy Now button and selecting your preferred subscription plan; create an account if you're a new user.

- Complete the payment using your credit card or PayPal account, and finalize the transaction.

- Download the template onto your device for future reference and completion, accessible anytime in the My Forms section of your profile.

Using US Legal Forms empowers you to access a vast library of over 85,000 fillable legal documents, which is significantly larger than many competitors.

With premium expert assistance at your disposal, you can ensure that your documents are completed accurately and comply with legal standards. Start using US Legal Forms today to streamline your legal documentation process!

Form popularity

FAQ

The escrow agent should be someone who is impartial and trusted by both the buyer and the seller. It is advisable to choose an escrow agent with experience and a solid reputation in handling similar transactions. You want to ensure that they are knowledgeable about local laws and procedures. At US Legal Forms, we can help you find the right escrow agent who meets your specific requirements.

Your escrow agent is a neutral party that handles the transaction of your property. They are usually appointed at the start of closing and ensure that all conditions of the contract are met before the transaction is finalized. It's important to communicate openly with your escrow agent so that they can effectively manage your transaction. If you need assistance in identifying your escrow agent, check out US Legal Forms for guidance.

Selecting the escrow agent is typically the buyer's responsibility, but it can also be a joint decision made with the seller. This choice is vital, as the escrow agent plays a crucial role in managing funds and documents during the transaction. You should consider the reputation and reliability of the escrow agent you select. At US Legal Forms, we provide resources to help you find a qualified escrow agent for your needs.

To avoid escrow fees, you can negotiate these costs with the other party involved in the transaction. Additionally, you might consider opting for a private agreement or using a service that allows for direct exchanges. However, remember that having an escrow agent often provides added security. Platforms like US Legal Forms can help you find options that may reduce costs while ensuring transaction safety.

The primary purpose of an escrow agent is to act as a safeguard in financial transactions. They hold onto funds and documents, ensuring that both parties meet their obligations before the final transfer occurs. This adds an extra layer of security and trust in real estate deals or other significant financial transactions. An effective escrow agent can facilitate a smooth transaction process while protecting everyone's interests.

The escrow agent is usually a neutral third party, often a title company or a real estate attorney. Their role is to manage the funds and documents until all conditions of the sale are met. This ensures that both the buyer and seller fulfill their obligations before the transaction is completed. Choosing a knowledgeable escrow agent can enhance the security of your transaction.

Choosing the right escrow agent is crucial for a smooth transaction. First, consider their experience in handling similar transactions and check reviews from past clients. Additionally, ensure they have the necessary certifications and licenses. Using a trusted platform like US Legal Forms can connect you with reputable escrow agents, simplifying your selection process.

Escrow fees refer to the costs associated with the services provided by an escrow agent. These fees cover the handling of funds and documents in a transaction. Typically, the seller and buyer share these costs, depending on the agreement. Understanding these fees helps you prepare for the overall expenses involved in your transaction.

To fund an escrow account, you will typically wire funds directly to the escrow agent, following the agreed-upon instructions. Ensure that you have a clear understanding of the total amount required, as well as any fees associated with the process. After the funds are deposited, the escrow agent will confirm receipt and manage the funds until the transaction is complete. Using US Legal Forms can help streamline this process with additional resources and templates.

In New York, an escrow agent can be an attorney, an accountant, or a licensed real estate broker. They must have a thorough understanding of the escrow process and relevant laws. It is crucial to choose a qualified escrow agent to ensure a smooth and legal transaction. You can also consider using a reputable platform like US Legal Forms for guidance.