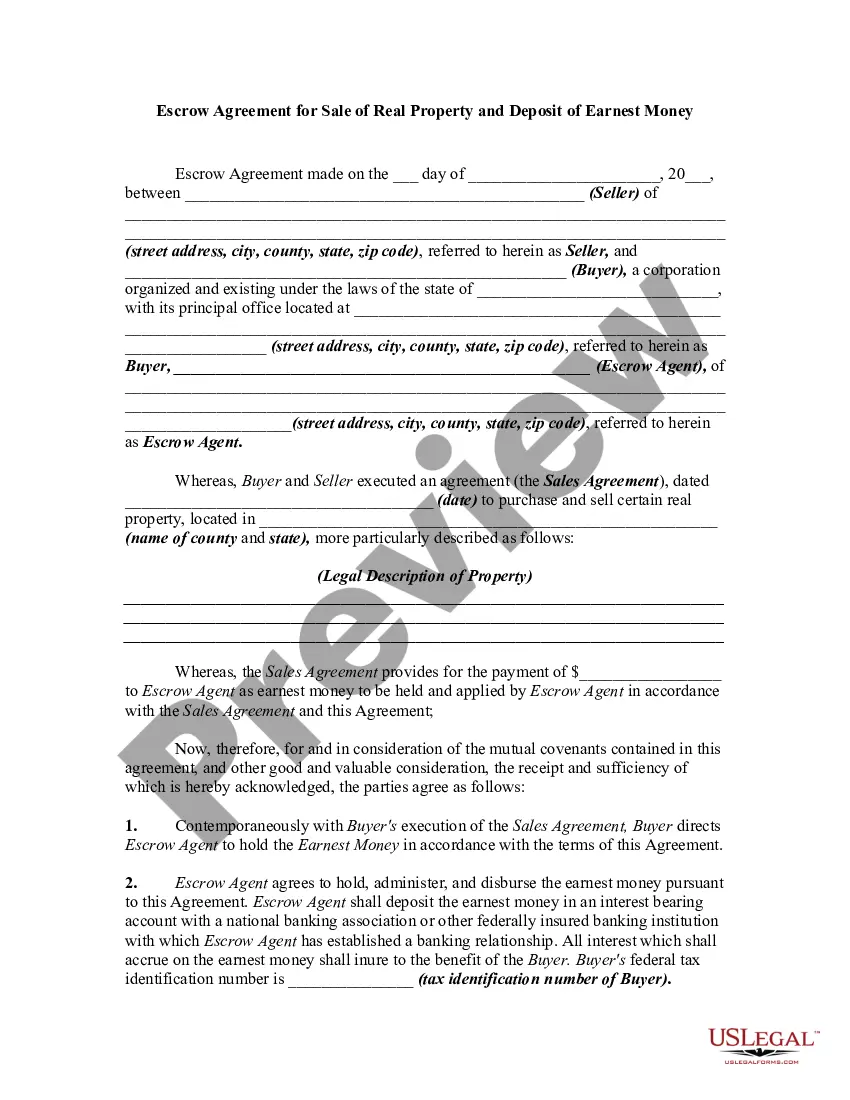

Escrow Account In Real Estate Definition

Description

How to fill out Escrow Agreement For Sale Of Real Property - Deposit Of Estimated Purchase Prices?

It’s well known that you cannot transform into a legal expert in a day, nor can you swiftly comprehend how to prepare the Escrow Account In Real Estate Definition without having a tailored expertise.

Drafting legal documents is a labor-intensive endeavor that necessitates specific training and abilities. Therefore, why not entrust the development of the Escrow Account In Real Estate Definition to the experts.

With US Legal Forms, one of the most extensive collections of legal templates, you can access a wide range of materials from court filings to formats for internal business communication. We recognize how vital compliance and conformity to federal and state regulations are. Consequently, all forms on our platform are tailored to specific locations and remain current.

You can retrieve your documents from the My documents tab at any time. If you are an existing customer, you can simply Log In and find and download the template from the same section.

Regardless of the intention behind your documents—whether it's financial, legal, or personal—our platform has you covered. Experience US Legal Forms today!

- Locate the form you require by utilizing the search bar at the top of the webpage.

- Examine it (if this feature is available) and review the accompanying description to ascertain whether the Escrow Account In Real Estate Definition meets your needs.

- If you need a different template, begin your search anew.

- Create a complimentary account and select a subscription plan to purchase the template.

- Click Buy now. Once the transaction is completed, you can download the Escrow Account In Real Estate Definition, fill it out, print it, and send or mail it to the specified individuals or entities.

Form popularity

FAQ

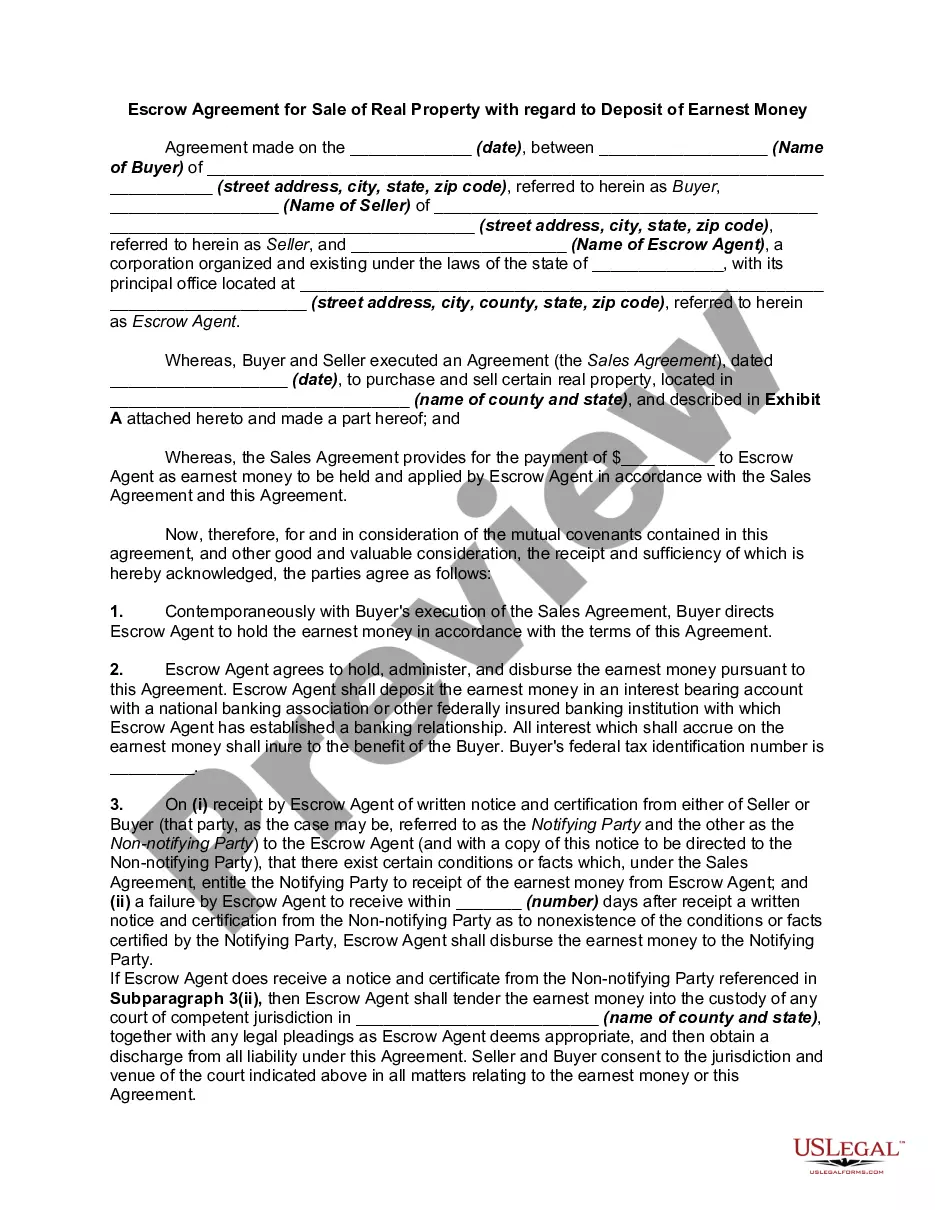

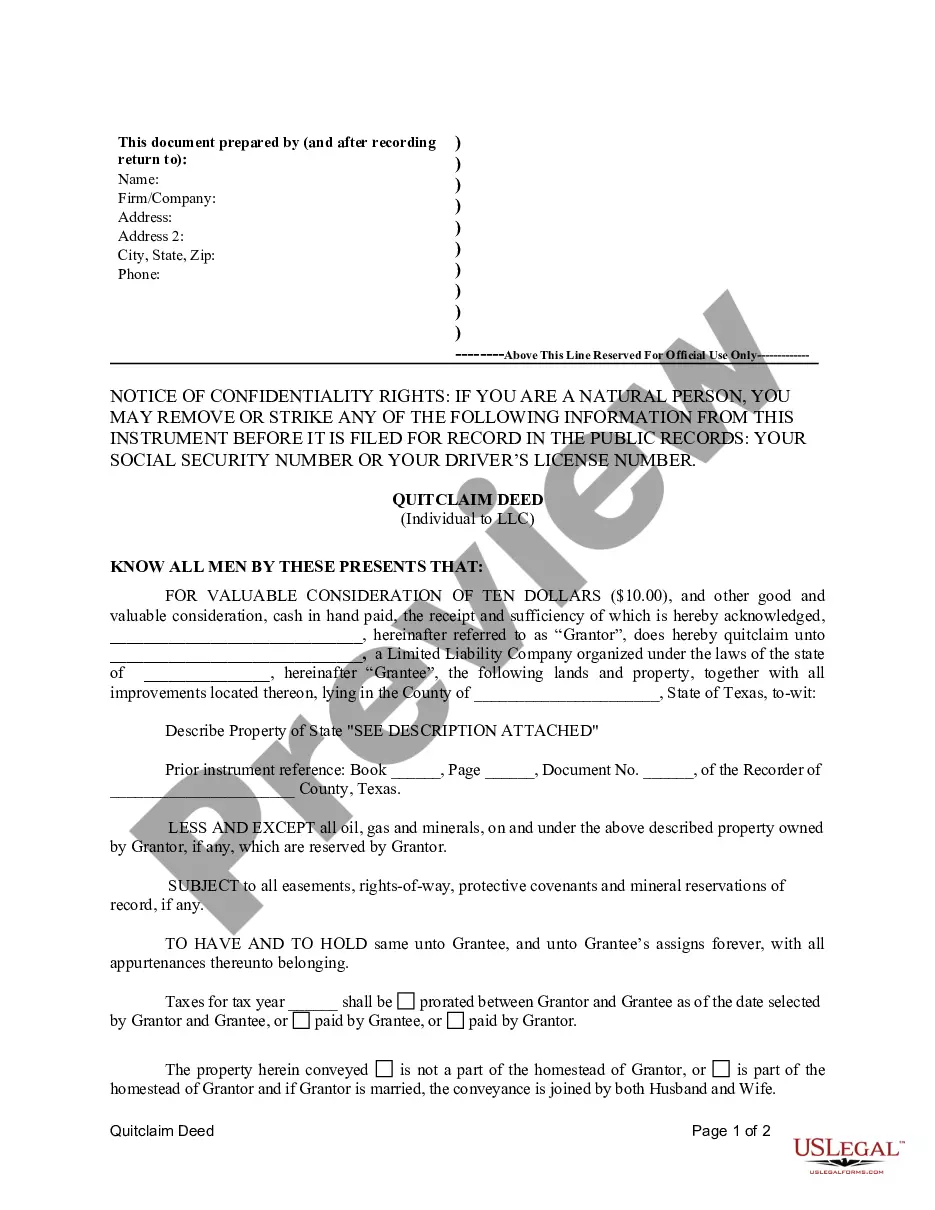

To get an escrow account, start by choosing a reliable escrow agent or company that specializes in real estate transactions. You will need to provide the necessary information about your property and the terms of the sale. Typically, the escrow agent will set up the account, hold the funds, and ensure that all parties meet the conditions of the agreement. Understanding the escrow account in real estate definition will help you navigate this crucial step smoothly.

Escrow accounts primarily hold funds designated for property taxes, homeowners insurance, and sometimes additional reserves. This strategy helps homeowners avoid the stress of large, one-time payments. By consistently depositing into an escrow account, you secure your financial obligations while focusing on enjoying your home. Using platforms like uslegalforms can simplify setting up and managing your escrow account effectively.

In an escrow account, the parts of the monthly payment that typically go in are property taxes and homeowners insurance. This setup helps ensure that you have funds available when these significant expenses are due. By allocating funds each month, you minimize the risk of unexpected financial burdens and maintain your financial stability as a homeowner.

The two primary monthly payments included in an escrow account are mortgage principal and interest, along with property taxes. By dividing these costs over the year and collecting them monthly, an escrow account in real estate simplifies your budgeting process. This arrangement allows you to manage larger expenses, making home ownership more manageable and systematic.

Typically, escrow accounts hold funds for property taxes and homeowners insurance. These components ensure that homeowners do not fall behind on essential payments while they manage their mortgage. When you set up an escrow account in a real estate transaction, you benefit from the convenience of having these expenses managed in a systematic way, giving you peace of mind.

An escrow account is essential in real estate transactions because it protects both the buyer and the seller. It holds funds securely during the process, ensuring that neither party faces unnecessary risk. This arrangement minimizes the chance of fraud and miscommunication while fostering trust. Overall, understanding the escrow account in real estate definition helps you see its role in creating a smooth transaction.

The two primary requirements for creating escrow involve a mutual agreement and the establishment of a neutral third-party escrow agent. Both the buyer and seller must agree to the terms of the transaction and select a trusted escrow service provider. By adhering to these requirements, you can confidently engage in the escrow account in real estate definition, knowing that your transaction will be handled professionally.

To account for escrow accounts, you should track the funds held in the account as liabilities, since they are not available for use until the transaction is complete. Create a detailed record of all deposits, disbursements, and any fees associated with the escrow service. Using a reliable platform like US Legal Forms can simplify this process, ensuring you maintain accurate records throughout the transaction.